OR

Editorial

Illogical Raise in Direct Taxes

Published On: June 5, 2023 07:30 AM NPT By: Republica | @RepublicaNepal

The recent revision of the tax structure by the government, which includes an increase in direct taxes and a broader inclusion of income earners in the tax bracket, is illogical and detrimental to the country's national economy. This move imposes an additional burden on citizens and fails to create vibrancy in economic activities. The government's decision to increase direct taxes on registration and renewal of automobiles, as well as the tax on interest earnings, further exacerbates the problem. Moreover, the introduction of a 39 percent tax for the upper income group with incomes exceeding Rs 5 million annually, and the inclusion of property transaction and share investors under the income tax bracket, only serves to add more burden to higher income earners, which is unjustifiable. It is worth noting that the income tax on salary income in Nepal was already the highest in South Asia, and the government has chosen to further increase it in the upcoming budget. Previously, the maximum rate of income tax was 30 percent, with an additional 20 percent surcharge for those earning more than 2 million. This resulted in a total income tax of 36 percent. However, the government has now increased the income tax surcharge to 30 percent for individuals with an annual income exceeding Rs 5 million. As a result, a staggering 39 percent income tax will be levied on incomes above Rs 5 million. Given that Nepal already has the highest income tax rate in South Asia, it is unjustifiable to add further burden to the taxpayers. The government's decision to solely burden the higher income group, without providing relief to lower income taxpayers, is also highly questionable.

Undoubtedly, the government is facing low revenue collection amidst a recession and a significant decline in aggregate demand. Nepal's per capita public debt has skyrocketed to Rs 73,860, marking a four-fold increase in the past decade. This increase can primarily be attributed to unproductive spending and sluggish growth in government revenue collection. Additionally, the country's budget deficit has reached Rs 271 billion as of May this year. Despite growing calls to reduce the government's recurrent expenditure, the government has chosen to ignore this matter and focus solely on increasing taxes to generate more revenue. While the government has nominally raised the minimal tax slab to Rs 600,000 annually for salary earners, providing some relief to the lower income group, it has simultaneously imposed a high income tax rate of 39 percent on those earning more than Rs 5 million per year. Furthermore, the government has increased the direct taxes on the registration and renewal of automobiles, resulting in an average additional tax burden of Rs 1,000-2,000 for vehicle owners during annual tax settlement. Additionally, the tax on interest earnings has been raised from five percent to six percent. Moreover, the government has also increased customs and excise duty by up to 15 percent on entry-level electric cars, jeeps, and vans. These measures are likely to make electric vehicles, particularly those used for public transport, more expensive by up to Rs 1 million, as reported by automobile dealers. These budget measures clearly fail to address the problems currently faced by the economy in the midst of a recession.

The government announced a budget of Rs 1.751 trillion for the fiscal year 2023/24, surpassing the ceiling of Rs 1.688 trillion set by the National Planning Commission (NPC). At a time when there is a pressing need to reduce government expenditure, recurrent expenditure has increased to Rs 1.141 trillion, with an additional amount of Rs 387 billion compared to the current fiscal year. Similarly, the government has set ambitious targets for revenue collection at Rs 1.248 trillion and foreign grants at Rs 50 billion. However, given the poor performance in these areas this year, achieving these targets seems almost impossible. Therefore, the budget for this year appears to lack professionalism. Through the revised direct tax regime, the government aims to collect an additional Rs 90 billion in taxes, primarily to fund recurrent expenditure. However, even if this amount were used for development projects, it would not be beneficial for an economy as it will reduce the private sectors’ tendency to invest.

Economic theory suggests that an increase in direct taxes reduces disposable income, leading to a decline in people's purchasing power and exacerbating the spiral of falling aggregate demand and economic recession. Given that the government has already taken substantial loans from the domestic sector, the additional burden of higher direct taxes could trigger a severe "crowding out effect," limiting the capacity of the private sector to contribute to economic activities. Instead, the government should focus on cutting unproductive expenses while enabling the private sector to inject more money into the economy independently. As a newspaper, we believe that the illogical raise in direct taxes, as implemented by the government, will have detrimental effects on the country's national economy. The burden imposed on citizens, coupled with the lack of relief for lower income taxpayers, is unjustifiable. The government's focus on increasing taxes instead of addressing unproductive expenses and promoting private sector participation in economic activities is a shortsighted approach. To foster economic vibrancy, the government should reconsider its decision and explore alternative measures that encourage growth and development while ensuring a fair and equitable tax system.

