OR

Investors indifferent to restructuring of minister’s cabinet

Published On: November 23, 2019 11:42 AM NPT By: Republica | @RepublicaNepal

KATHMANDU: Nepal's stock market remained under pressure throughout the week with investors showing lack of enthusiasm to take buying positions. The Nepal Stock Exchange (Nepse) index registered a modest drop of 4.59 points on Sunday. The benchmark index wavered on Monday, Tuesday and Wednesday with meager declines of 0.24 points, 1.13 points and 1.65 points.

Losses accentuated on the last trading day of the week as Thursday witnessed a 7.74 points drop. Consequently, the bourse's loss tally for the week stood at 15.35 points or 1.35% compared to the week earlier.

Investors approached stock market with caution in the review period with government mulling over restructuring of the cabinet of ministers. The decision officially came on Wednesday where six ministers and three state ministers were axed with replacement ministers called in to fill their place.

Meanwhile, it was also confirmed that Prime Minister KP Sharma Oli will hold his position for the remaining tenure of around 2 and a half years, while Nepal Communist Party (NCP) will be led by Pushpa Kamal Dahal. However, the transformation seemed to have no effect on the overall investor sentiment among investors pointing towards further murky outlook. Weekly volume dropped to Rs 1,573 million against Rs 1,727 million in the prior week.

Class 'A' stocks also took a knock with the Sensitive Index sinking 1.27%. Sectoral performance show lack of optimism. Only Trading sub-group rallied 42.61% with relentless buying pressure seen on shares of Salt Trading Corporation. 'Others' sub-index edged 0.27% higher. Besides, all other sectors ended in red. Manufacturing & Processing scrips led the losses. The group's sub-index tumbled 7.80% dragged by Shivam Cements Ltd. Hydropower and Non-Life Insurance segments also struggled with 3.19% and 2.34% slumps. Finance, Microfinance, Life Insurance, Hotels and Banking sub-indices registered declines of over 1% each. Development Bank sub-index inched 0.57% lower.

On the corporate front, Citizen Investment Trust published its first quarter report on Friday. The state-run fund reported a 15% year-on-year growth in its earnings. Its net profit stands at Rs 121 million. Meanwhile, Soaltee Hotel Ltd has called for its Annual General meeting (AGM) on January 9. Approval of dividend is its key agendas among others. Earlier, the hotel announced 15% bonus shares and 11.32% cash dividend.

ARKS technical analysis indicates the market forming a bearish candlestick on the weekly timeframe. This week's slump saw the index drop to its immediate support of 1,120 points making next week's market activity crucial for traders.

Technical indicators also indicate some pressure prevailing in the equity market. Hence, a breach of the support might hint further downward movement in the bourse. On the other hand, a rebound from the current level with substantial volume might present buying opportunity for investors and traders.

This column is produced by ARKS Capital Advisors Ltd

www.arkscapitaladvisors.com

(Views expressed are those of the producer and do not necessarily reflect those of this publication)

You May Like This

Nepse sees modest drop hitting a fresh 3-month low

KATHMANDU, Aug 14: The Nepal Stock Exchange (Nepse) index remained under some pressure throughout Tuesday's trading hours. ... Read More...

Nepse climbs as energy stocks rally

KATHMANDU, May 22: Stocks opened on a flat note as the Nepal Stock Exchange (Nepse) index hovered along the opening level... Read More...

Nepse down 4 points

KATHMANDU, Jan 30: Stocks maintained negative bias throughout Tuesday's session. The secondary market came under pressure since the starting of... Read More...

