OR

Contributory social security scheme to cover private sector

Published On: November 24, 2018 11:18 AM NPT By: Sagar Ghimire | @sagarghi

11% salary will be deducted for social security fund, with employer adding 20%

KATHMANDU, Nov 24: Employees in all private sector firms will now be enrolled in a contribution-based social security scheme.

According to a government scheme to ensure social security for all employees, all those employed by registered private sector companies will have to contribute a certain percent of their monthly salary to the social security fund while the employers will also be required to add a certain percent regularly.

Once the employers and employees are listed under the scheme, 11 percent of the basic salary of an employee will be deducted each month and the employer will contribute an additional 20 percent to the fund for each employee.

The social security scheme will come into implementation phase-wise. It is slated to be launched by Prime Minister KP Oli amid a function next Tuesday.

Under the scheme, all staff enrolled in the social security scheme will be entitled to assistance for medical treatment, health and maternity protection, accident and disability protection, dependent family protection and elderly protection (pension).

Earlier on November 12, the government issued a notice instructing all employers to get listed in the scheme within three months. In the first phase, employers and the suppliers of workers are required to list themselves in the scheme. A deadline of December 1 has been set for employers in Province 3. By January 15, all employers should list themselves.

Mahesh Prasad Dahal, Secretary at the Ministry of Labor, Employment and Social Security (MoLESS), said the social security scheme is meant to ensure that each employee is entitled to appropriate remuneration, facilities and contributory social security, as per the spirit of the constitution.

“First, the companies will be listed under the scheme and they will then have to list their employees within three months. Each employee will have an account in the social security fund,” said Dahal. “The employee will be drawing benefits from the fund on a needs basis,” he added.

Employees can draw support from the fund for their and their family members’ medical treatment. The family members will be receiving the pension in case of the death of the contributing employee. Under old-age protection, a contributing employee will be entitled to life-long pension after retirement from the job.

While an employee will be entitled to social security benefits for accident and disability from the day the contribution to the fund starts, he/she will have to make contributions for at least six months for entitlement to medical and health related protections. Only those who have contributed for at least 12 months will be eligible to draw maternity protection benefits. But, the fund will not be covering expenses resulting from natural disasters and road accidents.

The scheme will cover full expenses in case of work-place accident or occupational disease. For non-workplace accidents, the scheme will cover expenses up to Rs 700,000. In case of the death of a contributor, his/her spouse or parents will be getting a pension of 60 percent of the contributor’s last basic salary while the children will also be getting a 40 percent educational scholarship until they are 18 years old.

“The implementation of the contributory scheme is a milestone in Nepal’s employment and social sector as it will ensure social security for employees and workers while also helping employers in their liability management. It will help foster cordial labor relations and an investment-friendly environment,” said Dahal.

Full coverage of medical expenses for work accident, occupational disease

Disability and accident protection

Maternity assistance

Dependent family protection

Medical coverage of up to Rs 700,000 for non-work accident

60 pc pension to spouse or parent in case of death of employee

Pension to contributor after retirement

You May Like This

Over 3,000 employees being mobilized for election in Kavre

KAVREPALANCHOWK, Nov 1: A total of 3,112 employees will be mobilized for the November 20 election to the members of... Read More...

27 employees register application for voluntary retirement

RASUWA, March 3: As many as 27 civil service employees working in different government agencies of the district have submitted... Read More...

Parliamentary team finds nexus of immigration employees in women smuggling

KATHMANDU, March 28: A parliamentary team has come up with the finding that employees of the Department of Immigration under... Read More...

Just In

- ACC Premier Cup semi-final: Nepal vs UAE

- Sindhupalchowk bus accident update: The dead identified, injured undergoing treatment

- Construction of bailey bridge over Bheri river along Bheri corridor reaches final stage

- Taylor Swift releases ‘The Tortured Poets Department’

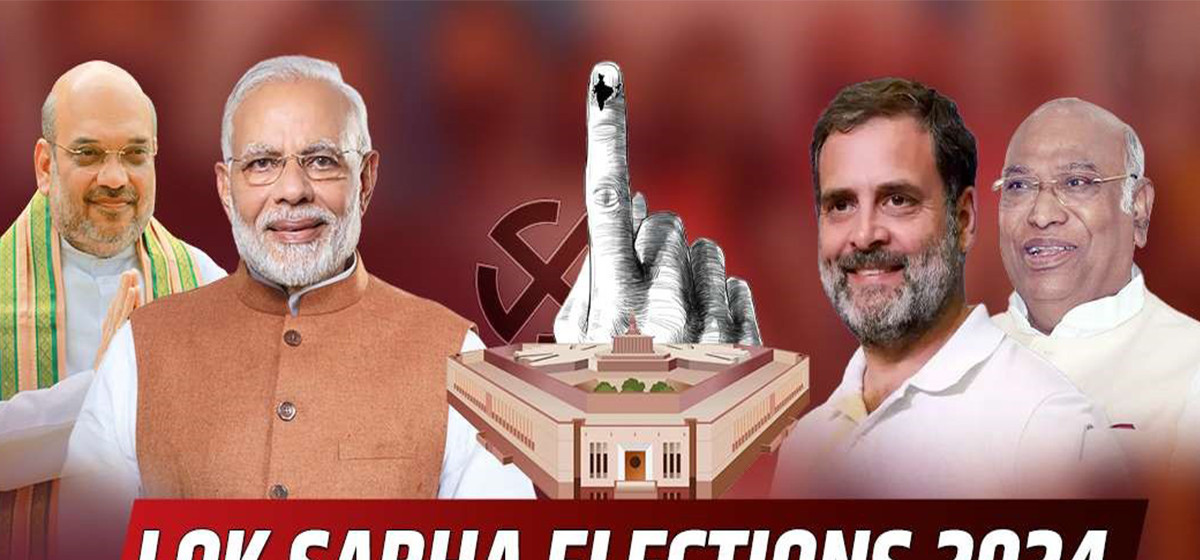

- India starts voting in the world’s largest election as Modi seeks a third term as prime minister

- EC seeks cooperation for free and fair by-election

- Bus carrying wedding procession attendees meets with accident in Sindhupalchowk; three killed

- CPN (Unified Socialist) to hold its Central Committee meeting on May 10-11

Leave A Comment