OR

Daily Market Commentary

Nepse ekes modest gain ahead of Tihar holidays

Published On: November 3, 2021 08:07 PM NPT By: Republica | @RepublicaNepal

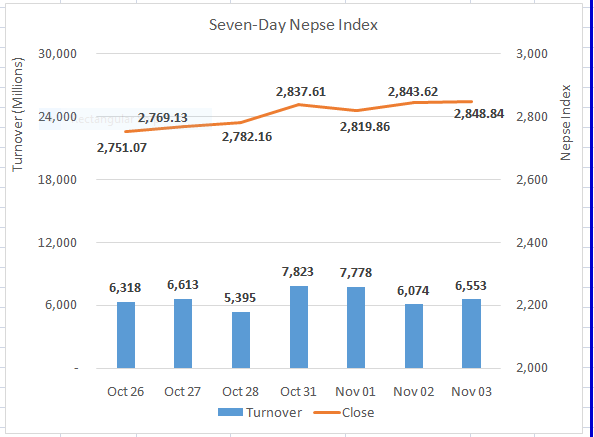

KATHMANDU, Nov 3: The equity index opened firmly in green but gains remained subdued since the beginning of Wednesday’s session. After dropping slightly towards negative territory in the afternoon, a minor last minute recovery pushed the index back in green helping the index extend prior day’s advance ahead of the festive holidays. Nepse stood at 2,848.84 – up 5.22 points against the session earlier.

The bourse has continued to trade above the 2,800 psychological level on its course of a recovery towards 3,000 mark. Volumes remained moderate reflecting lack of conviction. Rs. 6.5 billion worth of equities changed hands.

Majority of sectors inched higher, while only few saw losses. Hotels & Tourism, Non-Life Insurance, Life Insurance and Investment sectors ended in red. On the other hand, Hydropower, Banking and Manufacturing & Processing stocks saw strength and rose 0.73%, 0.44% and 0.4%, respectively. All other sectors edged higher.

Shares of Nabil Bank Ltd were traded the most after the commercial bank said it will distribute 33.6% stock dividend and 4.4% cash dividend to its shareholders from FY 20/21’s earnings. Mahalaxmi Bikas Bank Ltd, Api Power Company Ltd, Arun Kabeli Power Ltd and Nepal Reinsurance Company Ltd were among other actives.

Mahalaxmi Bikas Bank Ltd, Sahas Urja Ltd and ICFC Finance Ltd saw strength and rose to hit the upper circuit level of 10%. Arun Kabeli Power Ltd, NRN Infrastructure & Development Ltd and Manushi Laghubitta Bittiya Sanstha Ltd climbed 7.5%, 7.11% and 6.1%.

On the other hand, Chhyangdi Hydropower Ltd tanked 5.59% followed by Shree Investment & Finance Co. Ltd which dipped 4.07%. Unilever Nepal Ltd, Green Life Hydropower Ltd and United Modi Hydropower Ltd fell around 3% apiece.

As per the ARKS technical analysis, the index formed a small spinning top candlestick which usually reflects uncertainty in the equity market. After highly volatile months driven by economic and financial news, the index is seeing some consolidation around 2,800 mark. Though momentum indicators point towards possibility of a recovery, investors should wait for a volume backed surge before taking any major buying positions.

This column is produced by ARKS Capital Advisors Ltd.

(Views expressed in the article are those of the producer and do not necessarily reflect those of this publication)

You May Like This

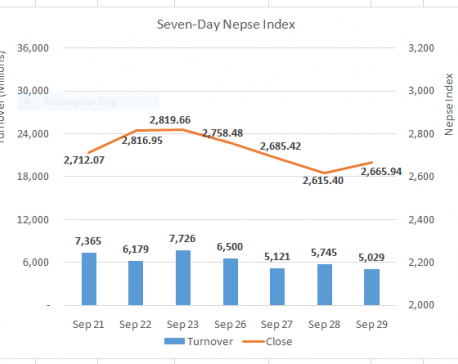

Stocks recoup losses as 2,600 mark holds ground

KATHMANDU, Sept 29: The Nepal Stock Exchange (Nepse) saw strength in the morning on Wednesday with the index climbing around 30... Read More...

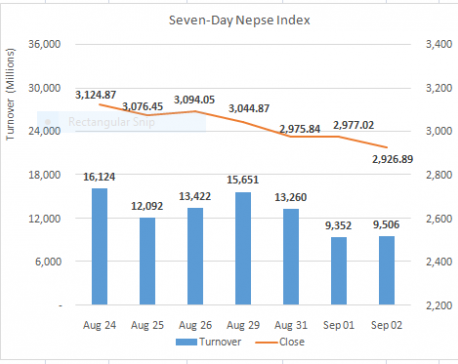

Nepse resumes correction to chase 2,900 mark

KATHMANDU, September 2: The equity market opened in positive territory but traded in red within the first trading hour on... Read More...

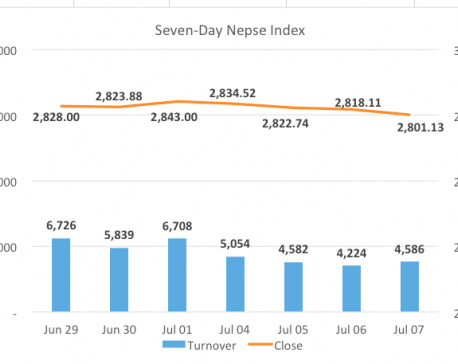

Nepse sees modest losses as quarter end approaches

KATHMANDU, July 7: Stocks traded briefly in green before pulling back towards the opening level in the morning. Subsequently, the benchmark... Read More...

Just In

- 104 houses gutted in fire in Matihani (With Photos)

- By-elections: Silence period starts from today, campaigning prohibited

- A Room of One's Own- Creative Writing Workshop for Queer Youth

- Tattva Farms rejuvenates Nepali kitchens with flavored jaggery

- Evidence-Based Policy Making in Nepal: Challenges and the Way Forward

- Insurers stop settling insurance claims after they fail to get subsidies from government

- Nepal-Qatar Relations: Prioritize promoting interests of Nepali migrant workers

- Health ministry to conduct ‘search and vaccinate’ campaign on May 13

Leave A Comment