Just In

- World Malaria Day: Foreign returnees more susceptible to the vector-borne disease

- MoEST seeks EC’s help in identifying teachers linked to political parties

- 70 community and national forests affected by fire in Parbat till Wednesday

- NEPSE loses 3.24 points, while daily turnover inclines to Rs 2.36 billion

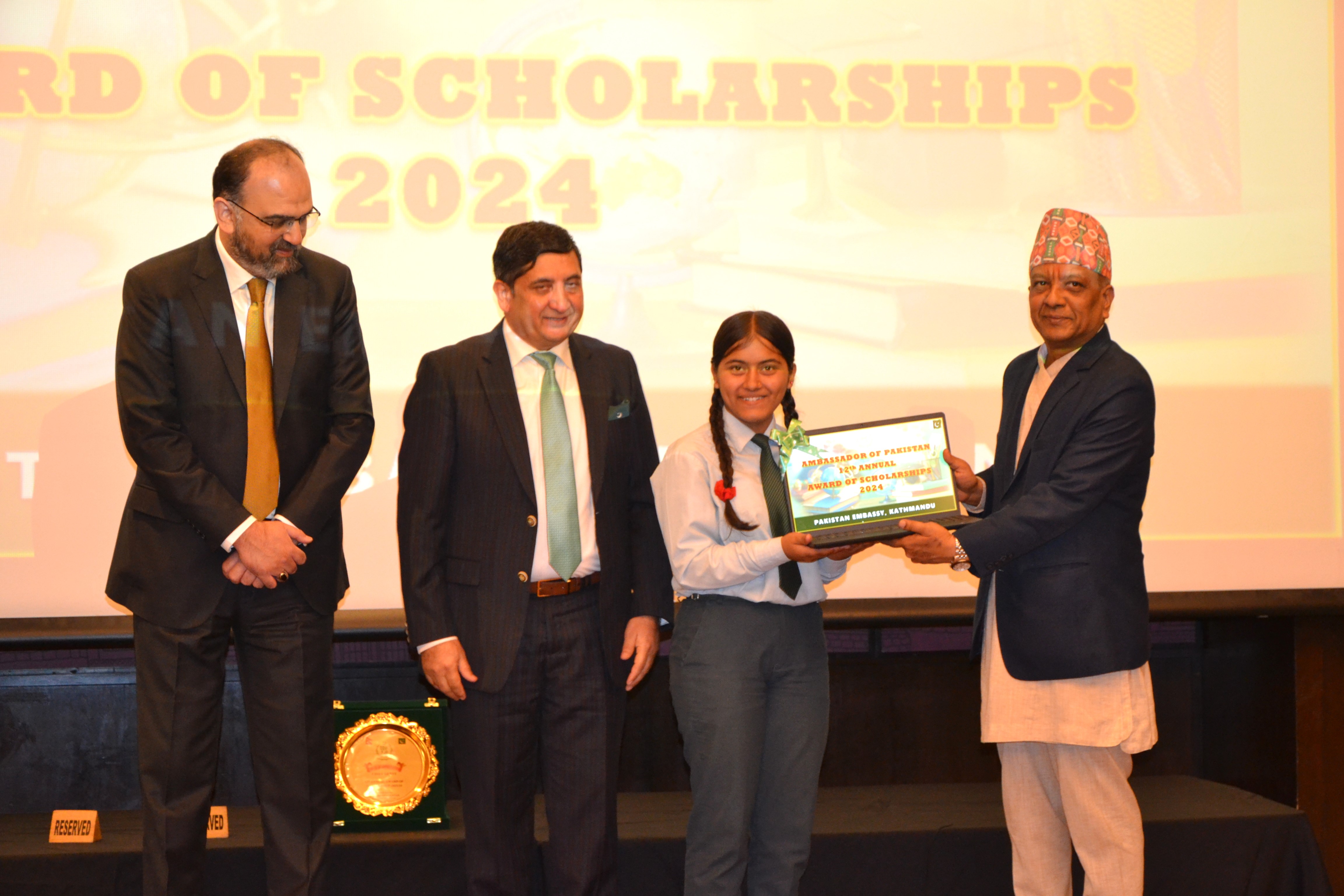

- Pak Embassy awards scholarships to 180 Nepali students

- President Paudel approves mobilization of army personnel for by-elections security

- Bhajang and Ilam by-elections: 69 polling stations classified as ‘highly sensitive’

- Karnali CM Kandel secures vote of confidence

Leave A Comment