OR

Daily Commentary: Stock market ends in red after paring morning gains

Published On: September 7, 2020 09:25 AM NPT

Nepse benchmark index down 10 points

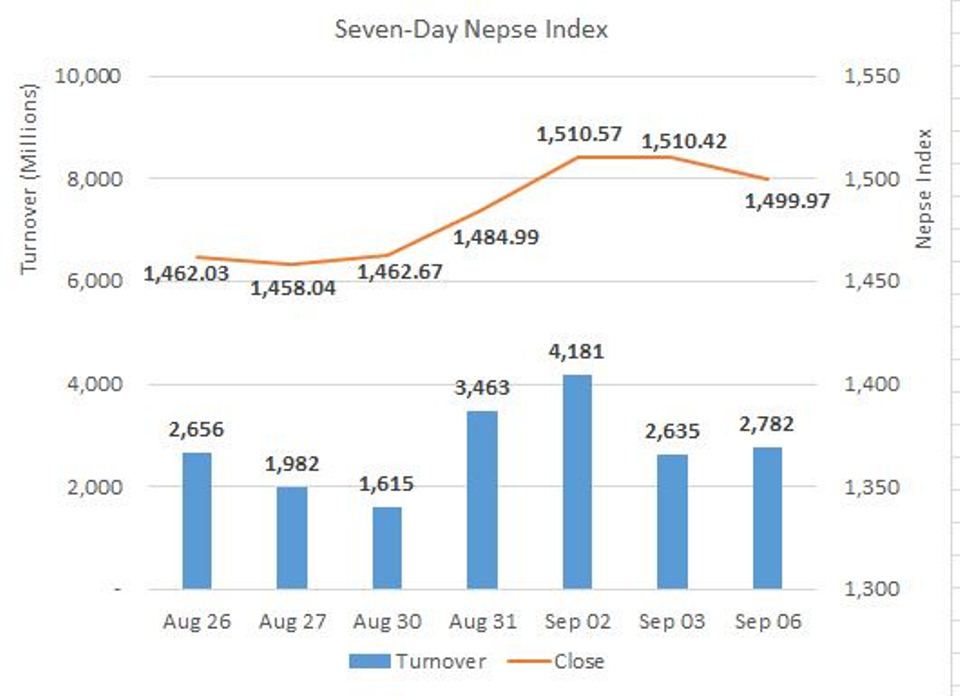

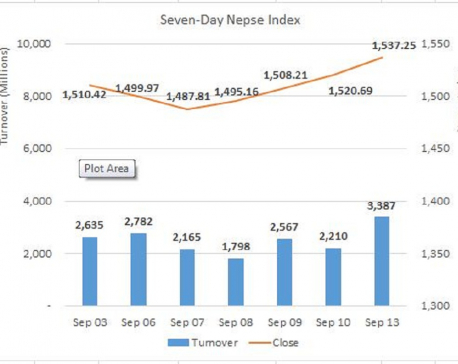

KATHMANDU, Sept 7: Stocks opened firmly higher on Sunday, as the Nepal Stock Exchange (Nepse) index traded more than 40 points higher in the pre-opening session. However, the index quickly gave up its gains to trade flat at mid-day. Furthermore, the local bourse saw sustained selling pressure in the afternoon pushing the index in the red towards the closing hours. Eventually, the benchmark ended Sunday’s trading at 1,499.97 – down 10.45 points against prior close.

Nepse witnessed some corrective pressure following an extended rally in the past couple of weeks. Stocks took a breather on Thursday last week and gave up moderate gains on Sunday on the back of profit booking by traders. Nonetheless, the index still lies around the crucial 1,500 points mark. Trading around this range will be pivotal in determining the course of the market in the coming sessions. Turnover remained upbeat with over Rs. 2.78 billion worth of shares traded on the day.

Most of the sectors retraced on the day following the broad based index. Only Trading and Mutual Fund segments ended the day in green with advances of 2.51% and 0.05%. Hotels segments came under the axe with a 1.66% drop. Manufacturing & Processing, ‘Others’ and Development Bank segments also struggled and dropped by over 1% each. Heavyweight banks witnessed a decline of 0.66%, while all other sectors inched marginally lower.

