OR

Govt picks Fitch Ratings for Nepal’s sovereign credit rating

Published On: December 26, 2019 08:30 AM NPT By: Sagar Ghimire | @sagarghi

Credit rating is a must as the government mulls turning to the international money market for funds

KATHMANDU, Dec 26: The government has picked Fitch Ratings, the American rating agency, for the sovereign credit rating of Nepal. The decision to select Fitch Ratings will pave the way for the global rating agency to assess the creditworthiness of Nepal, a first for the country.

Shishir Kumar Dhungana, secretary (Revenue) at the Ministry of Finance (MoF), told Republica that the ministry this week decided to select Fitch Ratings to determine the creditworthiness and risk assessment of the country.

“The ministry chose Fitch Ratings for the sovereign credit rating based on its technical and financial proposal,” said Revenue Secretary Dhungana. “The credit rating agency will provide its report and rating within eight weeks after the signing of an agreement with it if it gets all the necessary documents and information,” he added.

Moody’s Investor Services and Standard and Poor’s were also in the fray.

According to Dhungana, it will take nearly four weeks to carry out the necessary preparations for the ministry to sign the agreement with Fitch Ratings. “It should not take more than 12 weeks to obtain the country’s sovereign credit rating,” he said.

The government has taken the initiative to have the country’s credit worthiness rating from a global rating firm for the first time, amid improvement in the country’s macroeconomic indicators in recent months.

Economists say that the country’s credit rating will not only provide foreign investors insights into the level of risk associated with investment here, but also help the government access capital from the international market on the basis of the country’s creditworthiness.

“Similar to credit rating for a company, sovereign credit rating from a global rating firm will paint a clear picture of the creditworthiness of the country,” Min Bahadur Shrestha, a senior economist who is also a former vice-chairman of the National Planning Commission, told Republica.

“Credit rating not only helps foreign investors measure the risk of the country either to invest or issue credit to it, but also provides an opportunity to review the progress and shortcomings in various aspects of the economy,” said Shrestha, who has also served as an executive director at Nepal Rastra Bank. “This will put pressure to carry out necessary reforms to make sure we have a good credit rating.”

Sovereign credit rating is also a must for the government as it is now mulling mobilizing funds from the international money market by floating offshore bonds.

With the decision to go for assessment of the country’s credit worthiness, the government will also have to maintain a high level of transparency in data related to the economic and financial indicators of the country as the global rating company relies on these for assigning the rating, according to economists.

While assigning a rating, which can stretch from ‘AAA’ at the top (high quality) to D (defaulted), Fitch Ratings factors in various indicators like inflation rate, economic growth, foreign direct investment and external debt.

You May Like This

NEPSE loses 3.24 points, while daily turnover inclines to Rs 2.36 billion

KATHMANDU, April 25: Nepal Stock Exchange (NEPSE) on Thursday shed 3.24 points to close at 1,965.93 points. ... Read More...

Rautahat traders call for extended night market hours amid summer heat

RAUTAHAT, April 25: Amid rising temperature, businessmen in Rautahat have called for permission to operate their businesses until late at... Read More...

First meeting of Nepal-China aid projects concludes

KATHMANDU, April 25: The first meeting of the Aid Projects of China's Autonomous Region Tibet to Nepal (2024-2028) took place... Read More...

Just In

- World Malaria Day: Foreign returnees more susceptible to the vector-borne disease

