OR

daily market commentary

Nepse snaps six-day losing streak

Published On: August 29, 2018 10:45 AM NPT By: Republica | @RepublicaNepal

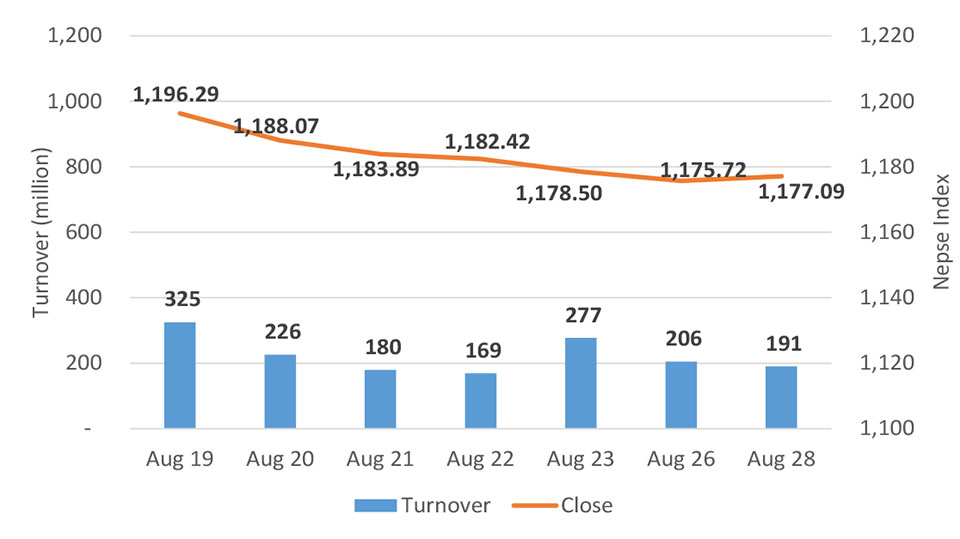

KATHMANDU: Stocks traded lower for most of the trading session on Tuesday. The benchmark Nepal Stock Exchange (Nepse) index came under pressure from the very beginning of the trading session. However, a pullback toward the final trading hour saw the Nepse index recoup all its intraday losses to close 1.37 points higher at 1,177.09 points.

Trading activity remained subdued throughout the session as the bourse continued see series of dreary sessions. Investors kept away from trading activities in the backdrop of sustained downtrend and no significant sign for recovery of late. Market activity remained below par as the exchange recorded a total transaction of over Rs 190 million only.

Most of the major sub-indices moved in tandem with the broader market and closed in green. Strength was visible among shares of Hotels and Development Banks as their sub-indices rose by 0.68 percent and 0.61 percent, respectively. Manufacturing & Processing sub-index also jumped up by 0.57 percent. Meanwhile, banking sub-index posted a modest gain of 0.19 percent.

On the other hand, Life Insurance sub-index shed 0.56 percent. Besides, Hydropower and 'Others' sub-indices also ended the day in red.

Market participation was led by Nepal Life Insurance Company Ltd as Rs 16 million of its shares were traded in the secondary market on the day. Shares of NMB Bank Ltd and NLG Insurance Company Ltd were also actively traded as the companies recorded total turnovers of Rs 14 million and Rs 10 million, respectively. Mahalaxmi Bikas Bank Ltd also posted a turnover of over Rs 9 million after the Class 'B' financial institution announced 7 percent cash dividend and 8 percent bonus shares to its shareholders from the profit earned in Fiscal Year 2017/18.

Global IME Laghubitta Bittiya Sanstha Ltd led the list of companies in terms of advances. Its share price went up by almost 4 percent. NIC Asia Bank Ltd followed suit with a surge of 3.83 percent in its share price. Development Bank stocks, including Garima Bikas Bank Ltd and Gandaki Bikas Bank Ltd, also added over 3 percent each on their share prices. Among others, shares of Barun Hydropower Company Ltd and National Hydro Developers Ltd also closed higher.

Conversely, share prices of Summit Micro Finance Development Bank Ltd and RSDC Laghubitta Bittiya Sanstha Ltd shed 3.40 percent and 3 percent, respectively. Ngadi Group Power Ltd saw its share price go down by 2.87 percent, while unit price of Laxmi Value Fund-1 declined by 2.84 percent. Ridi Hydropower Company also saw its price go down by 2.63 percent.

On earnings front, Unilever Nepal Ltd published audited earnings report for FY2017/18 on Monday. The company has reported a slight year-on-year increase in its net profit to Rs 999 million compared to last year's Rs 965 million. Its Earnings per Share (EPS) for the fourth quarter stands at Rs 318 as per the report.

ARKS technical analysis model indicates the market posting a modest gain after six consecutive days of losses. As a result, range bound movement of the index has continued for more than two months, where the index has gyrated between 1,224 and 1,164 points. A breakout from these levels, can suggest a plausible course for the market, given that it is supported by momentous market activity.

This column is produced by ARKS Capital Advisors Ltd www.arkscapitaladvisors.com

(Views expressed are those of the producer and do not necessarily reflect those of this publication)

You May Like This

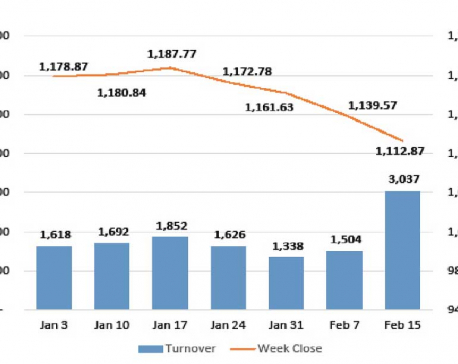

Nepse tumbles for four weeks in a row

KATHMANDU: Stocks continued to struggle throughout the week as Nepal Stock Exchange (Nepse) index saw red in four out of... Read More...

