OR

Nepse ends volatile session on a positive note

Published On: December 29, 2020 09:01 AM NPT By: Republica | @RepublicaNepal

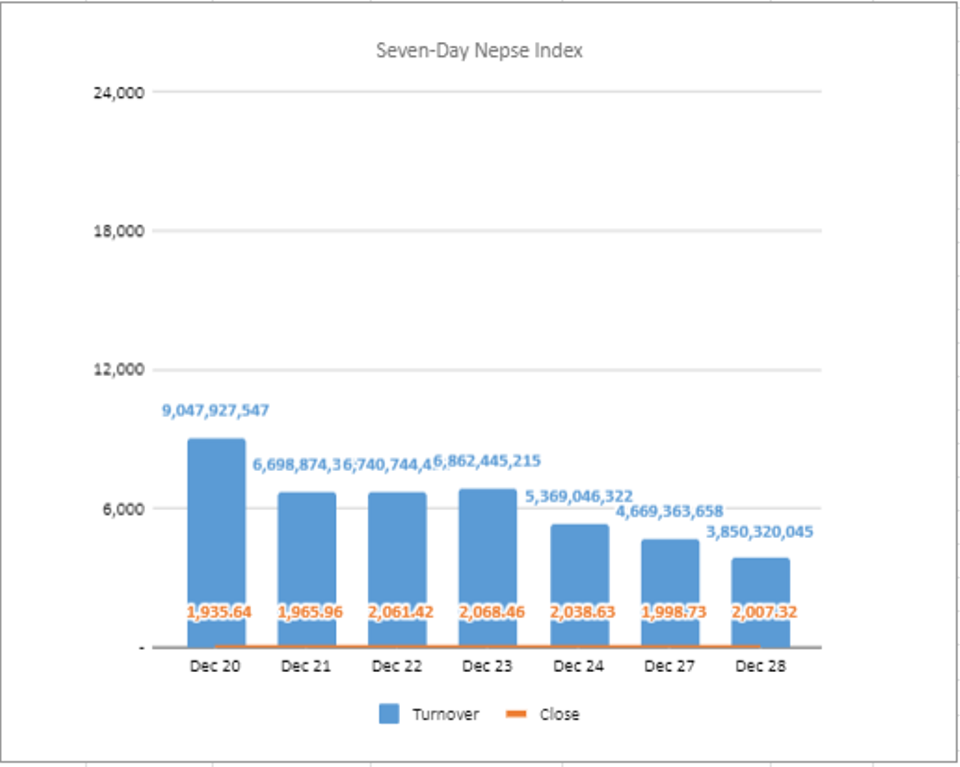

Dec 29: The equity market opened in green in the morning but a sharp fall in the beginning hour saw the Nepal Stock Exchange (Nepse) index trade in the negative territory. Later on, the index managed to recoup, nonetheless, the market again pullback towards a lower note. The Nepal Stock Exchange (Nepse) index hovered in Monday’s session and close the trading at 2007.29 points with a gain of 8.57 points.

After opening with a serious loss on Sunday, the index found a foothold on Monday’s trading day. However, lack of clarity continues in the equity market as investors took a cautious approach to trade in the market. Consequently, turnover also fell in the session and only Rs. 3.850 billion.

Most of the sectors ended the day on a positive note except Trading, Development Banks and Others sub-index fell by 2.46%, 0.48%, and 0.06% respectively. On the other hand, Manufacturing & Processing sub-index rose 2.04%. The sub-indices of Banking, Hotels, Hydropower, Finance, Non-life Insurance, Microfinance, Life Insurance and Mutual Fund ended the day on a slight increment.

Nepal Life Insurance Company Ltd, Citizen Investment Trust, and NIC Asia Bank Ltd were the most heavily traded stocks on Monday with over Rs. 349 million, 323 million and 300 million respectively. Likewise, Nabil Bank Ltd and Shivam Cements Ltd registered turnovers of Rs. 243 million and Rs. 211 million correspondingly. Nepal Credit & Commercial Bank Ltd, Global IME Bank Ltd, Nepal Reinsurance Company Ltd, and Prabhu Bank Ltd were the other actively traded shares.

