OR

Margin trading to come into force after few weeks only

Published On: May 24, 2018 02:30 AM NPT

Nepse seeks NRB's nod before launching the facility

KATHMANDU, May 24: Investors will have to wait for few more few weeks to get margin trading facility from brokerage firms as Nepal Stock Exchange (Nepse) needs to get the nod of Nepal Rastra Bank (NRB) to start such service.

Nepse sent the working procedure on providing margin trading facility to the central bank, seeking the latter's 'guidance' on the new service that to be provided through brokerage firms.

“As this service means there will be credit creation in the market, the central bank could have concern over the issue. So, we have decided to get the clearance or guidance from the NRB, which is the sole regulatory authority of the credit market, to implement it,” Murahari Parajuli, the spokesperson for Nepse, told Republica.

Last week, Nepse had approved the working procedure on margin trading facility. The margin facility aims at reducing the procedural hassle for investors while getting financing service from the bank and financial institutions (BFIs) to make investment in the stock market. Once the margin trading facility comes into practice, they will be able to get financing service from the brokerage firms itself.

In line with the demand of investors, Securities Board of Nepal (Sebon) had issued a circular to Nepse in the first week of January with an instruction to prepare working procedure on margin trading facility and present it for the board's approval.

According to Parajuli, Nepse will issue permit to interested eligible brokerage firms once the central bank gives its go ahead to the stock exchange company.

“This process may take few weeks. Once, Nepse provides permit to the brokerage firms, they can start providing margin trading facility,” he added.

Among others, brokerage firms having net worth of at least Rs 50 million will be allowed to provide such service.

Investors can use the borrowed funds to trade securities in the secondary market. Under this facility, a brokerage firm will first take a certain amount, known as initial margin, from investors and pour it into the remaining amount to buy stocks of any listed company. The initial margin has been set at 50 percent of either the average share price of past 180 days, or market price, whichever is low.

While providing margin trading facility, brokerage firms will charge investors a certain interest rate or service charge. However, the margin trading service will not be available for buying securities of all listed companies. According to the working procedure and the Sebon's directive, margin trading facility will be available for buying securities of only those companies that have at least 10,000 shareholders, have a positive net worth and have distributed at least 10 percent annual dividend in the past two fiscal years.

The working procedure has given authority to the brokerage firms to sell securities bought through the margin trading facility if the borrower fails or refuses to make payment for the minimum maintenance margin or the investor does not come into contact. According to the working procedure, brokerage firms must take 40 percent of the total market value of the securities as margin maintenance in the account during the period of the use of margin trading facility.

Maintenance margin is the minimum amount of equity that must be maintained in a margin account.

You May Like This

Stockbrokers allowed to provide margin trading facility

KATHMANDU, Nov 7: Securities Board of Nepal (Sebon) has paved the way for stock brokerage firms to provide margin trading services... Read More...

Brokerage firms to be allowed to provide margin trading service

KATHMANDU, Oct 17: The Securities Board of Nepal (Sebon) is preparing to allow stock brokerage firms to provide margin trading service... Read More...

Brokerage firms to be allowed to provide margin trading service

KATHMANDU, Oct 18: The Securities Board of Nepal (Sebon) is preparing to allow stock brokerage firms to provide margin trading service... Read More...