- MoEST seeks EC’s help in identifying teachers linked to political parties

- 70 community and national forests affected by fire in Parbat till Wednesday

- NEPSE loses 3.24 points, while daily turnover inclines to Rs 2.36 billion

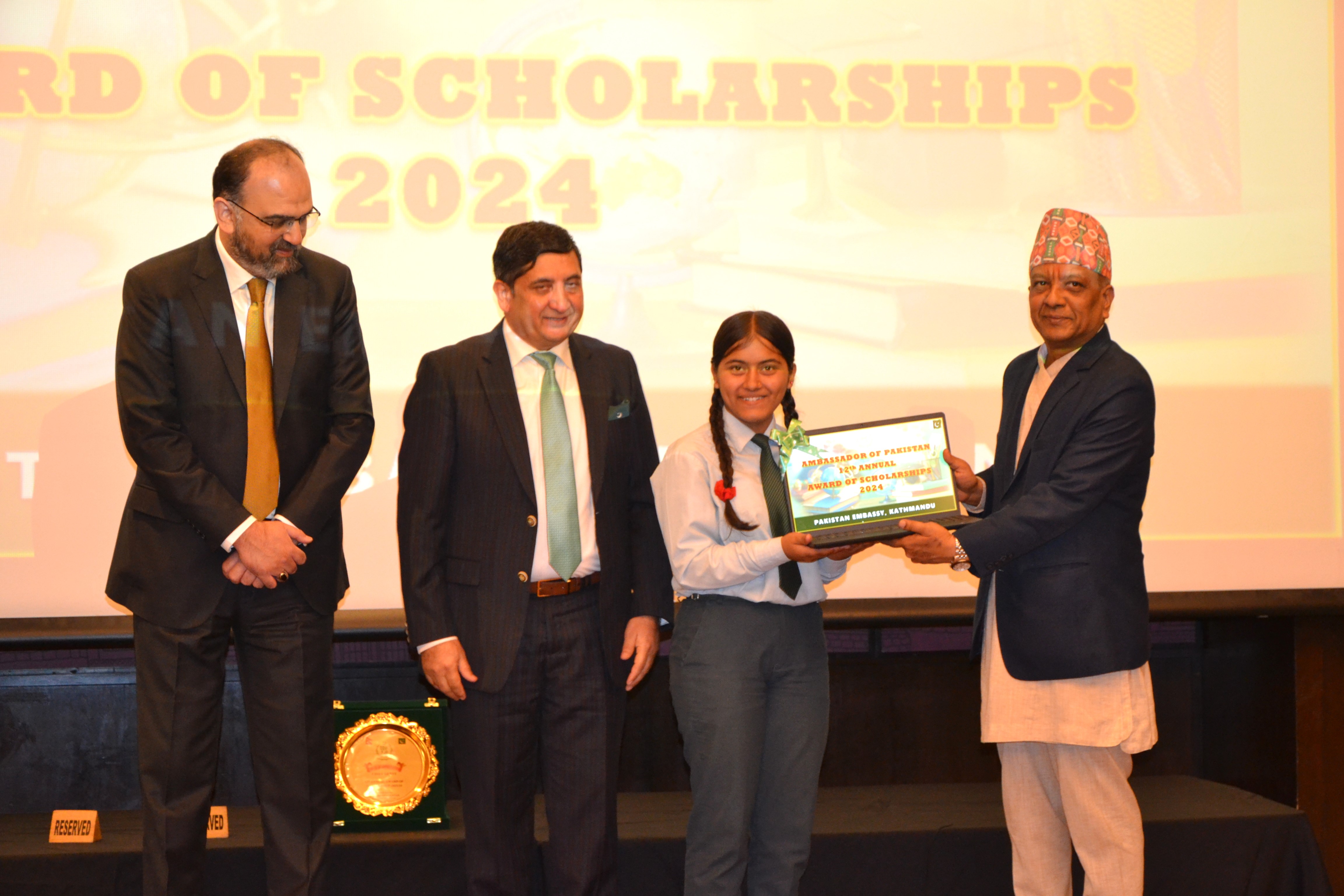

- Pak Embassy awards scholarships to 180 Nepali students

- President Paudel approves mobilization of army personnel for by-elections security

- Bhajang and Ilam by-elections: 69 polling stations classified as ‘highly sensitive’

- Karnali CM Kandel secures vote of confidence

Leave A Comment