OR

Loose regulation makes Nepal profitable prospect: NRB chief

Published On: June 18, 2016 06:35 AM NPT By: Republica | @RepublicaNepal

KATHMANDU, June 17: While investors keep saying that investing in infrastructure in Nepal is challenging, the central bank governor says that the country is profitable to invest in as there aren’t enough and stringent laws and regulations here.

Not only does Nepal lack mega infrastructure projects, it also doesn’t have stringent laws, which gives enough space for investors, Nepal Rastra Bank (NRB) governor Chiranjivi Nepal said at a workshop on ‘Infrastructure Financing: Challenges and Opportunities’ organized jointly by the Confederation of Nepalese Industries (CNI) and Hydroelectric Investment and Development Company Ltd (HIDCL) in Kathmandu on Friday.

Even though the reform process slowdown in the recent years has left some roadblocks for investors interested in mega infrastructure projects, there have been some positive initiatives too, he said, citing the example of the formation of Investment Board Nepal (IBN) which has been following every project closely to facilitate them.

“Investors look for five indicators before putting up their money,” the governor said, naming five indicators as political stability, policy consistency, flexible labor policy, tax policy and inflation rate. The formation of IBN has ensured some sort of policy consistency for foreign investors, he said, adding that Nepal was learning by doing and this could prove to be the best opportunity for investors.

IBN Chief Executive Officer (CEO) Radhesh Pant, on the occasion, said that law alone cannot attract investment. “The laws should be there to gain trust from investors, but the government has to ensure that there is some profit for investors to come to invest in Nepal,” he said, adding that along with the implementation of the projects, policies should also go on improving. “But the government’s commitment and fulfillment of those commitments are a must to build trust on the government.”

Pant said the government must join hands with the private sector for the implementation of the projects as the private sector alone cannot complete the land acquisition and compensation process without the government’s participation.

Likewise, Nabil Bank Ltd Chief Executive Sashin Joshi also reiterated that without a guarantee of profit, no investor would ever invest anywhere. “Our neighbouring countries have been courting investors with incentives,” he said, asking why the investors should come to Nepal.

Nepal, he said, needed foreign investment as domestic investment was not enough to fund the infrastructure investment gap that the country faces. “Nepal needs $ 3 billion every year to develop hydropower alone according to the Millennium Challenge Corporation,” he said, adding that Nepal needed $ 7 billion to achieve the double-digit growth which ensures Nepal’s graduation to the developing country status from the current Least Developed Country status. “Thus, Nepal needs foreign investment in infrastructure.”

However, there are various challenges in attracting foreign investment in infrastructure.According to Ashish Garg, member of the Infrastructure Cell of CNI, Nepal needs to be in the investment radar with better credit ratings and investment protection. “Nepal also needs to develop a sustainable foreign-exchange management regime apart from simplifying the approval process by delivering a one-desk policy,” he said, adding that an enabling environment, establishment of a dedicated banking system, and building trust between the government and the private sectors are some of the way forward.

Likewise, advocate Gandhi Pandit urged the government to amend the laws to help promote project financing and attract institutional investors to Nepal.

Participants also dwelt on various legal and procedural problems in project financing and how to simplify them

You May Like This

NC clinches chief and deputy chief posts in Diprung Rural Municipality

KHOTANG, July 1: Nepali Congress (NC) candidate Bhupendra Rai has emerged victorious in the race for the chief of Diprung... Read More...

Maoist Center wins race for chief and deputy chief of Banfikot Rural Municipality in Rukum

RUKUM, May 17: CPN(Maoist Center) candidate Dharma Bahadur KC has won the race for chief of Banfikot Rural Municipality in... Read More...

NC elected chief, UML deputy chief in Sinja Rural Municipality

JUMLA, May 16: Dewal Sing Rawal of Nepali Congress has been elected as chief of Jumla Rural Municipality. ... Read More...

