OR

NRB Governor Adhikari hints at introducing a contractionary monetary policy for FY 2022/23

Published On: July 7, 2022 06:20 AM NPT By: Republica | @RepublicaNepal

Previously provided privileges and relaxations will be gradually lifted: Adhikari

KATHMANDU, June 7: Nepal Rastra Bank (NRB) Governor Maha Prasad Adhikari said that the privileges and relaxations provided to various sectors during the COVID-19 pandemic would be gradually lifted to prevent such measures from becoming counterproductive.

The NRB governor made the statement at a discussion program on the monetary policy for the upcoming fiscal year 2022/23 organized by the Management Association of Nepal (MAN) on Tuesday. The governor mentioned that the central bank had given certain flexibilities and relaxations in the policies in the past two years to allow a ‘breathing space’ for businesses that had been affected by COVID-19. “Such policies will be gradually lifted,” he said.

Citing the need to give some respite to the sectors impacted by the pandemic, the monetary policies enforced by the central bank in the past two years included a loan repayment deferral option for businesses, refinancing to export oriented-businesses and sick industries at a maximum interest rate of three percent, and targeted lending from commercial banks to the agricultural sector, small, medium-sized enterprises (SMEs), and the hydropower sector. Similarly, SMEs were able to get credit at a maximum interest rate of five percent.

Furthermore, the monetary policies also allowed the banks and financial institutions (BFIs) to issue more loans as the credit-to-core-capital plus deposit (CCD) was increased to 85 percent in the fiscal year 2020/21 and later the maximum limit of the credit-deposit (CD) ratio was kept at 90 percent in the fiscal year 2021/22.

The ‘flexibility’ shown by the NRB in the monetary policies for the past couple of years has been largely criticized for failing to implement ‘check and balance’ policies in the country’s monetary system. The central bank faces accusations that being too lenient has resulted in excessive imports, which has led to the depletion of the country’s foreign currency reserves, and a persistent liquidity crunch in the banking system along with soaring consumer prices.

Meanwhile, stakeholders forwarded a number of wishlists to NRB for the upcoming monetary policy.

Executive Chairperson of Muktinath Krishi Company Limited, Bharat Raj Dhakal, said that past investments in the agricultural sector from BFIs and the government have not been able to yield significant improvements. Stating that since the imports had not decreased, he recommended that it was necessary to create a ‘basket program’ where BFIs could collectively invest in the agriculture sector.

According to him, without such measures, the economy will not be able to decrease the risks of giving out agricultural loans, prevent the misuse of the loans, and generate the desired outcomes in the sector.

President of Hotel Association Nepal, Shreejana Rana, asserting that the tourism industry was still recovering from the impacts of the COVID-19 pandemic, has urged that the central bank continue refinancing the industry and restructuring and rescheduling the loans for at least two more years.

Senior Vice President of Nepal Chamber of Commerce, Kamalesh Kumar Agrawal advised that with the economy in a sensitive state, the central bank should scrap the threshold of Rs 40 million and Rs 120 million on margin loans to facilitate the share market.

Similarly, the president of Nepal Financial Institutions Association, Saroj Kaji Tuladhar recommended that the central bank support increasing the price of stocks. He has advocated for a centralized ‘know your customers’ system to reduce the hassles of bank customers.

NRB Governor Adhikari, in response, said that with the current economy in a difficult position, certain sectors will have it a bit harder. “We will have to compromise. However, the deprived, the small enterprises and those in the agriculture sector will not be at a loss,” he added.

You May Like This

Monetary policy cannot have all the tools to solve all economic problems: NRB Governor Adhikari

KATHMANDU, July 20: At a time when Finance Minister Dr. Prakash Sharan Mahat is publicly assuring that all the problems... Read More...

NRB removes lower slab of margin loan to be taken from single bank

KATHMANDU, July 22: Nepal Rastra Bank (NRB) has removed the lower limit on loans against shares. However, the central bank has... Read More...

NRB increases refinance fund size to Rs 50 billion

KATHMANDU, Feb 20: Nepal Rastra Bank (NRB) has released the mid-term review report of the monetary policy for the current Fiscal... Read More...

