OR

NRB allows banks to accept gold as deposits

Published On: March 6, 2020 09:50 AM NPT By: Republica | @RepublicaNepal

KATHMANDU, March 6: Nepal Rastra Bank (NRB) has allowed commercial banks to accept gold as interest-earning deposit which is expected to inject more cash into the market as well as help the banks to maintain their obligation for liquid assets.

The central bank has finally decided to formalize a provision that it had proposed in the Monetary Policy for FY2019/20. With the enforcement of the provision, commercial banks can now consider at least 25 grams of gold as deposits and provide interest to their clients.

The maturity period of gold deposits will be a minimum of three years and a maximum of five years, according to the NRB.

So far, people have been buying gold for non-productive purposes for cosmetic use or as a symbol of social status or an alternative to fixed assets. The new provision is expected to bring the assets into the country’s banking system while allowing owners to earn some interest income.

Bam Bahadur Mishra, an executive director at the NRB, said the new provision would help monetize gold that is being imported every year in large quantity by spending large amount of foreign currency. “It will also help to improve banks’ capacity to provide more loans,” added Mishra.

However, banks can accept only gold having purity of at least 99.5% as deposits. According to the circular, the concerned bank should develop its own mechanism to check purity of gold to be accepted as deposit. “While scrutinizing the actual valuation of gold, banks, however, could face technical problem in ascertaining the actual amount of chemicals that are used to make gold ornaments,” Mishra said.

As per the NRB circular, banks interested to accept gold in deposits should endorse related policy and working guideline from its board of directors. The central bank has allowed banks to fix rate of interest of gold deposit while the interest amount should be calculated on the basis of three months compound interest.

While the gold deposit scheme is expected to be attractive for individuals, it is also expected to be beneficial for the banks. Mishra said the banks have been allowed to consider the gold deposits as part of their cash reserve ratio (CRR) and statutory liquidity ratio (SLR).

SLR is the requirement under which banks need to invest on government-approved securities or gold against the total amount of credit they are lending. They can earn interest on these liquid assets. Likewise, CRR is the minimum percentage of total deposits that banks must deposit at the central bank.

Through these tools, the central bank requires the commercial banks to maintain their liquidity position intact. At present, the central bank has asked banks to maintain cash reserve ratio at 4% and statutory liquidity ratio at 10% of their total deposits.

NRB has fixed the limit for valuation of gold deposit at up to 25% of the CRR.

Mishra said the bank customers can also use the gold certificate as collateral to receive loan. The banks are allowed to issue loan of up to 70% of the gold valuation by pledging gold certificate as collateral.

You May Like This

Banks reduce interest rates on deposits as high as two percentage points for next month

KATHMANDU, Dec 16: Commercial banks have announced revised interest rates on deposits for the month of Paush (mid-December to mid-January),... Read More...

Former NRB governors urge central bank to take caution while devising Monetary Policy 2023/24

KATHMANDU, June 16: Former governors of Nepal Rastra Bank (NRB) have urged the central bank to enforce prudent measures through... Read More...

NRB quarterly review on monetary policy unlikely to keep fiscal stability: NCC

KATHMANDU, Nov 29: The Nepal Chamber of Commerce(NCC) has noted that the recent arrangement made by the Nepal Rastra Bank... Read More...

Just In

- Nepalgunj ICP handed over to Nepal, to come into operation from May 8

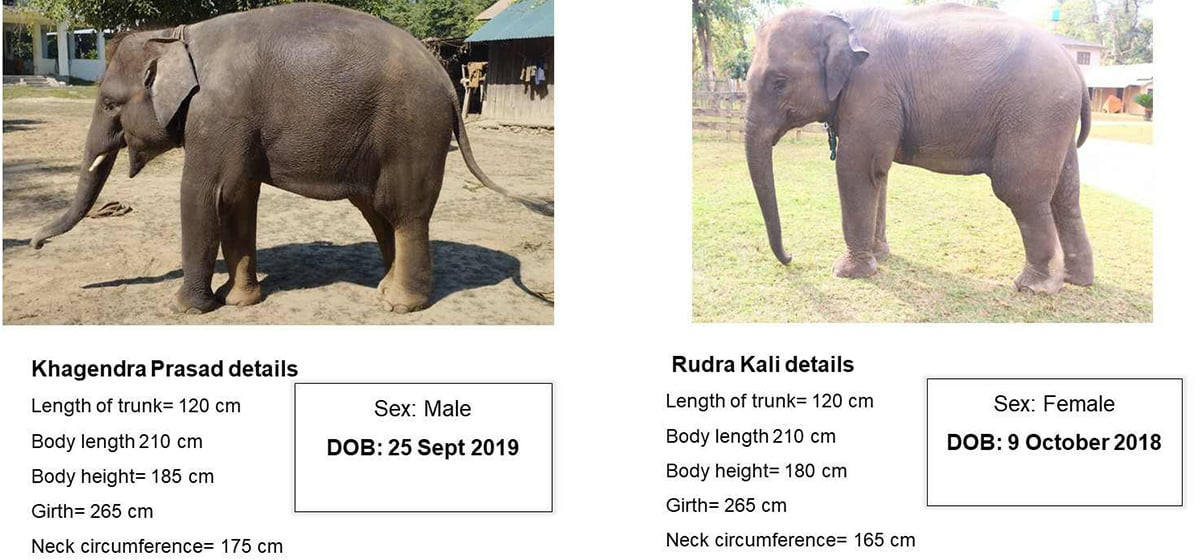

- Nepal to gift two elephants to Qatar during Emir's state visit

- NUP Chair Shrestha: Resham Chaudhary, convicted in Tikapur murder case, ineligible for party membership

- Dr Ram Kantha Makaju Shrestha: A visionary leader transforming healthcare in Nepal

- Let us present practical projects, not 'wish list': PM Dahal

- President Paudel requests Emir of Qatar to initiate release of Bipin Joshi

- Emir of Qatar and President Paudel hold discussions at Sheetal Niwas

- Devi Khadka: The champion of sexual violence victims

_20240423174443.jpg)

Leave A Comment