OR

Nepal’s external sector indicators improved in the first five months of the current FY

Published On: January 15, 2023 08:30 AM NPT By: Republica | @RepublicaNepal

Still Nepal’s economy is not completely free from risks: Analysts

KATHMANDU, Jan 15: The pressure on Nepal’s external sector, which had been persisting for almost one year, has now eased at the back of an increased remittance earnings and fall in imports.

According to the Current Macroeconomic and Financial Situation Report of Nepal unveiled by Nepal Rastra Bank (NRB), the foreign currency reserves in the last one month increased by Rs 46.29 billion. Along with gaining the balance of payments (BoP) surplus worth Rs 45.87 billion, the country’s foreign currency reserves reached Rs 1.292 trillion in the first five months of the current fiscal year.

In terms of the US dollar, the foreign currency reserves with the country increased to 9.82 billion as of mid-December from 9.54 billion in mid-July. The amount will be sufficient for Nepal to import goods and services for the next 8.7 months.

The NRB records show that the positive BoP was achieved mainly due to an increase in the remittance inflows. The country’s remittance earnings increased 23 percent to Rs 480.50 billion during mid-July and mid-December. The figure was down 6.3 percent in the same period last year.

Likewise, the net transfer amount also increased 21.6 percent to Rs 530.06 billion. On the other hand, the country’s import expense fell 20.7 percent to Rs 664.75 billion.

Prakash Kumar Shrestha, executive director of the NRB, said the macroeconomic indicators are on the improving lines. According to him, the improvement was also an outcome of the country adopting restrictive policy to check excessive imports. “However, the risk has not completely gone yet,” he said.

The report entitled ‘Migration and Development Brief,’ unveiled by the World Bank in December first week, has cautioned that remittances to Nepal are projected to decline by 5 percent next year due to the conclusion of construction projects related to the World Cup in Qatar.

Recently, the NRB is mulling to lift the provision of up to a cent percent cash margin that it has been imposing on imports of a number of luxury goods. The central bank is reportedly under pressure from the International Monetary Fund to ease the restrictive measures on imports. “Given the remittance and imports face adverse situations again, it could take the balance of the country’s external sector back to the same problem,” Shrestha said.

You May Like This

Remittance inflow increases 27.1 percent in six months

KATHMANDU, March 12: The country has witnessed the inflow of remittance worth over Rs 689 billion in the first seven... Read More...

Nepal receives over 724 billion in remittance in first nine months of current FY

KATHMANDU, May 12: Nepal has received remittance amounting to over Rs 724 billion in the nine months of the current... Read More...

NRB tightens noose on import of luxury items amid declining foreign currency reserves

KATHMANDU, Dec 21: Nepal Rastra Bank (NRB) has asked importers of selected luxury items to maintain cent percent cash margin to... Read More...

Just In

- World Malaria Day: Foreign returnees more susceptible to the vector-borne disease

- MoEST seeks EC’s help in identifying teachers linked to political parties

- 70 community and national forests affected by fire in Parbat till Wednesday

- NEPSE loses 3.24 points, while daily turnover inclines to Rs 2.36 billion

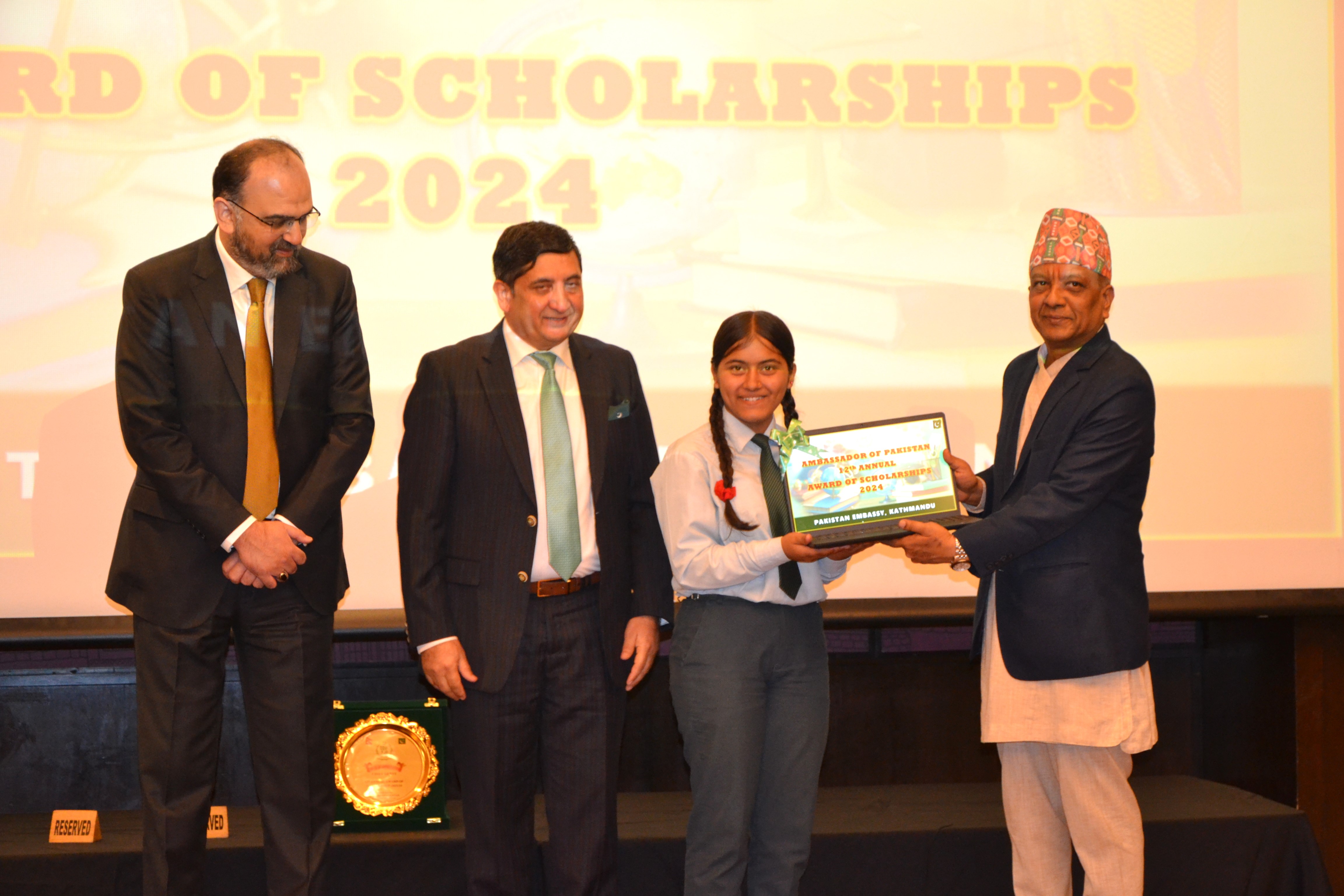

- Pak Embassy awards scholarships to 180 Nepali students

- President Paudel approves mobilization of army personnel for by-elections security

- Bhajang and Ilam by-elections: 69 polling stations classified as ‘highly sensitive’

- Karnali CM Kandel secures vote of confidence

Leave A Comment