OR

Daily Market Commentary

Nepse climbs higher as volatile stocks partially recoup prior month’s losses

Published On: July 11, 2021 09:58 PM NPT By: Republica | @RepublicaNepal

KATHMANDU, July 11: Stocks maintained positive bias since the beginning of Sunday’s trading session. The Nepal Stock Exchange (Nepse) index shot up by more than 40 points in the morning before registering a slight correction. Nonetheless, stocks continued to see strength in the latter trading hours. At the close, Nepse rose 74.71 points recouping its July losses to settle at 2,899.82.

After consolidation for multiple trading sessions around 2,800 mark, the market witnessed enthusiasm from investors. Further, with finance, development bank and hydropower stocks witnessing sharp losses from Mid-June, traders also took heavy buying positions in such stocks driving the broader market higher. Market participation also jumped as quarter end selling pressure has subsided of late. Over Rs. 8 billion worth of shares changed hands on the day, the bourse’s highest turnover in the month of July.

Finance and Development Bank stocks rallied sharply pushing the respective sub-indices more than 8% higher. Life Insurance sub-index jumped 2.92% followed by Hydropower sub-index which added 2.88%. All other stocks closed the day firmly higher. Heavyweight banking sector rose 2.34% on average.

NIC Asia Bank Ltd was the most actively traded stock of the day. The commercial bank registered a turnover of Rs. 400 million. Nabil Bank Ltd and Nepal Bank Ltd followed suit with turnovers of Rs. 258 million and RS. 244 million. Nepal Infrastructure Bank Ltd, Manjushree Finance Ltd and Himalayan Distillery Ltd posted transactions of Rs. 187 million, Rs. 177 million and Rs. 176 miillion, respectively.

Mainly, finance stocks dominated the list of gainers. Gurkhas Finance Ltd, Shree Investment & Finance Co. Ltd and ICFC Finance Ltd rallied exactly 10%. Shine Resunga Development Bank Ltd, Multipurpose Finance Ltd, Samriddhi Finance Company Ltd, Mahalaxmi Bikas Bank Ltd and Shangrila Development Bank Ltd rallied more than 9%.

On the other hand, Corporate Development Bank Ltd corrected sharply and fell 3.75%. Oriental Hotels Ltd, Upper Tamakoshi Hydropower Ltd and Nepal Telecom Ltd also saw modest losses.

As per the ARKS technical analysis, the index formed a strong bullish candlestick suggesting buying pressure on Sunday. Further, a jump in turnover also reflects momentum favoring buyers in the present context. As the index closed exactly at psychological 2,900 mark, the index’s reaction to the level will be crucial to determine the upcoming move of the stock market. Both Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) suggest slight shift in momentum towards bulls. A sustained trading above 2,900 with notable volumes can see the market stretch uptrend further.

This column is produced by ARKS Capital Advisors Ltd.

(Views expressed in the article are those of the producer and do not necessarily reflect those of this publication)

You May Like This

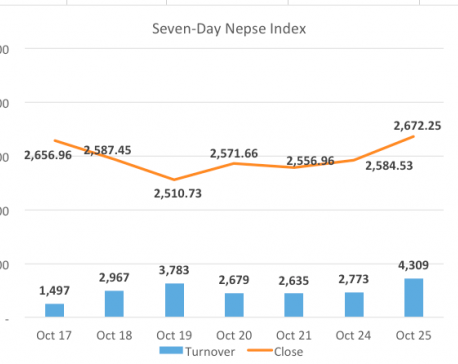

Nepse rally 87 points

KATHMANDU, Oct 25: The local equity market saw strength since the beginning of Monday’s trading hour. The Nepal Stock Exchange... Read More...

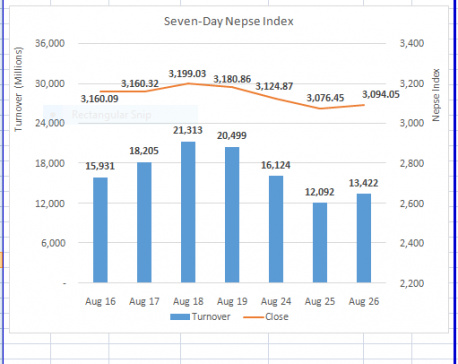

Nepse up slightly after three days of freefall

KATHMANDU, August 26: The Nepal Stock Exchange (Nepse) index witnessed an upbeat start to Thursday’s session. The index climbed above 3,100... Read More...

Daily turnover jumps as Nepse ends higher

KATHMANDU, May 13: The Nepal Stock Exchange (Nepse) index traded slightly higher in the morning and continued to advance gaining as... Read More...

Just In

- Nepal-Qatar Relations: Prioritize promoting interests of Nepali migrant workers

- Health ministry to conduct ‘search and vaccinate’ campaign on May 13

- Indian customs releases trucks carrying Nepali tea, halted across Kakarbhitta

- Silent period for by-election to begin from midnight

- SC issues short-term interim order to govt and TU not to take immediate action against TU legal advisor Khanal

- National consultation workshop advocates to scale up nutrition smart community in Nepal

- Patan High Court issues short-term interim order to halt selection process of NTB’s CEO

- NEPSE inches up 0.15 points; daily turnover increases to Rs 2.53 billion

Leave A Comment