OR

Daily Market Commentary

Nepse ends lower amidst subdued market activity

Published On: March 29, 2021 08:00 PM NPT

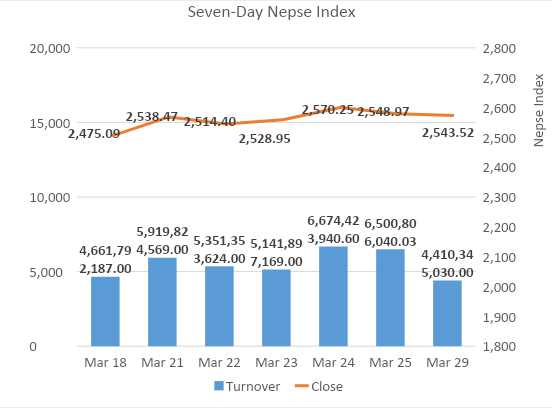

KATHMANDU, March 29: The Nepalese share market opened Monday’s session in green and maintained positive bias in the morning. However, selling pressure at mid-day dragged the benchmark Nepal Stock Exchange (Nepse) index more than 10 points lower. The index recouped the losses partially in the latter half of the session and closed at 2,543.52 – down 5.45 points against the session earlier.

The local bourse witnessed modest loss as investors remained less enthused to take buying positions. Further, market activity also dropped on the day reflecting uncertainty in the equity market amidst lack of any major financial or economic news. Rs. 4.4 billion worth of equities changed hands on the day. Nonetheless, with third quarter-end approaching, financial reports will likely play a key role in determining the sentiment in the coming weeks.

Hydropower, Microfinance and Finance sectors were the only gaining segments on the day with advances of 1.07%, 0.96% and 0.45%. Meanwhile, Trading sub-index fell the most and closed 4.62% lower. Hotels and Tourism segment also came under pressure and tanked 4% as Chandragiri Hills Ltd saw its first day of decline. ‘Others’ index also fell 1%. All other segments closed the day in red.

Nepal Infrastructure Bank Ltd and Upper Tamakoshi Hydropower Ltd were the most heavily traded stock of the day with turnovers of Rs. 443 million and Rs. 388 million. Chandragiri Hills Ltd and Nepal Bangladesh Bank Ltd followed with turnovers of Rs. 370 million and Rs. 147 million. Hydroelectricity Investment and Development Company Ltd and Himalayan Distillery Ltd registered turnovers of Rs. 128 million and Rs. 95 million.

Unnati Sahakarya Laghubitta Bittiya Sanstha Ltd, Ajod Insurance Ltd, Mahila Laghubitta Bittiya Sanstha Ltd and Summit Laghubitta Bittiya Sanstha Ltd saw considerable strength on the day as each scrip remained locked in the positive circuit limit of 10%. Ridi Hydropower Development Company Ltd and Sarathi Nepal Laghubitta Bittiya Sanstha Ltd also shot up by 7% each.

On the other hand, Chandragiri Hills Ltd suffered the most and dropped 7.17%. Mountain Hydro Nepal Ltd fell 6.67%, while Salt Trading Corporation lost 4.87%. Kalika Power Company Ltd, Chhyangdi Hydropower Ltd and United Finance Ltd also lost around 4% each.

In terms of ARKS technical analysis, the market formed a small bearish candlestick reflecting extension of Thursday’s correction. Nonetheless, the losses have remained modest suggesting absence of heavy selling momentum. A major move of the index towards either side from the recent range with notable volume might indicate a probable direction of index in the short term. 2,500 mark is still a crucial level to be watched on the downside.

This column is produced by ARKS Capital Advisors Ltd.

(Views expressed in the article are those of the producer and do not necessarily reflect those of this publication)

www.arkscapitaladvisors.com

You May Like This

Stocks register further dip as volume shrinks

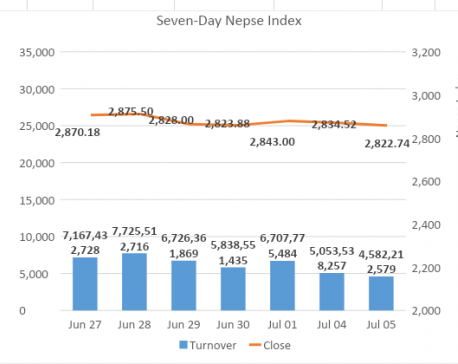

KATHMANDU, July 5: Stocks remained under pressure throughout the session despite a higher open on Monday. The Nepal Stock Exchange... Read More...

Stocks cap off week with a modest decline

KATHMANDU, June 24: Despite a higher opening, the Nepalese stock market’s benchmark fell steeply in the first few minutes of trading.... Read More...

Nepse ends lower amidst subdued market activity

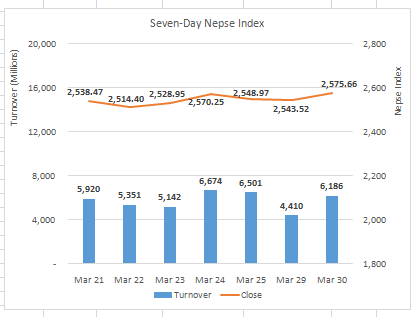

KATHMANDU, March 30: The equity market opened in green and hovered around 2,560 mark for most of the beginning trading hours.... Read More...

Just In

- Godepani welcomes over 31,000 foreign tourists in a year

- Private sector leads hydropower generation over government

- Weather expected to be mainly fair in most parts of the country today

- 120 snow leopards found in Dolpa, survey result reveals

- India funds a school building construction in Darchula

- Exploring opportunities and Challenges of Increasing Online Transactions in Nepal

- Lack of investment-friendly laws raises concerns as Investment Summit approaches

- 550,000 people acquire work permits till April of current fiscal year

Leave A Comment