You May Like This

_20230530080540.jpg)

Govt’s decision to increase direct taxes prompts fears of economic downturn amid recession

KATHMANDU, June 4: The government that reeled under the low revenue collection has widely revised the tax structure, particularly provision... Read More...

Govt introduces ‘luxury tax’ for the first time; levies 5 percent tax on foreign travels

KATHMANDU, May 30: The government has introduced the 'Luxury Tax' for the first time. The government is going to collect... Read More...

Govt to announce budget on Monday while it faces multiple economic challenges

KATHMANDU, May 28: The government is under pressure to devise suitable fiscal policy to generate more revenue sources, to overcome... Read More...

Just In

- 265 cottage and small industries shut down in Banke

- NEPSE lost 53.16 points, while investors lost Rs 85 billion from shares trading last week

- Rainbow tourism int'l conference kicks off

- Over 200,000 devotees throng Maha Kumbha Mela at Barahakshetra

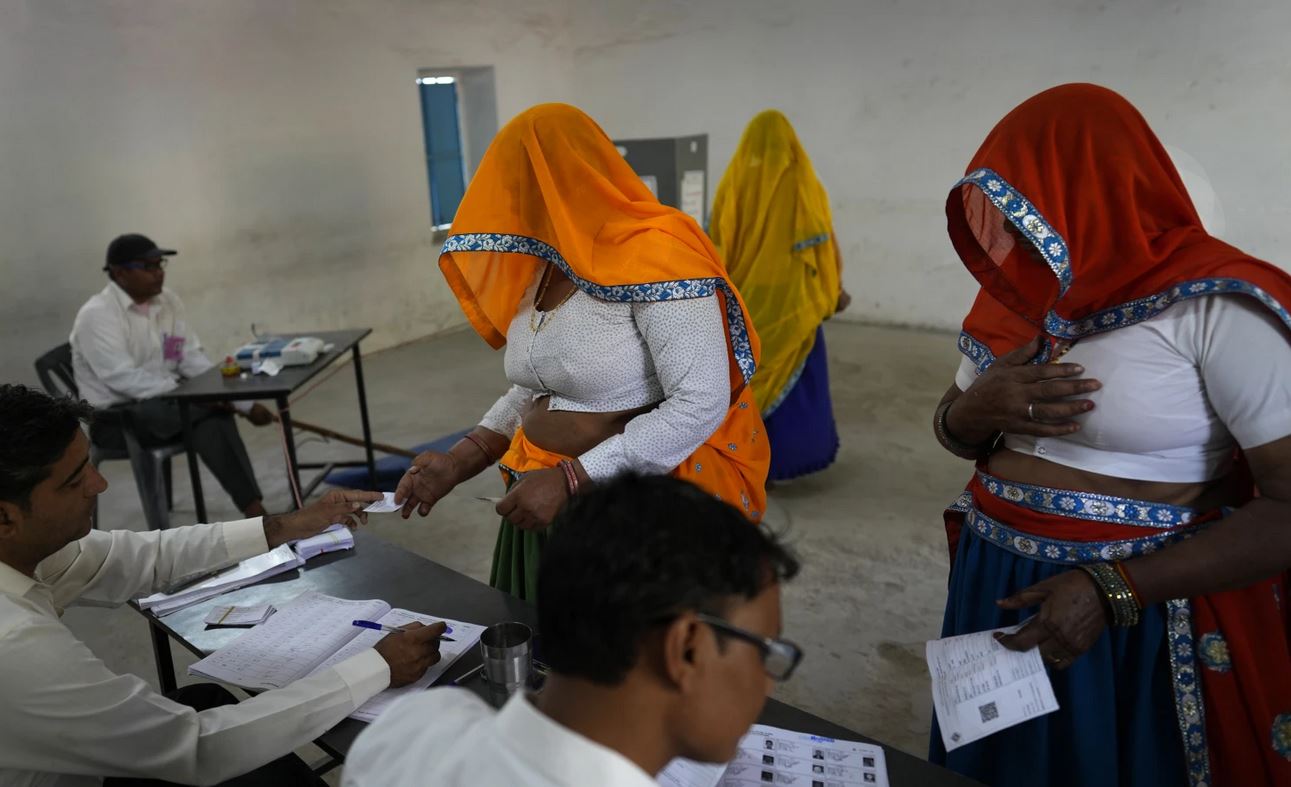

- Indians vote in the first phase of the world’s largest election as Modi seeks a third term

- Kushal Dixit selected for London Marathon

- Nepal faces Hong Kong today for ACC Emerging Teams Asia Cup

- 286 new industries registered in Nepal in first nine months of current FY, attracting Rs 165 billion investment

_20220508065243.jpg)

Leave A Comment