OR

Sebon brings new directives for listed companies

Published On: February 10, 2018 08:35 AM NPT By: Republica | @RepublicaNepal

KATHMANDU, Feb 10: The Securities Board of Nepal (Sebon) has issued new directives related to corporate governance for listed companies that require them, among others, to have two different individuals for the posts of chairperson and chief executive officer (CEO).

Publicizing the new directives, billed as code of conduct for public companies, on Thursday, the capital market regulator said that the move was aimed to strengthen the corporate governance of listed companies by making their activities accountable toward their shareholders and other stakeholders, and increasing transparency.

The new directives, however, will come into effect only on July 15, 2018, allowing the listed companies some time to prepare to implement the new directives.

The set of new directives has also fixed the maximum tenure of a company’s board director as four years, while barring appointment of more than one director from a single family.

A listed company must designate a compliance officer having an experience of three years or a bachelor’s degree in management, commerce or law to ensure that the firm has been complying with rules and regulations. The annual report of the listed company must have a mention about the compliance status in the annual report certified by an auditor.

The directives also require listed companies to make public disclosure about the changes in the capital share structure, financial position and other information regularly.

With an aim of making the internal control system robust in the listed company, the listed company should build an internal control system for checking corruption and financial irregularities, avoid personal interest or conflict of interest of company’s directors, chairperson and CEO in mobilizing capital and management of the company, according to the new directives.

Regarding the risk management, the Sebon requires listed companies to form a risk management committee to mitigate possible organizational and financial risks and an independent board director should be involved in any review of the risk management framework and policies.

The directives also restrict listed companies and board directors of making financial dealing where they have personal financial interest like renting house or working as auditor, advisor, CEO, employee, insurance surveyor and insurance agent.

Officials of the Sebon say that the capital market regulator has studied international practices to include important provisions in the corporate governance directives for listed companies. According to the Sebon’s statement, the new directive was issued by taking in view the six principles of Organization for Economic Cooperation and Development (OECD) on corporate compliance. These principles include ensuring the basis for an effective corporate governance framework, the rights of shareholders and key ownership functions, the equitable treatment of shareholders, role of stakeholders in corporate governance, and disclosure and transparency.

“The aim of issuing the directive is to ensure financial discipline and strengthen corporate governance in listed public companies,” said Rewat Bahadur Karki, executive chairman of the Sebon. “We issued such code of conduct for board directors and staffs of Sebon itself before introducing compliance rules to listed companies,” he added.

You May Like This

Sebon approves IPO worth Rs 21b of 21 companies in FY2017/18

KATHMANDU, Aug 5: The Securities Board of Nepal (Sebon) approved primary shares worth Rs 20.78 billion, of 21 companies, in the... Read More...

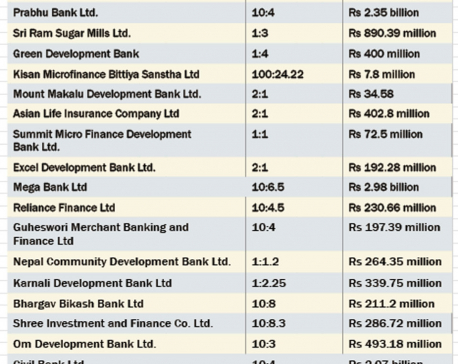

19 companies await Sebon nod to launch rights issue

KATHMANDU, July 22: A total of 19 companies are awaiting approval of the Securities Board of Nepal (Sebon) to float... Read More...

IPO of 11 companies in pipeline: Sebon

KATHMANDU, April 4: Eleven companies have sought approval from the Securities Board of Nepal (Sebon) to float 5.92 million units... Read More...

Just In

- By-elections: Silence period starts from today, campaigning prohibited

- A Room of One's Own- Creative Writing Workshop for Queer Youth

- Tattva Farms rejuvenates Nepali kitchens with flavored jaggery

- Evidence-Based Policy Making in Nepal: Challenges and the Way Forward

- Insurers stop settling insurance claims after they fail to get subsidies from government

- Nepal-Qatar Relations: Prioritize promoting interests of Nepali migrant workers

- Health ministry to conduct ‘search and vaccinate’ campaign on May 13

- Indian customs releases trucks carrying Nepali tea, halted across Kakarbhitta

Leave A Comment