OR

Daily Commentary: Stocks see modest correction after continuous rally

Published On: December 3, 2020 05:38 PM NPT By: Republica | @RepublicaNepal

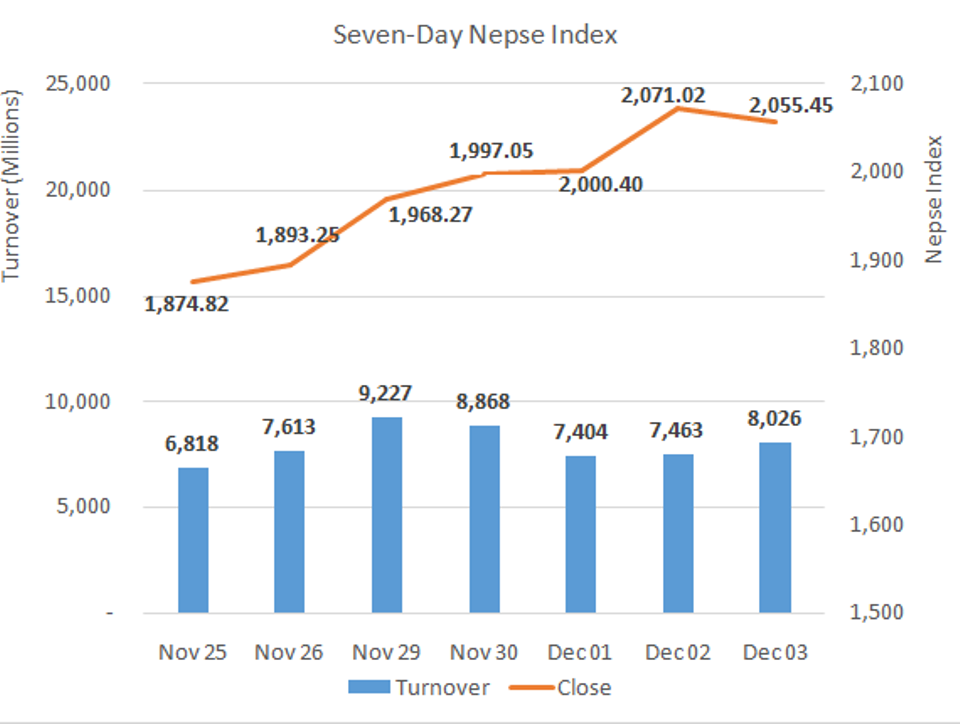

Nepese benchmark index falls 15.57 points

KATHMANDU, Dec 3: The Nepal Stock Exchange (Nepse) index opened Thursday’s session in green but witnessed correction in the latter part of the trading hours. After crossing 2,100-point mark in the morning, the benchmark pulled back towards negative territory.

A recovery attempt ensued but stocks witnessed further retracement as the benchmark closed 15.57 points lower at 2,055.45.

Following a gain of 400 points in the month of November, the buying pressure slightly eased on the back of profit booking in multiple sectors. However, the market has continued to see noteworthy turnover with investors absorbing selling pressure in significant volumes. Over Rs 8 billion worth of equities were traded in the last trading day of the week.

While most of the sectors ended in negative zone, Microfinance and Hydropower segment inched higher on Thursday. Trading sub-index suffered the most and tumbled 6.94%. Life Insurance stocks also fell 2.01% on average. Non-Life Insurance and ‘Others’ sectors dropped more than 1% apiece. All other sub-indices edged marginally lower.

Nepal Reinsurance Company Ltd’s shares were traded the most. Over Rs 1 billion worth of its shares changed hands making it the maiden company to register a single day turnover above that mark. Nepal Telecom Ltd and Nepal Life Insurance Company Ltd were also actively traded with turnovers of Rs 422 million and Rs 300 million. National Life Insurance Company Ltd, Shivam Cements Ltd, Prime Commercial Bank Ltd and Nepal Bank Ltd were the other top turnover stocks of the day.

Shares of Upper Tamakoshi Hydropower Ltd and Nepal Seva Laghubitta Bittiya Sanstha Ltd led the list of advances with rallies of over 9% each. Deprosc Laghubitta Bittiya Sanstha Ltd and Chhimek Laghubitta Bittiya Sanstha Ltd also jumped over 6%. Chhimek Laghubitta Bittiya Sanstha Ltd declared its dividend for the year 2019/20 on the day. The microfinance company will be distributing 22% stock dividend and 7% cash dividend. Prime Commercial Bank Ltd, Suryodaya Laghubitta Bittiya Sanstha Ltd and Mithila Laghubitta Bittiya Sanstha Ltd were the other major gainers of the day.

On the other hand, Bishal Bazar Company Ltd and Salt Trading Corporation Ltd were the major laggards with both scrips tumbling more than 6%. Bottlers Nepal Terai Ltd, Rasuwagadhi Hydropower Company Ltd and Sanjen Laghubitta Bittiya Sanstha Ltd fell more than 5% each. Asian Life Insurance Company Ltd, RSDC Laghubitta Bittiya Sanstha Ltd and Hydroelectricity Investment and Development Company Ltd followed suit.

As per the ARKS technical analysis, the market formed a bearish candlestick on the daily timeframe. Some retracement was evident on the back of profit taking but upbeat volumes suggest that the sentiment remains firmly positive. While some consolidation may take place for the short term, the uptrend still has notable momentum as suggested by technical indicators.

This column is produced by ARKS Capital Advisors Ltd.

(Views expressed in the article are those of the producer and do not necessarily reflect those of this publication)

www.arkscapitaladvisors.com

You May Like This

Daily Commentary: Stocks stretch gains with increased market activity

Nepse benchmark jumps 56.72 points ... Read More...

Stocks end mildly higher on Monday

Nepse benchmark index goes up 4.22 points ... Read More...

Daily Commentary: Nepse closes week on a positive note

Benchmark index goes up 5.74 points ... Read More...

Just In

- Insurers stop settling insurance claims after they fail to get subsidies from government

- Nepal-Qatar Relations: Prioritize promoting interests of Nepali migrant workers

- Health ministry to conduct ‘search and vaccinate’ campaign on May 13

- Indian customs releases trucks carrying Nepali tea, halted across Kakarbhitta

- Silent period for by-election to begin from midnight

- SC issues short-term interim order to govt and TU not to take immediate action against TU legal advisor Khanal

- National consultation workshop advocates to scale up nutrition smart community in Nepal

- Patan High Court issues short-term interim order to halt selection process of NTB’s CEO

Leave A Comment