OR

FinMin cautions against buying cars on credit

Published On: September 12, 2018 08:27 AM NPT

KATHMANDU, Sept 12: Minister for Finance Yuba Raj Khatiwada has urged people to not buy cars from bank credit.

Speaking at the inaugural ceremony of ‘NADA Auto Show-2018’ in Kathmandu on Tuesday, Khatiwada said that the car purchase should be from earnings rather than bank loans.

“A friend from Nepal Automobiles Dealers Association (NADA) just told me that he wants to change car every year. If people do not have yearning for near cars, the automobile business will slow down,” Khatiwada said, adding: “But what I told him is that you should ride car from your income, not from borrowed money. I told him not to buy car until you have the repayment capacity.”

Citing the example of financial crisis of 2008, which was caused due to excessive reliance on credit, he said that the country should learn lesson from the past experience of the world.

“We keep on saying that our consumption should be based on production, not from borrowing. We keep on saying that the country should be self-reliant. Then, we also keep on putting forth our complaints on automobiles,” he said, referring to demand of automobile leaders to relax bank lending loan to value ration. “We should find some balance between these two things,” said Khatiwada.

The finance minister’s statement comes in the wake of growing competition among bank and financial institutions (BFIs) to attract people by offering cheaper loans. For example, Himalayan Bank Ltd has announced to offer auto loans at 9.95 percent per annum, while the Everest Bank Ltd is also willing to provide auto financing service at 9.99 percent. The interest rates for purchase of motor vehicles are comparatively very low compared to other lending rates for loans like housing, business and other working capital loans which are not below 13-14 percent. Lending rate below the double-digit level is a lucrative offer for those who want to buy car at this time when fixed-deposit rate is above 10 percent.

According to automobile dealers, majority of consumers rely on bank financing to purchase four-wheelers.

However, the finance minister has cautioned people against buying car from the borrowed money. “Our consumption should be based on our income and our capacity. Production based on credit does not help us and our economy,” he added.

In line with the aspiration of growing number of people to own a car, BFIs have also made it easier for them to get financing service. As banks see less risk on auto financing where the car works as collateral, they have been providing loans up to 65 percent of the total value.

Stating that loan toward automobiles sector is ‘unproductive’, the Nepal Rastra Bank (NRB) is also discouraging BFIs to channelize financial resources to automobiles sector.

You May Like This

Complaints filed against ambassadors-designate Khatiwada and Regmi

KATHMANDU, Oct 19: Three separate complaints have been registered against Yuba Raj Khatiwada, the ambassador designate of Nepal to the... Read More...

‘New trade routes must to boost bilateral trade’

KATHMANDU, Feb 4: Minister for Finance Yuba Raj Khatiwada has said that opening of new trade routes with China will... Read More...

Panel formed to look into financial instability submits 58-point recommendations

KATHMANDU, Dec 20: A committee formed by the Ministry of Finance to look into the recent financial markets volatility has... Read More...

Just In

- Nepalgunj ICP handed over to Nepal, to come into operation from May 8

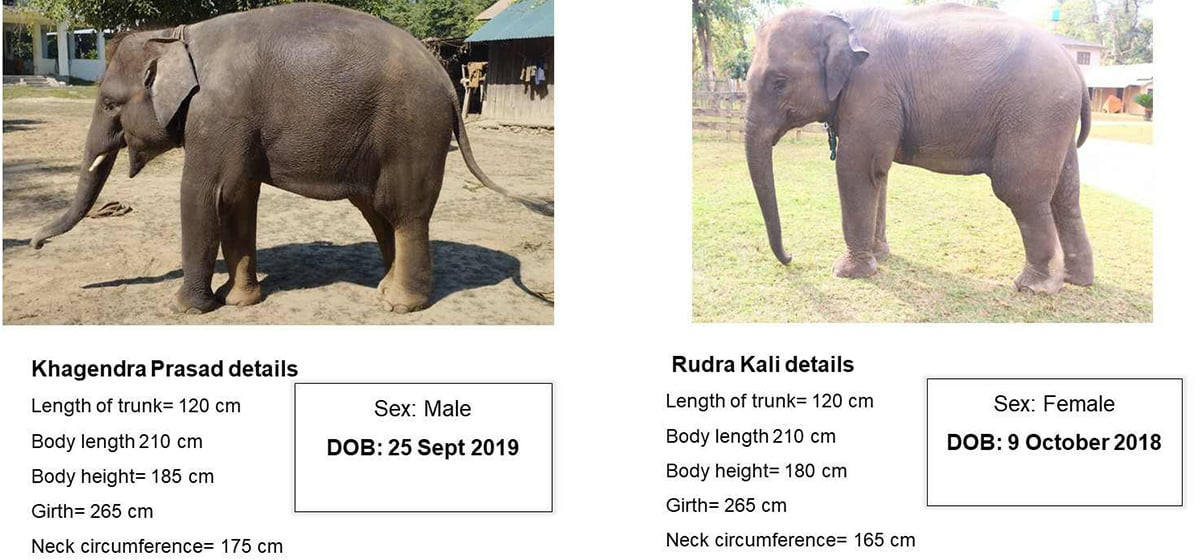

- Nepal to gift two elephants to Qatar during Emir's state visit

- NUP Chair Shrestha: Resham Chaudhary, convicted in Tikapur murder case, ineligible for party membership

- Dr Ram Kantha Makaju Shrestha: A visionary leader transforming healthcare in Nepal

- Let us present practical projects, not 'wish list': PM Dahal

- President Paudel requests Emir of Qatar to initiate release of Bipin Joshi

- Emir of Qatar and President Paudel hold discussions at Sheetal Niwas

- Devi Khadka: The champion of sexual violence victims

_20240423174443.jpg)

Leave A Comment