OR

Daily Market Commentary

Nepse begin post-holiday trading on a weak footing

Published On: November 8, 2021 07:15 PM NPT By: Republica | @RepublicaNepal

KATHMANDU, Nov 8: Stocks opened in positive territory and maintained its footing in green for most of the beginning trading hours. However, sellers prevailed in the afternoon dragging the index 19.20 points lower at the close. Nepse finished Monday’s trading at 2,829.64.

Stocks have continued to trend sideways as investors lack conviction in the current juncture. Turnover also dropped firmly. A below par turnover of Rs. 4.4 billion was witnessed on the day.

Most of the sectors fell, while only Finance, Investment and Mutual Fund ended in green. Among losing sectors, Development Bank group fell the most as the average fell 1.24%. ‘Others’, Banking and Non-Life Insurance sub-indices also fell over 1% each.

Mahalaxmi Bikas Bank Ltd and Nabil Bank Ltd were the most actively traded stocks with turnovers of Rs. 521 million and Rs. 303 million. ICFC Finance Ltd and National Hydropower Company Ltd followed suit with turnovers of Rs. 224 million and Rs. 154 million. United Modi Hydropower Ltd, Api Power Company Ltd, Lumbini Bikas Bank Ltd and Nepal Reinsurance Company Ltd were among other top turnover stocks.

ICFC Finance Ltd, Sahas Urja Company Ltd, Terathum Power Company Ltd and Manushi Laghubitta Bittiya Sanstha Ltd hit the upper circuit of positive 10%. Mahalaxmi Bikas Bank Ltd, Janaki Finance Ltd and Nepal Infrastructure Bank Ltd also saw considerable strength.

Support Laghubitta Bittiya Sanstha Ltd, on the other hand, tanked around 8%. Panchthar Power Company Ltd tanked 5% despite reporting growth in its net profit in the first quarter. Kalika Power Company Ltd, Himalaya Urja Bikas Company Ltd, Joshi Hydropower Development Company Ltd and Ru Ru Jalbidhyut Pariyojana Ltd slumped around 4% apiece.

On the technical front, Nepse has stretched its consolidation phase trading range bound above 2,800 mark. No clear direction is visible of late, with 2,800 mark acting as a near term support. On the higher side, a breakout above 2,880 can signal short term upward move. Momentum indicators also show mixed signal in the current juncture.

This column is produced by ARKS Capital Advisors Ltd.

(Views expressed in the article are those of the producer and do not necessarily reflect those of this publication)

You May Like This

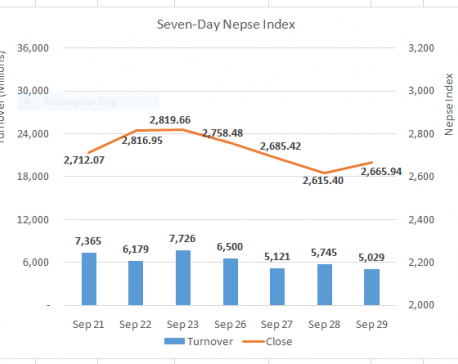

Stocks recoup losses as 2,600 mark holds ground

KATHMANDU, Sept 29: The Nepal Stock Exchange (Nepse) saw strength in the morning on Wednesday with the index climbing around 30... Read More...

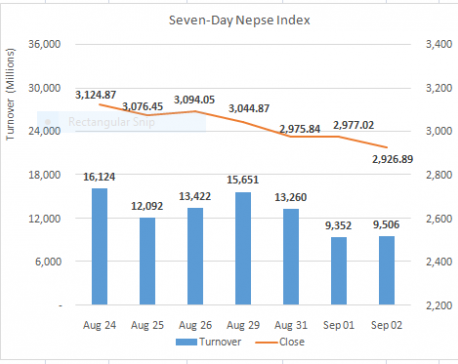

Nepse resumes correction to chase 2,900 mark

KATHMANDU, September 2: The equity market opened in positive territory but traded in red within the first trading hour on... Read More...

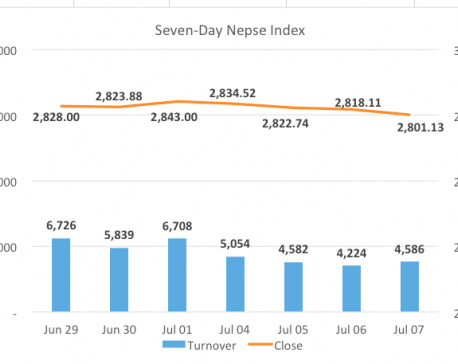

Nepse sees modest losses as quarter end approaches

KATHMANDU, July 7: Stocks traded briefly in green before pulling back towards the opening level in the morning. Subsequently, the benchmark... Read More...

