OR

Daily market commentary

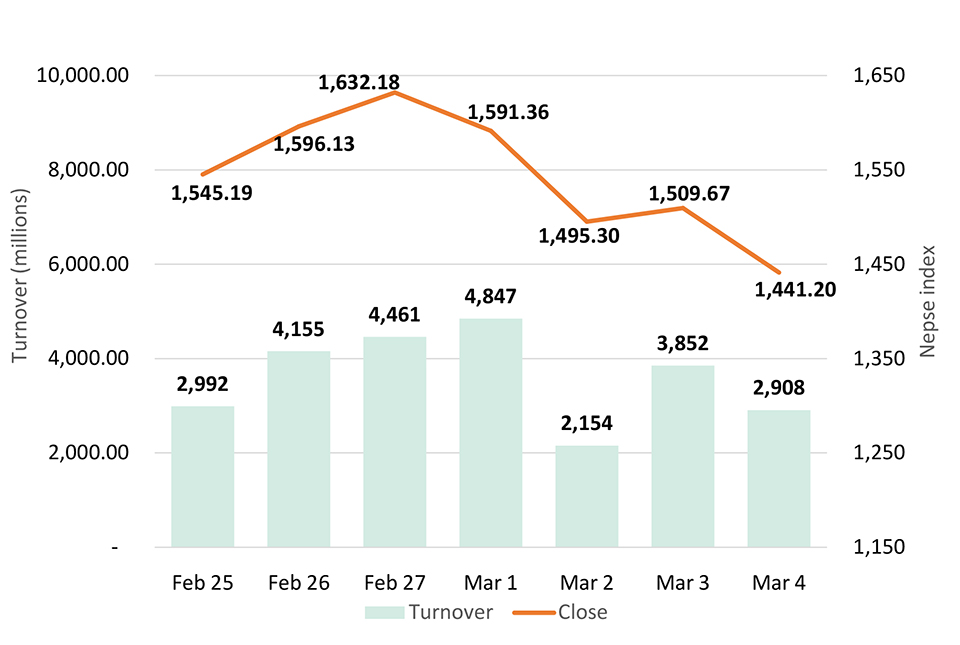

KATHMANDU: The Nepal Stock Exchange (Nepse) index dropping roughly 29 points by the first trading hour on Wednesday. A failed recovery attempt thereafter saw the major average maintain a negative bias throughout the session. Following a steady decline, the index plateaued slightly toward the end. Nonetheless, Nepse closed lower by a massive 68.47 points to end the day at 1,441.20 points.

After taking a breather on Tuesday, the bourse saw considerable weakness on the day's trading. The heavy selling pressure came amid fear of further slump following a massive three-month rally. Many are of the belief that the market was due for a sharp correction and now a rebound is on the card, while some market participants see the downfall stretching further. Some investors also attribute the decline to fear of coronavirus outbreak which has taken the worldwide financial markets through turmoil over the past couple of weeks. Nevertheless, active market participation was witnessed with the bourse recording turnover of almost Rs 3 billion.

Hit hard by the broad slump were Microfinance, Non-life Insurance and Life Insurance sectors with the respective sub-indices shedding 6.16%, 6.1% and 5.21%, respectively. Banking and Hotels sub-indices also tanked by over 4% each. All other sectors succumbed to Wednesday's bearish pressure and registered notable losses on the day.

Shares of Nepal Life Insurance Company Ltd were traded the most on the week's penultimate trading day. Over Rs 266 million worth of the life insurer's shares were traded on the day. NMB Bank Ltd, Himalayan Distillery Ltd and NIC Asia Bank Ltd, meanwhile, registered turnovers of over Rs 130 million each. Gurans Life Insurance Company Ltd, Nabil Bank Ltd and Global IME Bank Ltd were among other active stocks of the day.

