OR

SC continues stay order on Ncell tax

Published On: May 8, 2019 06:30 AM NPT By: Republica | @RepublicaNepal

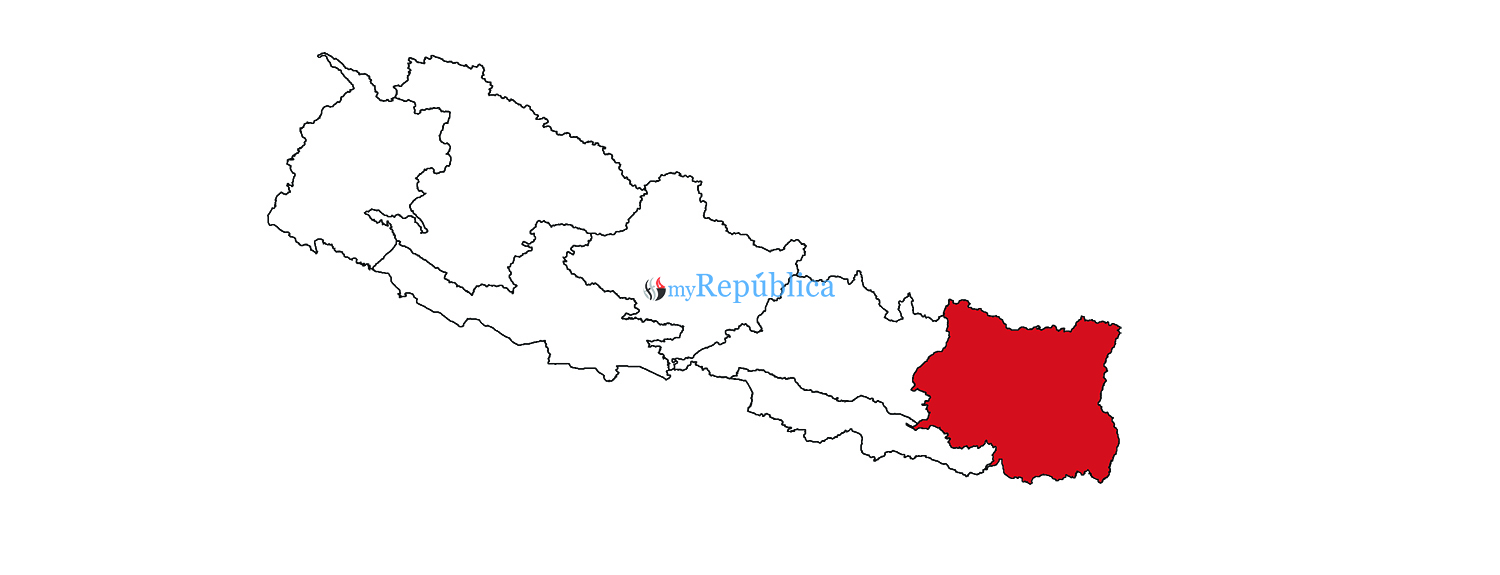

KATHMANDU May 8: Giving continuity to the short-term stay order it issued on April 25, the Supreme Court Tuesday directed the government to put the process of collecting capital gains tax (CGT) from telecommunications company Ncell Private Limited on hold.

A division bench of Justices Sapana Pradhan Malla and Prakash Kumar Dhungana ordered the government authorities—the Office of the Prime Minister and Council of Ministers, the Ministry of Finance and the Large Taxpayers Office—to hold back on the collection of CGT from the telecom company. A single bench of Justice Bam Kumar Shrestha on April 25 issued a short-term stay order on a petition filed by Ncell. In its petition the company questioned its CGT assessment done by the Large Taxpayers Office (LTO).

Giving continuity to the stay order means Ncell will not have to pay the tax amount sought by the LTO until the court issues its final ruling on the petition.

On April 17, the LTO had calculated the tax amount for the Ncell buyout and asked the company to pay the remaining CGT amounting to Rs 39.06 billion, including interest, within seven days.

Earlier in the month, the apex court had ordered Ncell and Axiata Company to pay CGT amounting to Rs 39 billion and interest and asked the LTO to assess the interest and other particulars.

The private telecommunications service provider had challenged the CGT assessment, stating that it does not require to pay the amount determined by the LTO as per the previous apex court order.

Following the SC order of February 7, the LTO had determined that Ncell had to pay Rs 39 billion as the balance of the CGT assessment including fines and interest. Ncell claimed that the tax assessment was against the apex court verdict.

Ncell said it was not given any information about the tax assessment nor was it asked for any tax filing before the assessment was made. The interests and fines assessed and added onto the payable CGT is against the SC verdict, according to an excerpt from Ncell's court appeal.

The petition states: “The tax amount with fines and interest was earlier assessed for Teliasonera. But LTO has now come up with the same assessment including interest and fines, which is against the spirit of the SC verdict of two weeks ago.”

Ncell argues that the CGT payable should be only Rs 14.36 billion (or 10 percentage points off the total 25 percent CGT) or the remaining amount of the total 25 percent CGT on share transaction prices. Ncell has already paid Rs 23 billion CGT or 15 percent of the total CGT payable.

You May Like This

SC begins final hearings on Ncell capital gains tax

KATHMANDU, June 6: The Supreme Court on Tuesday began final hearings on the capital gains tax (CGT) for telecommunications company Ncell... Read More...

Ncell goes to SC over tax assessment

KATHMANDU, April 23: Ncell Private Limited has challenged the capital gains tax assessment made by the Large Taxpayers Office, at the... Read More...

SC continues hearing on NCell profit tax evasion case

KATHMANDU, Feb 4: The Supreme Court has been continuously conducting hearings on the alleged profit tax evasion by private telecom corporation... Read More...

Just In

- Health ministry warns of taking action against individuals circulating misleading advertisements about health insurance

- UAE secures spot in ACC Premier Cup final, defeating Nepal by six wickets

- NC to boycott Gandaki Province Assembly, submits letter to Speaker

- 850 grams of gold seized from Indian national at TIA

- Rupandehi District Court orders to release Dipesh Pun on a bail of Rs 400,000

- Teachers’ union challenges Education Minister Shrestha's policy on political affiliation

- Nepal sets target of 120 runs for UAE in ACC Premier Cup

- Discussion on resolution proposed by CPN-UML and Maoist Center begins in Koshi Provincial Assembly

_20240311121839.jpg)

Leave A Comment