OR

LTO seeks experts' opinion on Ncell tax assessment

Published On: January 26, 2017 11:17 PM NPT By: Republica | @RepublicaNepal

KATHMANDU, Jan 26: Large Taxpayers Office (LTO) is forming a team of experts to advise it on Ncell's ownership transfer case.

Publishing a notice in Gorkhapatra daily, LTO invite interested tax experts, chartered accountants and lawyers to join its pool of experts. LTO will seek their opinions to determine capital gains tax (CGT) on deal worth around Rs 143 billion.

Shova Kanta Paudel, chief of LTDO, told Republica that they were forming a roster of experts

for reassessment of the taxes, including in Ncell's case.

Interested tax experts, chartered accountants, lawyers can register their names with the LTO within seven days of the publication of the notice. LTO will keep the name of such experts and their suggestion secret as per the existing law, according to Paudel.

The LTO's fresh move came after the government pledged to settle the issue and recover CGT within three months in a meeting of parliament's Public Accounts Committee (PAC) two weeks ago. Concluding a series of meeting on Tuesday, PAC also instructed the government to bar Ncell from rolling out 4G service until it outstanding CGT is cleared.

Malaysia-based telecom company, Axiata, bought shares in Ncell from Swedish company TeliSonera in a deal worth Rs 143 billion in December, 2015. Ncell has been dillydallying to clear CGT as per the law despite repeated directions from different authorities, including the PAC.

Ncell has argued that the current owner, as a buyer, has no responsibility to pay CGT. It insists that the responsibility rests with the seller. The GSM operator has paid around Rs 13 billion so far.

PAC Member Ram Hari Khatiwada says Ncell should pay around 25 percent of the transaction amount, or Rs 36 billion, as CGT.

You May Like This

Ncell 'dillydallying' on taxes stirs boycott backlash

KATHMANDU, April 26: Though the Large Tax Payers Office (LTO) had given Ncell Pvt Ltd seven days to pay its Capital... Read More...

House panel gives telcos a month to clear taxes and fees

KATHMANDU, Feb 11: Parliament's Finance Committee on Sunday directed the government to recover all outstanding taxes and fees from the country's... Read More...

CIAA drags tax scam accused to special court, seeks Rs 10 billion from accused

KATHMANDU, July 16: The Commission for the Investigation of Abuse of Authority on Sunday filed a corruption case against suspended chief... Read More...

Just In

- NEPSE nosedives 19.56 points; daily turnover falls to Rs 2.09 billion

- Manakamana Cable Car service to remain closed on Friday

- Nepal govt’s failure to repatriate Nepalis results in their re-recruitment in Russian army

- Sudurpaschim: Unified Socialist leader Sodari stakes claim to CM post

- ED attaches Raj Kundra’s properties worth Rs 97.79 crore in Bitcoin investment fraud case

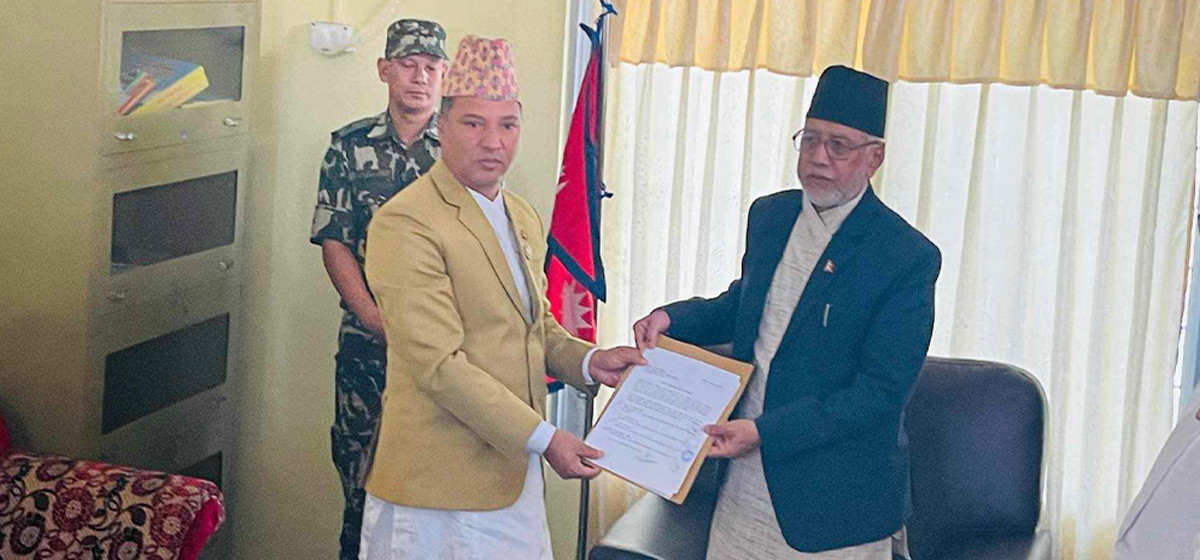

- Newly-appointed Auditor General Raya takes oath of office and secrecy

- CM Mahara expands Cabinet in Lumbini Province

- FinMin Pun addresses V-20 meeting: ‘Nepal plays a minimal role in climate change, so it should get compensation’

Leave A Comment