OR

Daily Commentary: Nepse begins week on a composed footing

Published On: July 13, 2020 08:52 AM NPT By: Republica | @RepublicaNepal

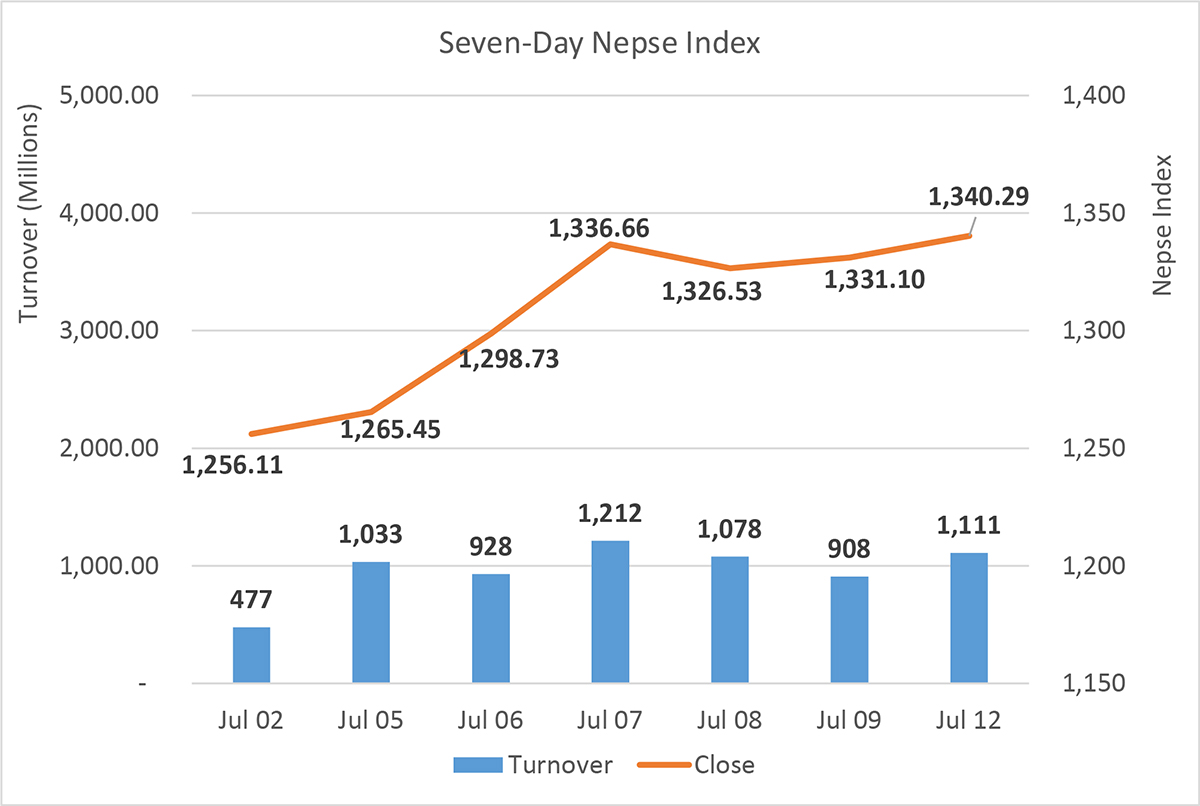

KATHMANDU, July 13: A sharp rally in the morning saw the Nepal Stock Exchange (Nepse) index shoot up by almost 20 points in the first half an hour of trading. The index pulled back thereafter but maintained a positive stance throughout the latter trading hours. At the close, Nepse registered a gain of 9.02 points to settle at 1,340.29.

Adding to Thursday’s gains, Nepse has continued to hold ground above 1,300 points mark which is an uplifting signal to investors. Furthermore, the volatility which was seen in the initial sessions after lockdown has drastically subsided with Nepse looking to consolidate around the current level. Expectation from the upcoming monetary policy and hopes of economic recovery have contributed to keeping the market afloat in the current zone. Further, the exchange has continued to witness upbeat market activity with daily turnover of around Rs. 1 billion in the past few sessions.