Just In

- World Malaria Day: Foreign returnees more susceptible to the vector-borne disease

- MoEST seeks EC’s help in identifying teachers linked to political parties

- 70 community and national forests affected by fire in Parbat till Wednesday

- NEPSE loses 3.24 points, while daily turnover inclines to Rs 2.36 billion

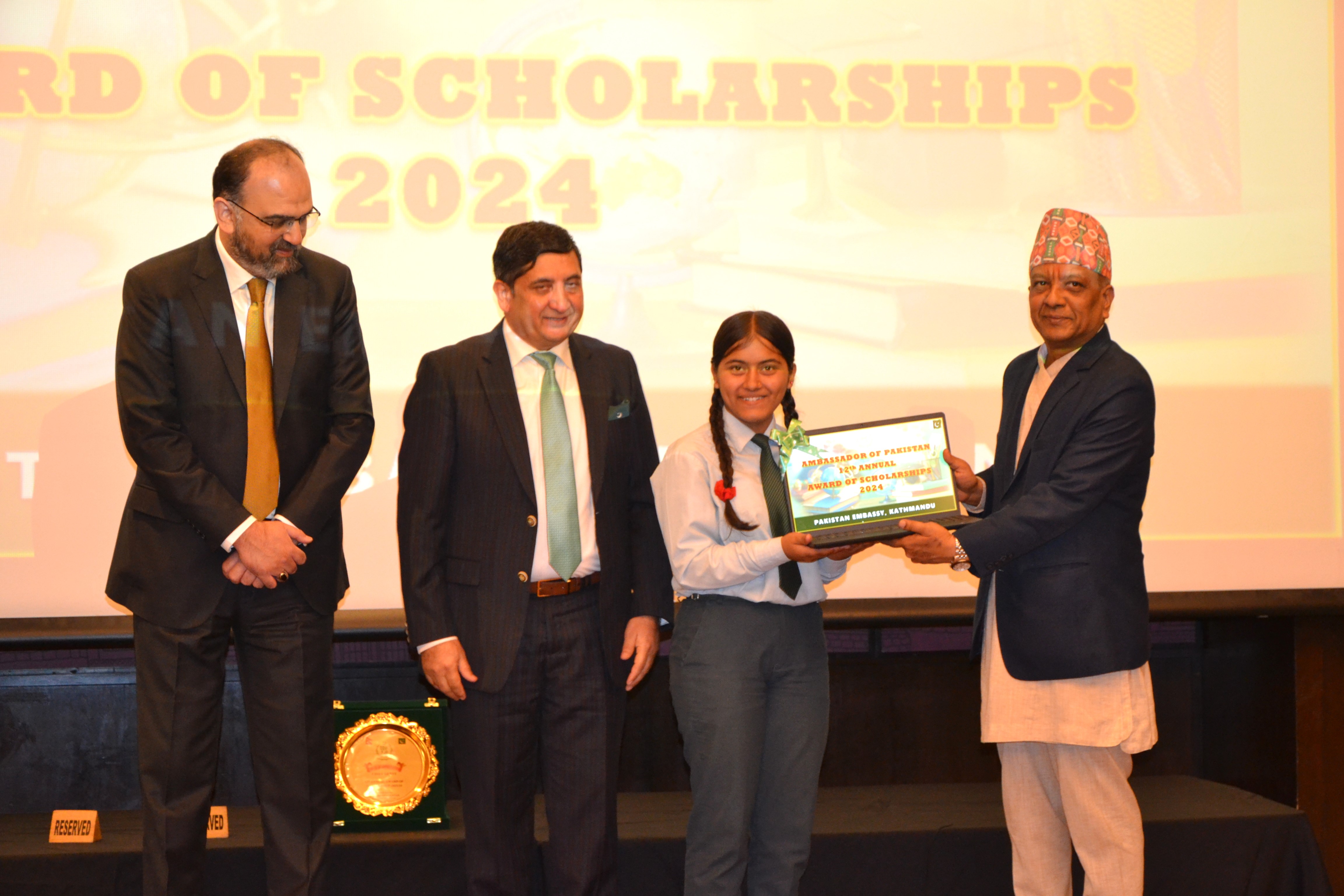

- Pak Embassy awards scholarships to 180 Nepali students

- President Paudel approves mobilization of army personnel for by-elections security

- Bhajang and Ilam by-elections: 69 polling stations classified as ‘highly sensitive’

- Karnali CM Kandel secures vote of confidence

Leave A Comment