Just In

- Seven houses destroyed in fire, property worth Rs 5.4 million gutted

- Police pistol missing after drug operation in Bara, investigation underway

- Truck carrying chemical used in drugs catches fire

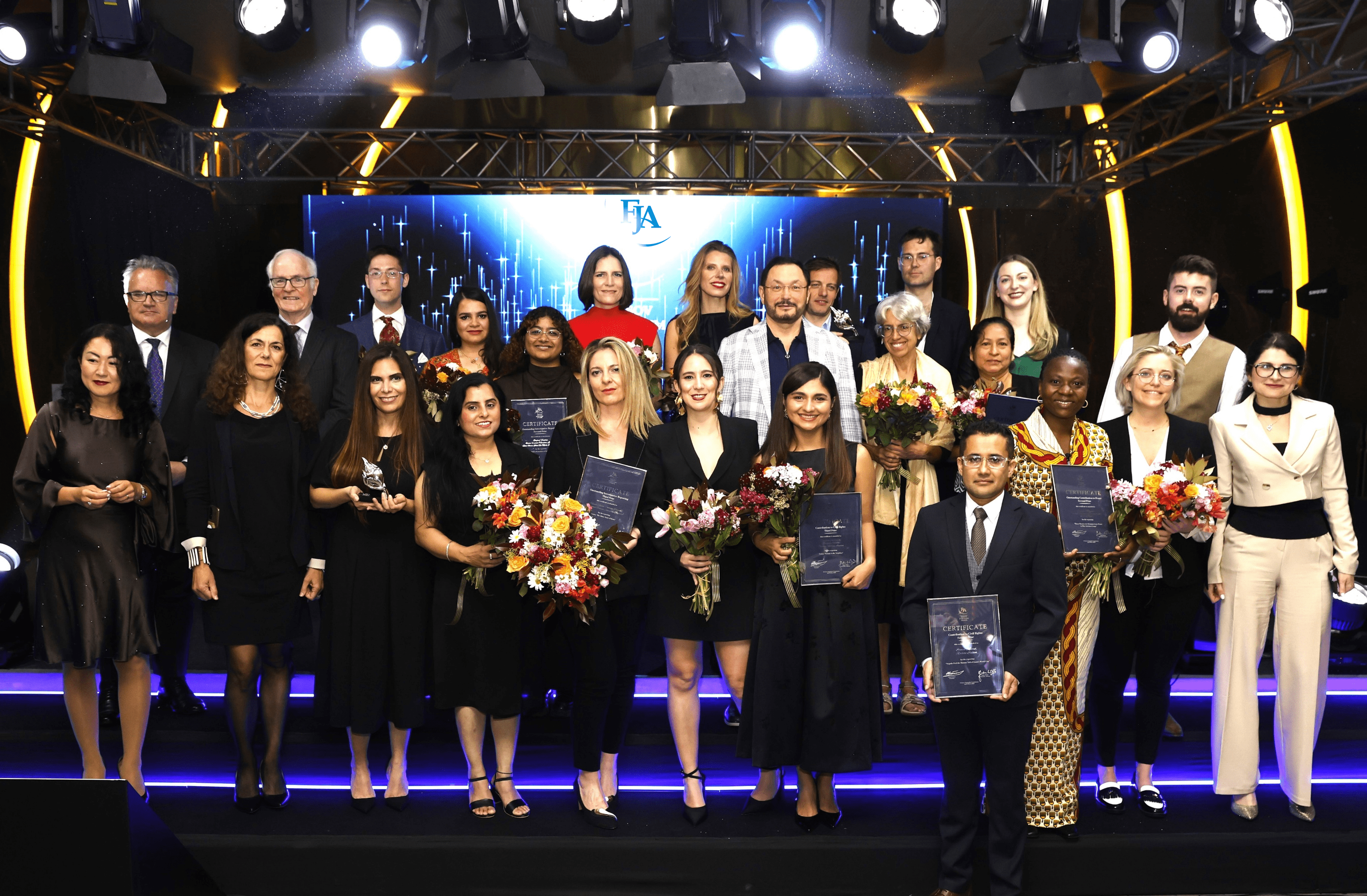

- Nepali journalists Sedhai and Kharel awarded second prize at Fetisov Journalism Awards for their exposé on worker exploitation in Qatar World Cup

- Devotees gather at Balaju Park for traditional ritual shower at Baisdhara (Photo Feature)

- PPMO blacklists 33 construction companies

- UK Parliament approves Rwanda deportation bill, ending weeks of legislative stalemate

- SC refuses to issue interim order in petition against Sudurpaschim province govt

Leave A Comment