OR

Opinion

Forest Finance from COP26: The Devil is in the Detail

Published On: January 28, 2022 06:30 AM NPT By: Bhaskar Singh Karky

Bhaskar Singh Karky

The author is a Resource Economist at the International Centre for Integrated Mountain Development.news@myrepublica.com

More from Author

A large percentage of the poorest of the poor in the developing world are dependent on forest resources and the bulk of forest finance needs to reach them. The pledge to end deforestation must cater to their needs and aspirations; only then will a standing tree be viewed as more valuable than a felled one.

Forests play a critical role in stabilizing global climate as they absorb nearly 30% of carbon dioxide emissions. In recognition of the need to halt and reverse the loss of forests to meet global climate targets, COP 26 began with leaders from 105 countries, which together account for 85% of the world’s forested area, signing a landmark declaration to end deforestation by 2030. This declaration is backed by $12 billion in financial commitments from 12 governments and $7 billion from private companies, including $1.7 billion dedicated to indigenous peoples and local communities involved in conservation. In addition, more than 30 private sector companies have also pledged to stop investing in activities linked to deforestation.

A similar pledge in 2014 – the New York Declaration on Forests – signed by 40 countries and 57 companies to half deforestation by 2020 and end it by 2030, failed. In fact, deforestation continued and even increased after that pledge was made. But this time around there is some hope as the pledge is backed by financial commitments. Additionally, it emphasizes the rights of indigenous people and local communities by recognizing their contribution to conservation.

However, there are significant challenges for the implementation of this pledge within the intended timeframe. From experience, such voluntary declarations pose a real challenge. If the New York Declaration of 2014 didn’t work, the Norway and Amazon Fund of 2019 did not work either. Already, a day after signing this declaration, Indonesia has issued a statement saying it does not intend to end deforestation by 2030 and described the pledge as “inappropriate and unfair”.

Put simply, a political declaration will not halt deforestation. At its heart, it needs to be supported by financial incentives for behavioral change and a financing architecture that is transparent, accountable, and fair. These are still lacking in many developing countries, and without such a financial architecture in place, the investments may not reach the intended targets. From an investor’s point of view, there may be concerns around the limited opportunities for monitoring financial flows. Most importantly, a large percentage of the poorest of the poor in the developing world are dependent on forest resources and the bulk of forest finance needs to reach them. The pledge must cater to their needs and aspirations; only then will a standing tree be viewed as more valuable than a felled one.

The private sector which has pledged to stop investing in activities that drive deforestation also faces challenges. There is a problem with delinking deforestation from supply chains, especially in consumer goods and therefore stopping financing of activities that lead to deforestation is not as simple. Especially given that private and public finance in the form of subsidies continue to drive deforestation. In the end, the funds may not be sufficient to address deforestation and forest degradation at a global scale from the Amazon, to the Congo basin to Himalayan montane forest. There is always the danger of large areas getting left out with trade offs being made even when all forests are equally important.

This pledge is ambitious and involves a large range of stakeholders, but the devil is in the detail. The intentions of global leaders may be good, but to back this, developing countries need appropriate incentive mechanisms and a financing architecture that can be monitored. Also, much of the finance from the private sector is generated by large companies. Such companies are mainly associated with manufacturing, energy and or the transport sector, such as steel, cement, oil, gas, food processing, airlines, and automobiles among others. Developing countries will have to rely on national-level forestry and conservation institutions as intermediaries to deal with such companies. The government’s role is to create an enabling environment for attracting forest finance and be a regulatory body for monitoring investments and progress.

This non-binding pledge brings about a ray of hope for forestry stakeholders by creating an opportunity for increasing investment in better forest management. But if this takes another couple of years to make the frameworks and guiding policies, the 2030 targets could be missed. Sometimes, we just have to let honesty be the guiding principle and seize this opportunity in good faith for taking immediate action.

You May Like This

Ranibari forest, the single community forest inside ring-road

KATHMANDU, Jan 28: Ranibari Community Forest is being developed as a single community forest inside the ring road of the... Read More...

Climate-induced loss and damage report stresses need for more adaptation measures

KATHMANDU, Nov 9: A new report ‘When the climate becomes a threat: Evidence of Climate Change induced Loss and Damage... Read More...

Kusum exemplary in nurturing private forest

ILAM, July 20: Kusum Dahal, a local of Maijogmai rural municipality-1, has shown his exemplary deeds in nurturing private forest... Read More...