Just In

- World Malaria Day: Foreign returnees more susceptible to the vector-borne disease

- MoEST seeks EC’s help in identifying teachers linked to political parties

- 70 community and national forests affected by fire in Parbat till Wednesday

- NEPSE loses 3.24 points, while daily turnover inclines to Rs 2.36 billion

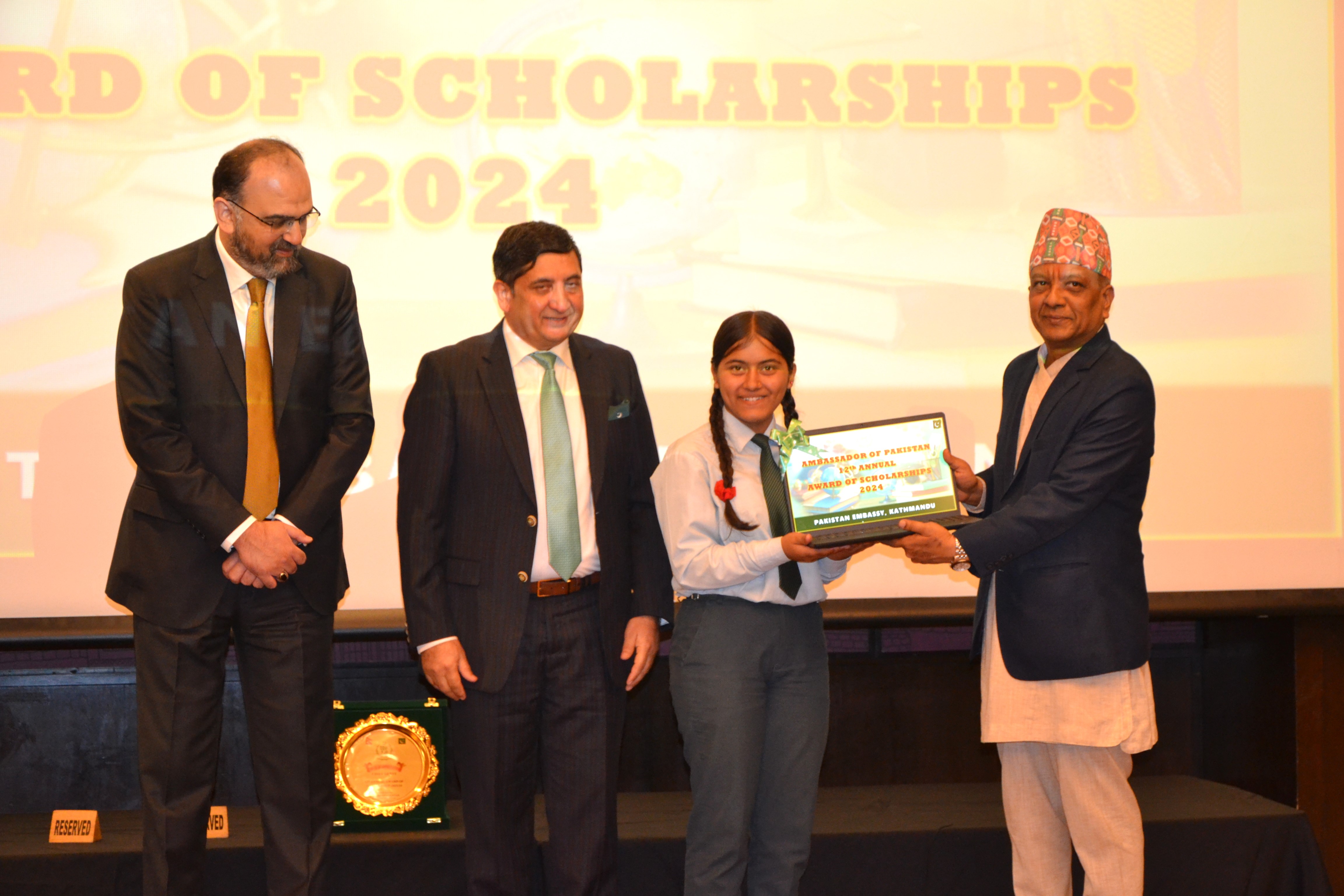

- Pak Embassy awards scholarships to 180 Nepali students

- President Paudel approves mobilization of army personnel for by-elections security

- Bhajang and Ilam by-elections: 69 polling stations classified as ‘highly sensitive’

- Karnali CM Kandel secures vote of confidence

Leave A Comment