Sectors ended mixed with gains coming mainly from Microfinance and Insurance segments. Microfinance sub-index rallied 3.67 percent, while sub-indices of Life Insurance and Non-Life Insurance stocks jumped 2.46 percent and 1.31 percent, respectively. ‘Others’, Finance, Manufacturing & Processing and Trading segments also edged higher. On the other hand, Hotels sector suffered a dent in its recovery as the index gave up 2.48 percent in the session. Development Bank, Mutual Fund, Banking and Hydropower sectors suffered modest losses.

In terms of stock wise turnover, Nepal Life Insurance Company Ltd saw the biggest turnover of the day as over Rs 160 million worth of its shares changed hands. Nepal Reinsurance Company Ltd closely followed with a total transaction of Rs 143 million. NIC Asia Bank Ltd and Global IME Bank Ltd, subsequently, registered turnovers of Rs 44 million each. Himalayan Distillery Ltd, Swarojgar Laghubitta Bittiya Sanstha Ltd and NMB Bank Ltd were among other actively traded stocks.

Microfinance companies dominated the list of gainers. Suryodaya Laghubitta Bittiya Sanstha Ltd, Swarojgar Laghubitta Bittiya Sanstha Ltd, Ganapati Microfinance Bittiya Sanstha Ltd, Mithila Laghubitta Bittiya Sanstha Ltd and NIC Asia Laghubitta Bittiya Sanstha Ltd remained locked in the upper circuit of positive 10 percent. Manjushree Finance Ltd , Womi Microfinance Bittiya Sanstha Ltd and Gurans Laghubitta Bittiya Sanstha Ltd also saw considerable strength in the day.

In contrast, shares of Tinau Mission Development Bank Ltd and Joshi Hydropower Development Company Ltd suffered the biggest losses with both scrip shedding over 5 percent on their price. Soaltee Hotel Ltd, Guheshwori Merchant Bank & Finance Co. Ltd and Radhi Bidyut Company Ltd, meanwhile, dropped over 4 percent each. Other losing scrips include Taragaon Regency Hotel Ltd, Nepal Finance Ltd and Green Development Bank Ltd.

On the ARKS technical front, the market formed a small bullish candlestick on the daily timeframe as the market has continued to trend sideways. The resistance at around 1,350 points has still held ground, while on a more positive note the index has consolidated and firmly stayed above the psychological 1,300-point mark. Moving Average Convergence Divergence (MACD) has formed a golden cross suggesting some more upward movement likely. Similarly, Relative Strength Index (RSI) which gauges momentum has slightly tilted upwards from neutral zone signaling some room for the market to move higher. Cautious buying can be done in the current level, with confirmation of a breakout above 1,360 points.

This column is produced by ARKS Capital Advisors Ltd

(Views expressed in the article are those of the producer and do not necessarily reflect those of this publication)

www.arkscapitaladvisors.com

You May Like This

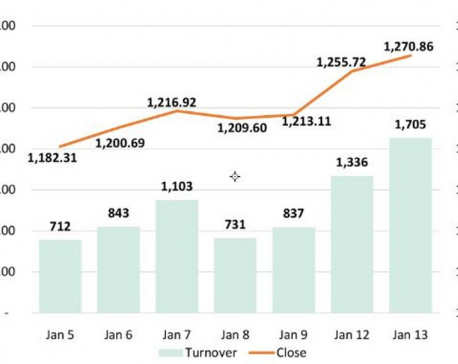

Stocks fall slightly in volatile trading

KATHMANDU, Jan 15: The Nepal Stock Exchange (Nepse) index whipsawed initially at the beginning of Tuesday's trading, dropping sharply to... Read More...

Nepse continues rising streak, up 15 points

KATHMANDU, Jan 14: The stock market saw considerable buying pressure in the morning session as the Nepal Stock Exchange (Nepse)... Read More...

Sitting and former finance ministers call for rescue of share market

KATHMANDU, Dec 12: Sitting and former finance ministers are in agreement on the possible measures to rescue the current share... Read More...

Just In

- Godepani welcomes over 31,000 foreign tourists in a year

- Private sector leads hydropower generation over government

- Weather expected to be mainly fair in most parts of the country today

- 120 snow leopards found in Dolpa, survey result reveals

- India funds a school building construction in Darchula

- Exploring opportunities and Challenges of Increasing Online Transactions in Nepal

- Lack of investment-friendly laws raises concerns as Investment Summit approaches

- 550,000 people acquire work permits till April of current fiscal year

Leave A Comment