Just In

- World Malaria Day: Foreign returnees more susceptible to the vector-borne disease

- MoEST seeks EC’s help in identifying teachers linked to political parties

- 70 community and national forests affected by fire in Parbat till Wednesday

- NEPSE loses 3.24 points, while daily turnover inclines to Rs 2.36 billion

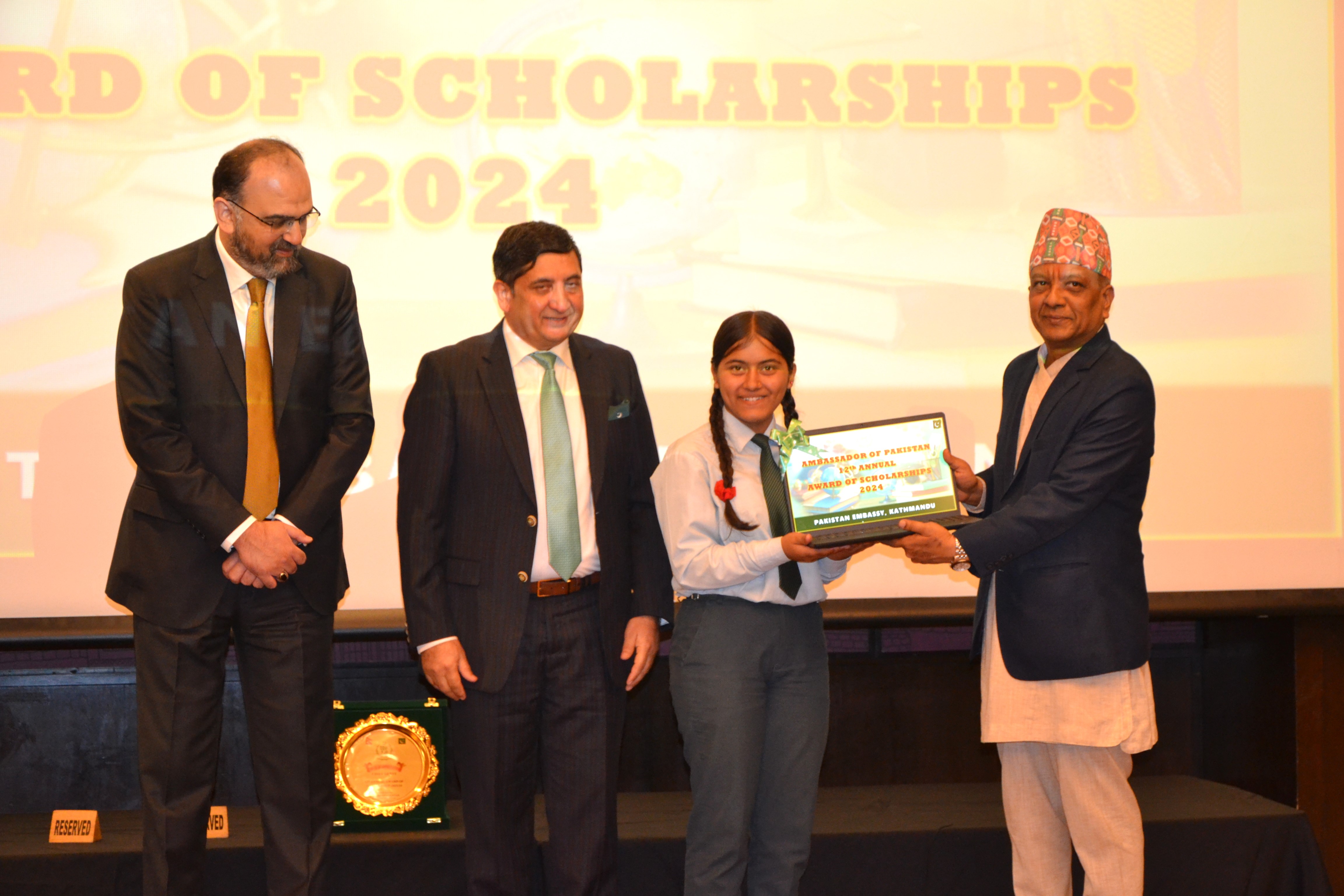

- Pak Embassy awards scholarships to 180 Nepali students

- President Paudel approves mobilization of army personnel for by-elections security

- Bhajang and Ilam by-elections: 69 polling stations classified as ‘highly sensitive’

- Karnali CM Kandel secures vote of confidence

Leave A Comment