OR

Daily Market Commentary

Nepse registers lower volume despite positive earnings stance

Published On: February 2, 2019 11:23 AM NPT By: Republica | @RepublicaNepal

KATHMANDU: The benchmark equity index began the week's trading on a weak note. The first trading session of the week on Sunday saw the Nepal Stock Exchange (Nepse) witness a loss of more than 10 points on the day. However, the Nepse index recovered slightly and added over 2 points on Monday.

Nonetheless, the stocks continued to struggle in the latter sessions with Nepse Index dropping 3.9 points and 0.4 points on Tuesday and Wednesday.

At the final trading session of the week, Nepse managed to post the gains of 1.04 points on the day. However, the index posted a weekly loss of 11.15 points to close at 1161.63 points.

Following the weekly losses, market participation has also remained on the lower side of the spectrum. Despite the recent positive earnings reports published by Bank and Financial Institutions, the market has failed to find substantial optimism to boost the overall investor's sentiments in the bourse. Eventually, the exchange posted a total weekly turnover of Rs 1,338 million against Rs 1,625 million in the review period.

Sensitive index, representing the performance of Class 'A' stocks also closed in the red in the review period. It slid 0.74 percent. Most of the sub-indices also followed the market, except Trading and Microfinance which closed marginally higher.

Major weekly losses came from Manufacturing & Processing stocks reflected by a 3.06 percent decline in the group's sub index. Next on the list, Hydropower sub-index dropped 2.95 percent in the review period.

Similarly, Non- Life Insurance and Life Insurance stocks also came under pressure decline by 1.78 percent and 1.37 percent correspondingly. Finance, Banking, Hotels, Development Banks and 'Others' sub-indices also posted meager losses.

In terms of market activity, shares of Upper Tamakoshi Hydropower Ltd registered the highest turnover for a third consecutive week. Over Rs103 million worth of shares exchanged hands. It was followed by Citizen Investment Trust for a second week in a row with total transactions of over Rs 94 million.

Nepal Bank Ltd, NIC Asia Bank Ltd and Prabhu Bank Ltd Promoter Share followed suit with total turnover of Rs 49.42 million, 38.79 million and 38.61 million respectively.

Other active stocks of the week were Nepal Investment Bank Ltd, Prime Commercial Bank Ltd, NMB Bank Ltd and Nepal Life Insurance Company Ltd.

Among listings for the week include bonus shares of Citizen Investment Trust, Mahalaxmi Bikas Bank Ltd and Pokhara Finance Ltd. On the news, Asha Laghubitta Bittiya Sanstha Ltd issued 6, 74,000 unit shares as its Initial Public Offering (IPO) from February 1 to 5.

On the announcement front, NMB Bank Ltd has reported a decent increment of 15.28 percent in its earnings. The net profits of the bank stand at Rs 1.1 billion.

As per the ARKS weekly technical analysis, the market formed a bearish candlestick reflecting weakness in the overall equity market. Technical indicators like Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) both indicate slight bearish sentiment prevailing in the current moment.

Likewise, the market has also been observing low volumes. Hence, the investors are suggests to trade cautiously at the present context. The resistance for the market lies around 1,190 points while the immediate support level is at 1,160 points.

This column is produced by ARKS Capital Advisors Ltd

www.arkscapitaladvisors.com

(Views expressed are those of the producer and do not necessarily reflect those of this publication)

You May Like This

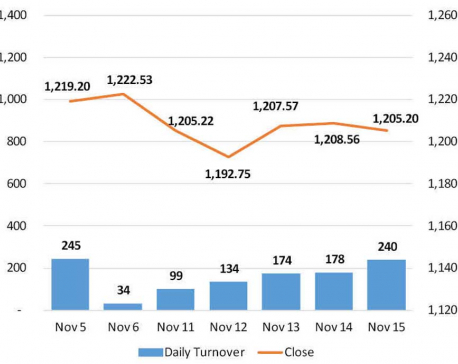

Nepse gains for third straight day

KATHMANDU, Dec 17: The market saw significant strength on the first trading day of the week. Stocks trading began on... Read More...

Nepse ends week lower despite positive earnings outlook

KATHMANDU, Nov 17: Stocks resumed post holidays trading on Sunday. However, trading remained largely affected by glitches in the Nepal... Read More...

Stocks end week with a modest drop

KATHMANDU: Nepal Stock Exchange (Nepse) posted a loss of 3.36 points to settle at 1,205.20 points on Thursday. Though the... Read More...

Just In

- MoHP cautions docs working in govt hospitals not to work in private ones

- Over 400,000 tourists visited Mustang by road last year

- 19 hydropower projects to be showcased at investment summit

- Global oil and gold prices surge as Israel retaliates against Iran

- Sajha Yatayat cancels CEO appointment process for lack of candidates

- Govt padlocks Nepal Scouts’ property illegally occupied by NC lawmaker Deepak Khadka

- FWEAN meets with President Paudel to solicit support for women entrepreneurship

- Koshi provincial assembly passes resolution motion calling for special session by majority votes

_20220508065243.jpg)

Leave A Comment