Just In

- World Malaria Day: Foreign returnees more susceptible to the vector-borne disease

- MoEST seeks EC’s help in identifying teachers linked to political parties

- 70 community and national forests affected by fire in Parbat till Wednesday

- NEPSE loses 3.24 points, while daily turnover inclines to Rs 2.36 billion

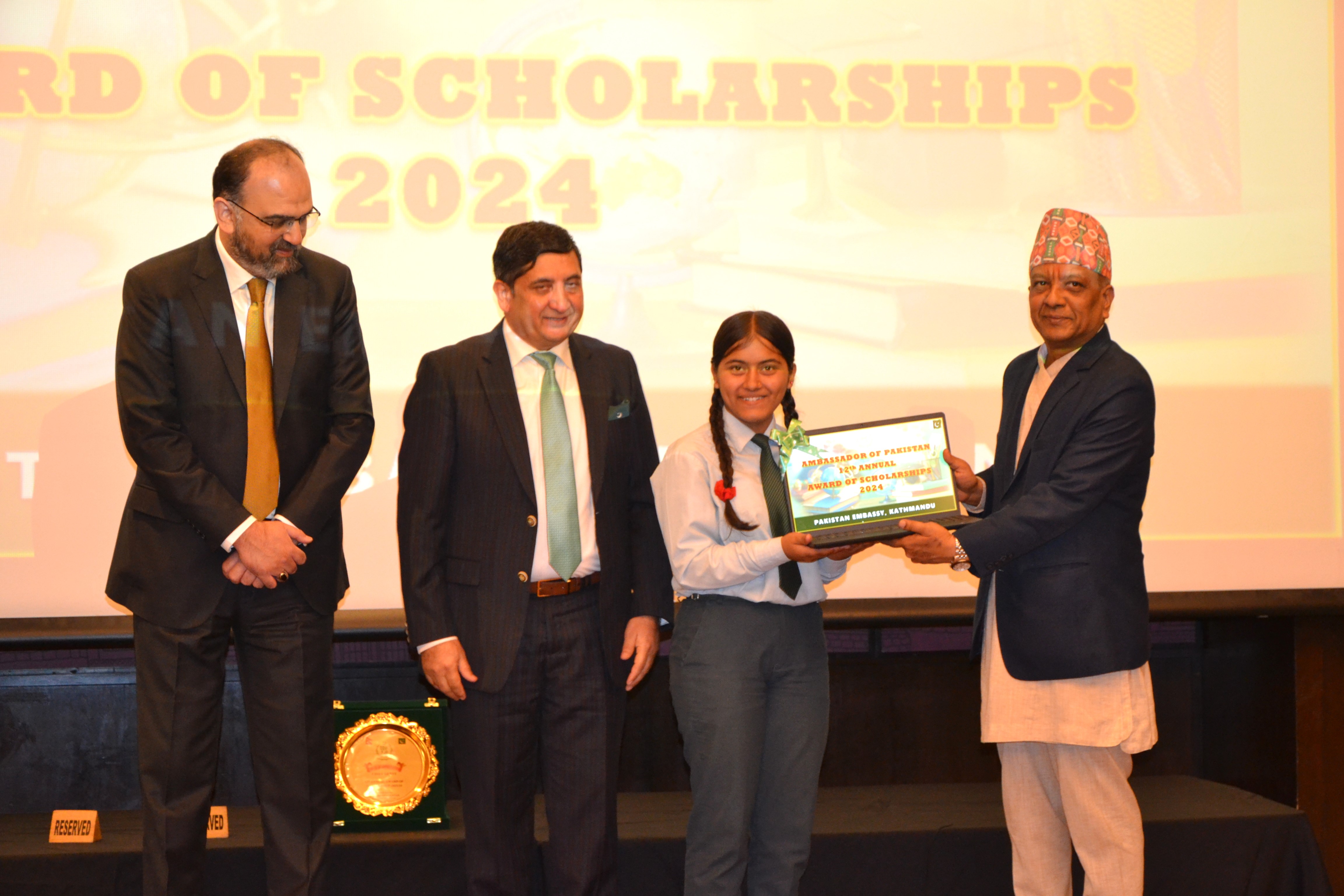

- Pak Embassy awards scholarships to 180 Nepali students

- President Paudel approves mobilization of army personnel for by-elections security

- Bhajang and Ilam by-elections: 69 polling stations classified as ‘highly sensitive’

- Karnali CM Kandel secures vote of confidence

Leave A Comment