Shares of Nepal Reinsurance Company Ltd was the most actively traded security in the session. Over Rs. 401 million worth of the reinsurer’s shares changed hands. Next, Nepal Bank Ltd posted a turnover of Rs. 117 million, while Neco Insurance Company Ltd registered a turnover of Rs. 100 million. Arun Kabeli Power Ltd, Shikhar Insurance Company Ltd, Shivam Cements Ltd and Citizen Investment Trust were among other top turnover scrips.

Unnati Sahakarya Laghubitta Bittiya Sanstha Ltd led the gains with a 10% rally. Arun Valley Hydropower Company Ltd and Joshi Hydropower Development Company Ltd closely followed with gains of 9.82% and 9.72%. Other energy stocks followed suit. Radhi Bidyut Company Ltd, Universal Power Company Ltd, Nepal Hydro Developers Ltd and Arun Kabeli Power Ltd also closed the day with considerable strength on the day.

On the losers’ front, shares of NRN Infrastructure and Development Ltd snapped its 5-day gaining streak to hit the lower circuit limit of negative 10%. Rasuwagadhi Hydropower Company Ltd and Himal Dolakha Hydropower Development Company Ltd corrected sharply to end with losses of 5.29% and 4.04%. Chhyangdi Hydro Ltd, Shree Investment and Finance Company Ltd and Multipurpose Finance Ltd fell over 3% each.

As per ARKS technical analysis, the index retraced after reaching its immediate resistance at around 1,550 – 1,560 points level forming a large bearish candlestick on the daily timeframe. Hence, sellers remain in control in the current juncture. However, the market is yet to breach the 1,500 psychological mark indicating the overall trend is still in action. The index can find support at 1,470 points mark if the index breaks the aforementioned level. Meanwhile technical indicators reflect restrained buying pressure compared to earlier session, making slight retracements in the equity market likely.

This column is produced by ARKS Capital Advisors Ltd

(Views expressed in the article are those of the producer and do not necessarily reflect those of this publication)

www.arkscapitaladvisors.com

You May Like This

Daily Commentary: Nepse breaks post lockdown high as BFIs advance

KATHMANDU, Sept 18: Stocks witnessed one of the best trading days in the last couple of months on Thursday. Stocks... Read More...

Daily Commentary: Nepse ends in green for fourth consecutive day

KATHMANDU, Sept 14: On Sunday, the benchmark Nepal Stock Exchange (Nepse) index traded for only a few minutes in the... Read More...

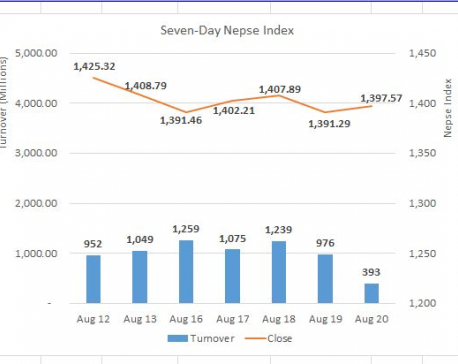

Daily Commentary: Turnover falls sharply as lockdown mars market activity

KATHMANDU, Aug 20: Stocks traded flat in the first half an hour of trading on Thursday. The benchmark Nepal Stock... Read More...

Just In

- World Malaria Day: Foreign returnees more susceptible to the vector-borne disease

- MoEST seeks EC’s help in identifying teachers linked to political parties

- 70 community and national forests affected by fire in Parbat till Wednesday

- NEPSE loses 3.24 points, while daily turnover inclines to Rs 2.36 billion

- Pak Embassy awards scholarships to 180 Nepali students

- President Paudel approves mobilization of army personnel for by-elections security

- Bhajang and Ilam by-elections: 69 polling stations classified as ‘highly sensitive’

- Karnali CM Kandel secures vote of confidence

Leave A Comment