OR

Govt backs off from its decision to squeeze stocks investors by considering their earnings in income tax bracket

Published On: June 5, 2023 08:30 AM NPT By: Republica | @RepublicaNepal

_20230530080540.jpg)

With the govt new decision, investors will have to pay only capital gains tax of 5 percent or 7.5 percent

KATHMANDU, June 5: The government has backed off from its decision to include the share transactions in the income tax bracket, just in one week of the budget announcement.

The government through the budget announcement on May 29 had declared to incorporate the earnings of the share investors also under the income tax bracket in addition to the existing capital gains tax. Till date, the individual investors are liable to pay capital gains tax of 5 percent or 7.5 percent, depending on the duration that the investors hold shares before they take them for transactions.

In the new system, the investors again need to pay the income tax for the leftover amount of the capital gains amount after paying capital gains tax. It means that the investors were supposed to pay income tax of even up to 39 percent in extra if the capital gains crossed the upper threshold of Rs 5 million.

Terming the government rule ‘unfair,’ investors have been at protest since Thursday. They even forced the stock brokerages to shut their businesses on Sunday.

To pacify the agitated investors, the Inland Revenue Department even issued a statement clarifying that the new provision is applicable only for the commercial investors, but not to the small investors. However, the attempt of the government taxman could not appease the investors, who have already lost over Rs 613 billion from the share market in the first nine months of the current fiscal year.

Under the pressure from the investors, Finance Minister Prakash Sharan Mahat called on the investors for a talk on Sunday. Consequently, the Ministry of Finance, through a press release, declared not to implement the new rule. Talking with the investors, Minister Mahat said the government will remove the clause from the budget while it will be taken for discussion at parliament.

You May Like This

Opposition alliance urges state organs not to support govt’s anti-constitutional activities

KATHMANDU, May 30: The opposition alliance has urged the state organs not to support the government in its anti-constitutional activities. Read More...

Youth and good governance

Youth represent the largest segment in Nepali society. According to Nepal’s National Youth Policy, approximately 20.8 percent of the total... Read More...

Just In

- Nepal's Seismic Struggle and Ongoing Recovery Dynamics

- Shrestha nominated as Chairman of NCC's Advisory Council

- Take necessary measures to ensure education for all children

- Nepalgunj ICP handed over to Nepal, to come into operation from May 8

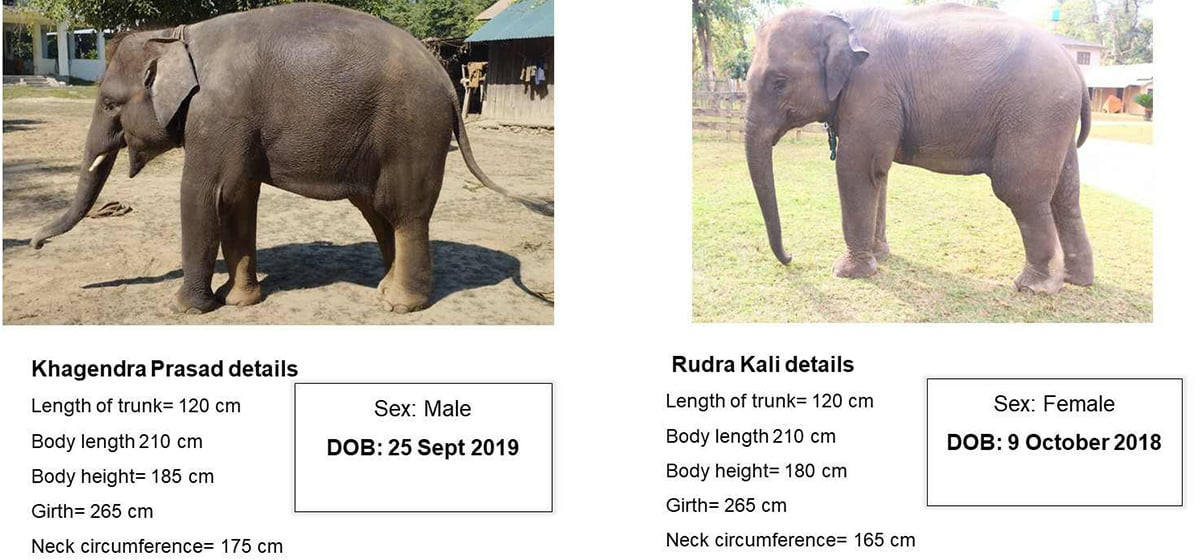

- Nepal to gift two elephants to Qatar during Emir's state visit

- NUP Chair Shrestha: Resham Chaudhary, convicted in Tikapur murder case, ineligible for party membership

- Dr Ram Kantha Makaju Shrestha: A visionary leader transforming healthcare in Nepal

- Let us present practical projects, not 'wish list': PM Dahal

_20240423174443.jpg)

Leave A Comment