Few stocks outperformed the broader index. Samudayik Laghubitta Bittiya Sanstha Ltd and Reliance Finance Ltd were among the few which saw a rally of over 5%. Laxmi Value Fund-1 and Swarojgar Laghubitta Bikas Bank Ltd saw their unit prices rise by almost 2% each. Salt Trading Corporation Ltd, Multipurpose Finance Company Ltd and Manjushree Finance Ltd also eke out marginal gains.

Microfinance stocks stretched their slump with most of the stocks remaining locked in the lower circuit of 10%. Share prices of National Microfinance Bittiya Sanstha Ltd, Nepal Seva Laghubitta Bittiya Sanstha Ltd, Swadeshi Laghubitta Bittiya Sanstha Ltd and Kalika Microcredit Development Bank Ltd hit the negative circuit of 10%. Sparsha Laghubitta Bittiya Sanstha Ltd, Civil Laghubitta Bittiya Sanstha Ltd, Forward Community Microfinance Bittiya Sanstha Ltd and Ghodi Ghoda Laghubitta Bittiya Sanstha Ltd closely followed with losses of over 9% each.

In terms of ARKS technical analysis, the market formed a strong bearish candlestick on the daily timeframe extending its downfall further. With Moving Average Convergence Divergence (MACD) bearish cross formation, the market will likely continue its south-bound movement further. Relative Strength Index (RSI) also suggests slightly bearish momentum prevailing in the secondary market. Nonetheless, the market currently rests at its minor support of 1,440 points where some rebound can be expected. However, highly cautious trading is suggested unless the market posts a notable move upside with above average turnovers.

This column is produced by ARKS Capital Advisors Ltd

www.arkscapitaladvisors.com (Views expressed are those of the producer and do not necessarily reflect those of this publication)

You May Like This

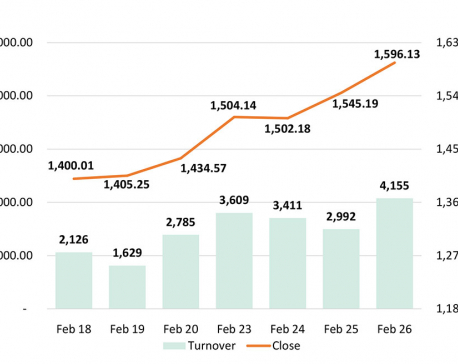

Nepse near 1,600 points, logs turnover of Rs 4.15b

KATHMANDU: The Nepal Stock Exchange (Nepse) index rallied sharply in the morning on Wednesday adding more than 25 points. The... Read More...

Nepse turns green after Wednesday’s retracement

KATHMANDU: The Nepal Stock Exchange (Nepse) index rose on Thursday morning but quickly gave up its gains to trade in... Read More...

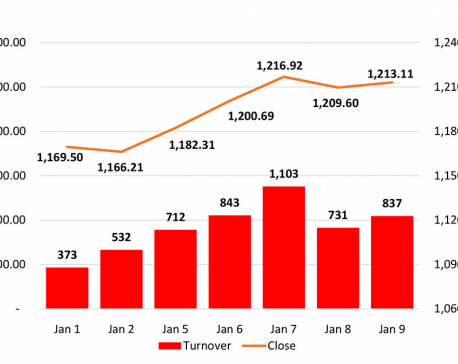

Nepse index hits double-digit fall

KATHMANDU, Nov 29: The price of shares in the domestic stock market has dropped by two digits. ... Read More...

Just In

- NRM to announce two citizen heroes today

- Federal capital Kathmandu adorned before Qatar Emir's State visit to Nepal

- Public transport to operate during Qatari king’s arrival, TIA to be closed for about half an hour

- One arrested from Jhapa in possession of 43.15 grams of brown sugar

- EC to tighten security arrangements for by-elections

- Gold price drops by Rs 2,700 per tola

- Seven houses destroyed in fire, property worth Rs 5.4 million gutted

- Police pistol missing after drug operation in Bara, investigation underway

Leave A Comment