OR

Nepse down 23 points as liquidity in banks get tighter

Published On: October 29, 2016 12:50 AM NPT By: Republica | @RepublicaNepal

KATHMANDU, Oct 29: Nepal Stock Exchange (Nepse) index plunged 22.68 points this week to close at 1,759.71 points on Thursday -- the last trading day of the week.

The stock market has taken a downward path in recent weeks after a long bull run, which was fuelled by liquidity surplus in the banking system and announcement of handsome stock dividend by bank and financial institutions to raise their paid-up capital. As BFIs are now saying that they are starting to feel liquidity crunch, the stock market is also feeling the pinch, say stock analysts. BFIs are now increasing their interest rates as they are starting to face liquidity crunch.

Slowdown in remittance growth rate, huge surplus in government treasury due to failure to boost capital spending and recent pick-up in lending of BFIs are some of the factors attributed for tight liquidity situation.

"Banks are now saying that they do not have excess liquidity anymore. This is likely to tighten their lending toward stock market. The stock market was enjoying cheaper fund of the banking system during liquidity surplus. Now liquidity situation is tightening for banks,” Anjan Raj Poudyal, former president of Stock Brokers Association of Nepal (SBAN), said "Many investors, who used to rely on bank financing in the stock market are now booking profit as banks are raising their rates.”

Also, the sluggishness in the stock market is due to the festive season when transactions and market activities go down, say brokers.

Insurance group was the biggest loser of the week as its sub-index tanked 108.17 points to close at 9,166.9 points. Hotels group also shed 73.55 points to settle at 2,289.95 points. Banking group, the heavyweight group in the secondary market, also ended 29.5 points lower at 1,656.49 points. The sub-indices of Development Bank and Others groups also went down 12.04 points and 1.16 points, respectively, to end the week at 1,831.07 points and 764.1 points. Hydropower group also logged loss of 0.58 point to close at 2,346.54 points. Finance group, however, posted a gain of 1.03 points to close at 817.45 points. The sub-indices of Manufacturing and Processing, and 'Trading' groups remained unchanged this week.

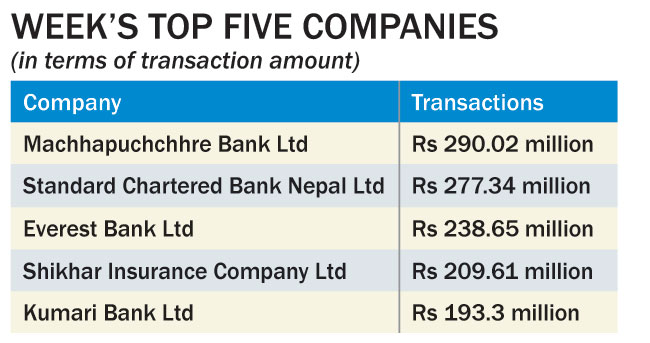

A total of 4.93 million units of shares of 151 companies worth Rs 4.12 billion were traded in the market this week through 23,626 transactions. The turnover this week was down by 37.05 percent compared to last week.

You May Like This

Nepse continues losing run to end 25 points down

KATHMANDU, June 11: The stock market started on a lower note on Sunday – the first trading day of the... Read More...

Panic selloff pushes Nepse 89 points down

KATHMANDU, Aug 8: Panic sell-off pushed Nepal Stock Exchange (Nepse) index down by a whopping 88.81 points on Monday. ... Read More...

Nepse down 4 points as investors book profit

KATHMANDU, July 16: Nepal Stock Exchange (Nepse) index shed 4.38 points this week to close at 1,718.15 points on Thursday... Read More...

Just In

- Govt receives 1,658 proposals for startup loans; Minimum of 50 points required for eligibility

- Unified Socialist leader Sodari appointed Sudurpaschim CM

- One Nepali dies in UAE flood

- Madhesh Province CM Yadav expands cabinet

- 12-hour OPD service at Damauli Hospital from Thursday

- Lawmaker Dr Sharma provides Rs 2 million to children's hospital

- BFIs' lending to private sector increases by only 4.3 percent to Rs 5.087 trillion in first eight months of current FY

- NEPSE nosedives 19.56 points; daily turnover falls to Rs 2.09 billion

Leave A Comment