OR

Daily Commentary: Stocks stage recovery after Sunday’s rout

Published On: December 7, 2020 07:10 PM NPT By: Republica | @RepublicaNepal

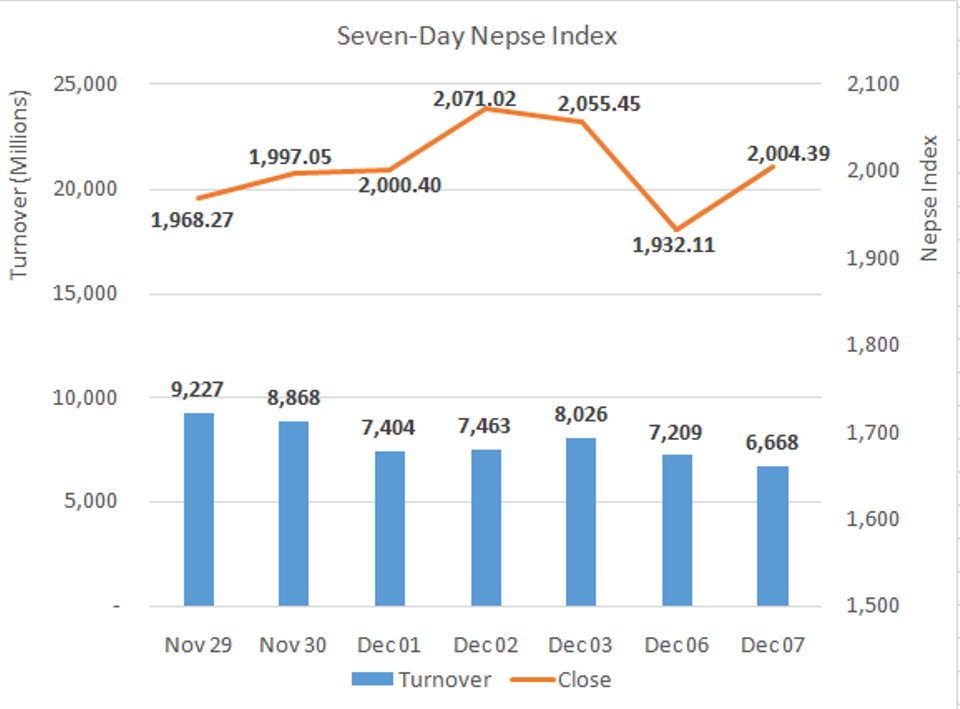

Nepse benchmark index jumps 72.28 points to close at 2,004.39 points

KATHMANDU, Dec 6:

After peaking in the morning, the local stock market pulled back sharply in the first trading hour as the Nepal Stock Exchange (Nepse) index touched 1900 mark. However, the bourse recouped earlier losses immediately and traded in green throughout the latter half of Monday’s session. At the close, Nepse registered a gain of 72.28 points to end at 2,004.39 points.

After a historical 123-point panic sell-off in the equity market driven by rumors on reducing margin-lending limit, investors found some confidence with many writing off the rumors. Hence, with most stocks trading in red in the morning, investors took notable buying positions after mid-day keeping the index firmly in green. Market participation slightly fell amidst indecision. Over Rs 6.66 billion worth of shares changed hands.

All composite indices closed the day higher. Leading the gains, Trading and Life Insurance sectors jumped over 6% each. Hydropower, Manufacturing & Processing and ‘Others’ sub-indices also shot up by around 5%. All other sectors ended the day in positive territory. Heavyweight banks rose 2.23%.

Shares of Nepal Reinsurance Company Ltd continued to lead the list of actives with total turnover of above Rs 1 billion mark. Nepal Life Insurance Company Ltd and Nepal Telecom Ltd saw turnovers of Rs 476 million and Rs 337 million. Prabhu Bank Ltd, Shivam Cements Ltd and Upper Tamakoshi Hydropower Ltd were other active stocks of the day.

On the gainers front, Narayani Development Bank Ltd and Rasuwagadhi Hydropower Ltd surged 10% each. Bishal Bazar Company Ltd, Global IME Laghubitta Bittiya Sanstha Ltd, Upper Tamakoshi Hydropower Ltd and Sanjen Jalvidhyut Company Ltd also saw considerable strength with gains of over 9% each. United Insurance Company Ltd, Nadep Laghubitta Bittiya Sanstha and Hydroelectricity Investment and Development Company Ltd were among other major gainers of the day.

10.25% NIC Asia Debenture 2083/84 and Everest Bank Ltd Convertible Preference Share came under pressure and fell 2% each. Excel Development Bank Ltd, Multipurpose Finance Ltd and Guheshwori Merchant Bank & Finance Co. Ltd were the other losing scrips which fell over 1% each.

In terms of ARKS technical analysis, the market formed a strong bullish candlestick on the daily timeframe, which helped the equity market recoup previous day gains. A green candlestick on Tuesday will confirm the reversal while a break below Monday’s low of 1,900 points will suggest possibility of further downward movement. Technical indicators also reflect selling pressure easing off after massive correction on Sunday. Given the market holds ground above 1,900 points mark, the uptrend will likely extend towards a new high.

This column is produced by ARKS Capital Advisors Ltd.

(Views expressed in the article are those of the producer and do not necessarily reflect those of this publication)

www.arkscapitaladvisors.com

You May Like This

Daily Commentary: Stocks stretch gains with increased market activity

Nepse benchmark jumps 56.72 points ... Read More...

Stocks end mildly higher on Monday

Nepse benchmark index goes up 4.22 points ... Read More...

Daily Commentary: Nepse closes week on a positive note

Benchmark index goes up 5.74 points ... Read More...

Just In

- Construction of bailey bridge over Bheri river along Bheri corridor reaches final stage

- Taylor Swift releases ‘The Tortured Poets Department’

- India starts voting in the world’s largest election as Modi seeks a third term as prime minister

- EC seeks cooperation for free and fair by-election

- Bus carrying wedding procession attendees meets with accident in Sindhupalchowk; three killed

- CPN (Unified Socialist) to hold its Central Committee meeting on May 10-11

- Over 16,000 paragliding flights conducted in one year in Pokhara

- MoPIT prepares draft of National Road Safety Act, proposes rescue within an hour of an accident

Leave A Comment