OR

NRB may backtrack from measures to rein in soaring stock market

Published On: July 14, 2016 02:20 AM NPT By: Republica | @RepublicaNepal

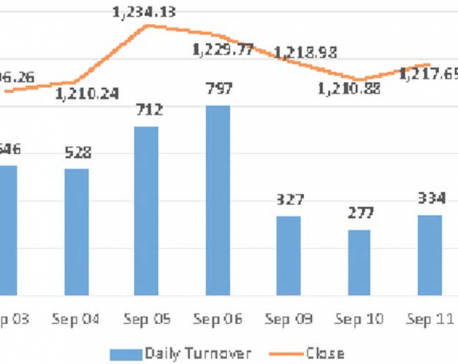

KATHMANDU, July 14: Nepal Rastra Bank (NRB) is likely to backtrack from its preparation to restrict flow of fund to the share market from the bank and financial institutions (BFIs) following sudden fall in price of securities in the last two days.

"Concluding that cheaper fund available from the BFIs due to excess liquidity was creating a stock market bubble, we were planning to limit flow of such fund," a senior central bank official said on condition of anonymity as he is not authorized to discuss the content of monetary policy with media.

"We are worried that our restriction could instead send jittery among investors and could have negative consequences in the market. The fall in the stock market over the last two days has left us perplexed. But we are still weighing the measures to prevent the bubble from inflating further," the senior official added.

According to NRB sources, the central bank was planning to tighten the process of issuing loans on share certificate pledges so that there will be restriction on flow of fund from the finance to stock market. While the exposure of the BFIs toward the stock market is still below the regulatory level, the soaring market without any solid fundamental has been putting pressure on the regulators to take needful measures to rein on speculative market.

The NRB is introducing monetary policy for Fiscal Year 2016/17 this week. According to an official at the NRB, a meeting of the board of directors of the central bank has been called for tomorrow morning. Preparation is to unveil the policy on Thursday afternoon after it is approved by the board.

Though the central bank is also preparing to increase the cash reserve ratio of the BFIs, the rates have not been decided yet, according to a source at the central bank. The central bank is also planning to introduce a measure in the monetary policy to make it mandatory for board directors to get banking training. Also, measures like encouraging the BFIs to make certain investment on corporate social responsibility, reiteration of the deadline for the BFIs to raise minimum paid-up capital, and limitation of the cash transaction amount, among others, are the highlights of the upcoming monetary policy, according to the source.

You May Like This

NRB tightens personal overdraft, resources to stock market

KATHMANDU, July 12: Nepal Rastra Bank (NRB) has controlled the flow of investment of bank and financial institutions (BFIs) toward... Read More...

Monetary Policy: NRB tightens flow of funds to stock market

KATHMANDU, July 14 In a bid to tighten the flow of finance from the banking sector to the stock market,... Read More...

Nepse snaps 3-day losing run, gains 7 points

KATHMANDU, Sept 12: Stocks traded flat in the initial trading hour on Tuesday. A midday surge followed, leading the Nepal... Read More...

Just In

- 286 new industries registered in Nepal in first nine months of current FY, attracting Rs 165 billion investment

- UML's National Convention Representatives Council meeting today

- Gandaki Province CM assigns ministerial portfolios to Hari Bahadur Chuman and Deepak Manange

- 352 climbers obtain permits to ascend Mount Everest this season

- 16 candidates shortlisted for CEO position at Nepal Tourism Board

- WB to take financial management lead for proposed Upper Arun Project

- Power supply to be affected in parts of Kathmandu Valley today as NEA expedites repair works

- Godepani welcomes over 31,000 foreign tourists in a year

_20220508065243.jpg)

Leave A Comment