Nepse closes higher for second straight day

KATHMANDU: Stocks traded flat in early trade on Tuesday. However, the benchmark Nepal Stock Exchange (Nepse) index moved slightly to... Read More...

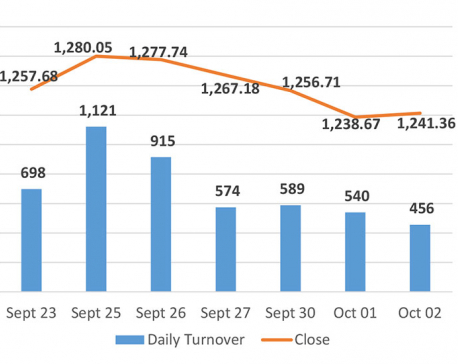

Nepse snaps four-day losing streak

KATHMANDU, Oct 3: Nepal Stock Exchange (Nepse) index posted a marginal gain on Tuesday to end four-day losing run. The... Read More...

Just In

- World Malaria Day: Foreign returnees more susceptible to the vector-borne disease

- MoEST seeks EC’s help in identifying teachers linked to political parties

- 70 community and national forests affected by fire in Parbat till Wednesday

- NEPSE loses 3.24 points, while daily turnover inclines to Rs 2.36 billion

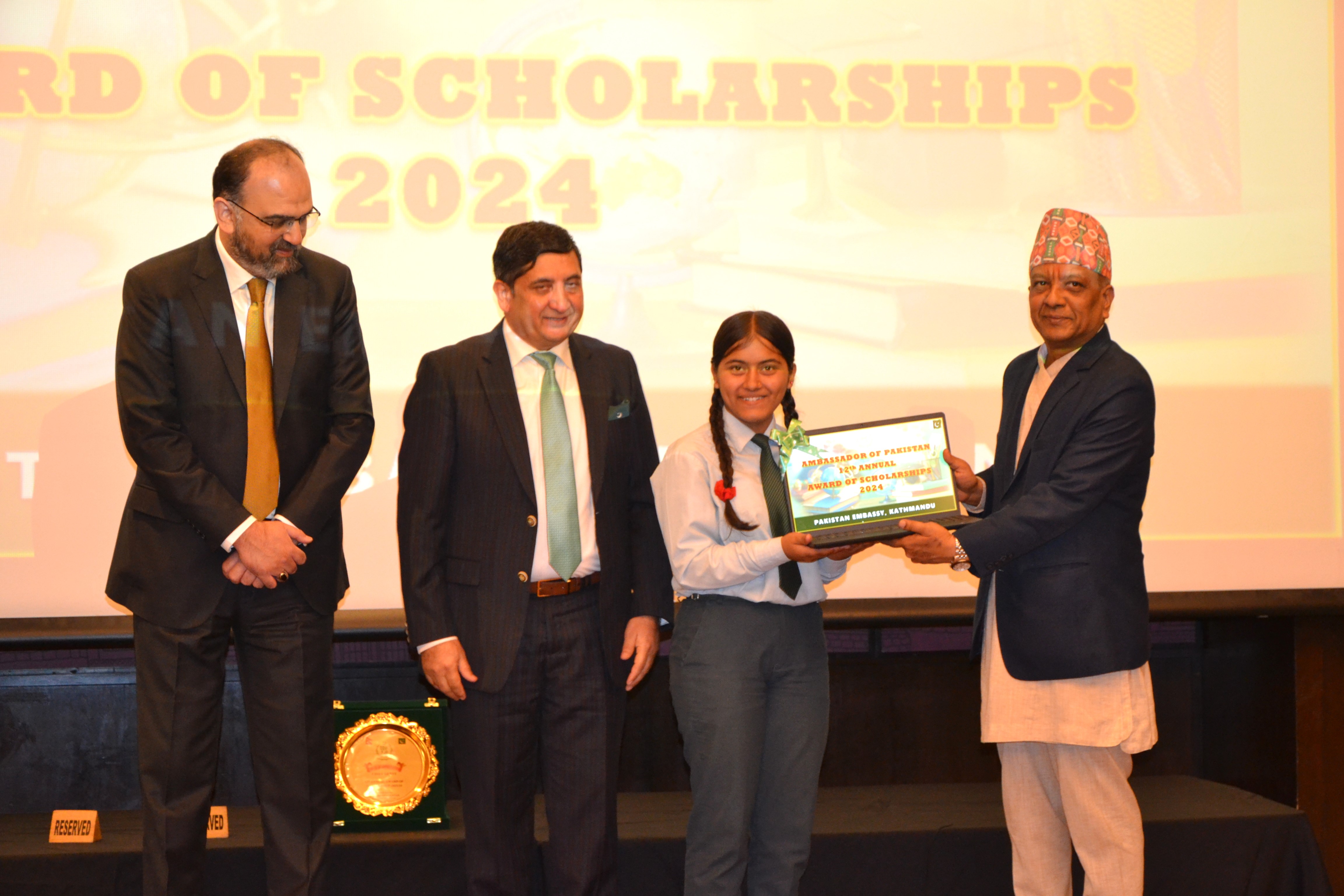

- Pak Embassy awards scholarships to 180 Nepali students

- President Paudel approves mobilization of army personnel for by-elections security

- Bhajang and Ilam by-elections: 69 polling stations classified as ‘highly sensitive’

- Karnali CM Kandel secures vote of confidence

Leave A Comment