Among gainers, shares of Narayani Development Bank Ltd hit the upper circuit of 10% on Monday. It was closely followed by the Central Finance Co. Ltd and its share price jumped 9.62%. Similarly, Radhi Bidhyut Company Ltd, Nepal Credit & Commercial Bank Ltd, IME General Insurance Company Ltd and NIC Asia Bank Ltd posted gains of over 7.59%, 6.01%, 5.64% and 5.43% respectively.

On the contrary, 10.50% SBL Debenture 2082 was the biggest losing scrips of the day as its share price tumbled more than 7%. Summit Laghubitta Bittiya Sanstha Ltd, Samriddhi Finance Company Ltd, and NMB 50 posted losses of 3.87%, 3.73%, and 3.32% respectively. Likewise, Salt Trading Corporation, Sanima Mai Hydropower Company Ltd and Joshi Hydropower Development Bank Ltd also suffered losses of almost 3% each.

On the technical front, the equity index formed a small bullish spinning top candlestick reflecting a lack of volatility and indecision in the current scenario. Nonetheless, a strong support level lies at 1,900 points from where a rebound can be expected in the present context. With momentum falling of late, the equity market will likely trade range-bound over the short term.

This column is produced by ARKS Capital Advisors Ltd.

(Views expressed in the article are those of the producer and do not necessarily reflect those of this publication)

www.arkscapitaladvisors.com

You May Like This

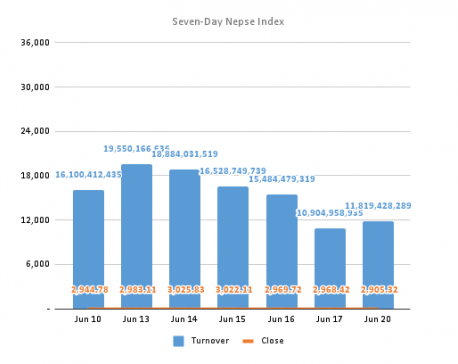

Nepse loses over 60 points as stock rout continues

KATHMANDU, June 21: The Nepal Stock Exchange (Nepse) opened this week’s trading on a significantly weak note. The equity market’s... Read More...

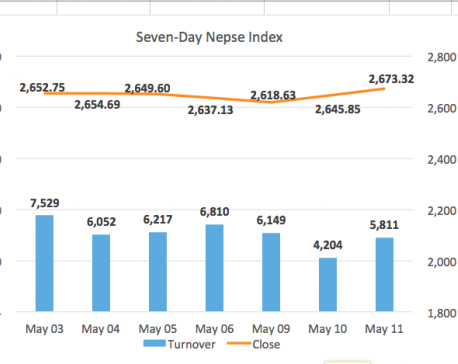

Turnover improves as Nepse extends gains

KATHMANDU, May 11: Stocks began Tuesday’s session on an upbeat note as the Nepal Stock Exchange (Nepse) index jumped more than... Read More...

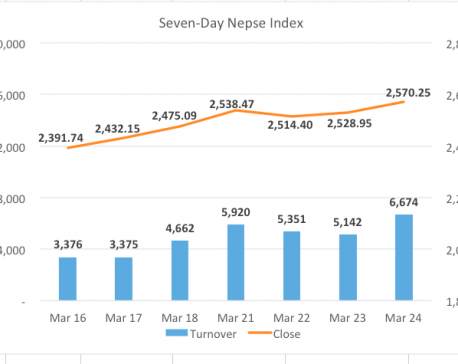

Nepse rallies with improvement in turnover

KATHMANDU, March 24: The Nepal Stock Exchange (Nepse) index saw another upbeat session with the market trending firmly in green... Read More...

Just In

- MoHP cautions docs working in govt hospitals not to work in private ones

- Over 400,000 tourists visited Mustang by road last year

- 19 hydropower projects to be showcased at investment summit

- Global oil and gold prices surge as Israel retaliates against Iran

- Sajha Yatayat cancels CEO appointment process for lack of candidates

- Govt padlocks Nepal Scouts’ property illegally occupied by NC lawmaker Deepak Khadka

- FWEAN meets with President Paudel to solicit support for women entrepreneurship

- Koshi provincial assembly passes resolution motion calling for special session by majority votes

_20220508065243.jpg)

Leave A Comment