OR

Daily market commentary

Banking stocks surge as market witnesses record turnover

Published On: February 28, 2020 09:32 AM NPT By: Republica | @RepublicaNepal

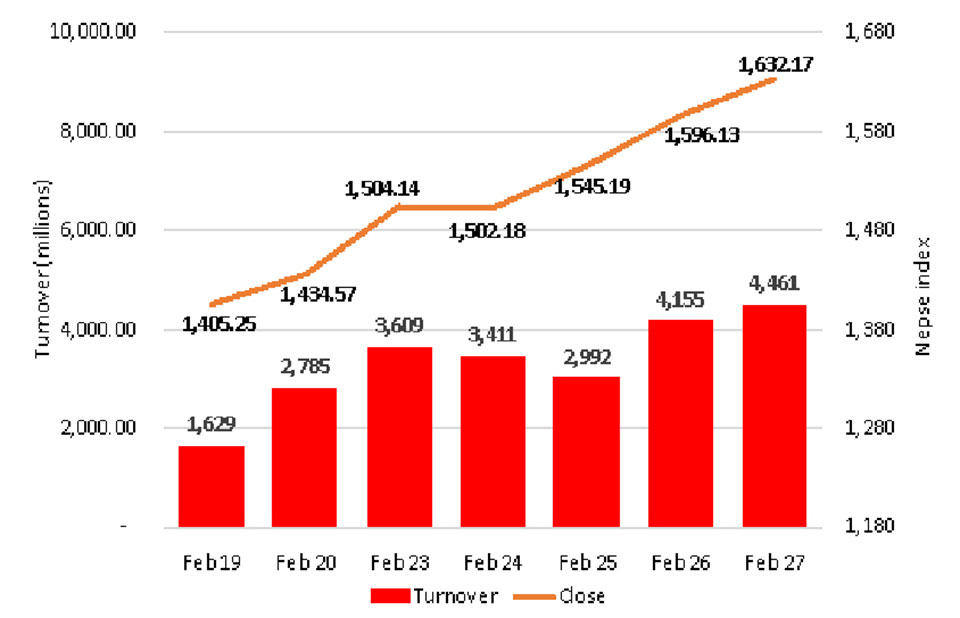

KATHMANDU: A sharp slide in Nepal Stock Exchange (Nepse) pushed the benchmark index almost 40 points lower in the first few minutes of the trading session on Thursday. Nonetheless, the morning selloff was short-lived as buyers took heavy positions thereafter, pushing the index in green by mid-session. The index rose further in the latter trading hours to close the last trading day of the week with a gain of 36.05 points at 1,632.17 points.

With the day’s gain, the local bourse has witnessed advances for three consecutive days where it accumulated a total of 130 points. Market heavyweight Banking sector, which saw relatively lower gains in the three-month rally, was the major driving force this week. Investors taking positions in commercial banks also helped the index notch a series of record-breaking turnovers. After the index posted a turnover of Rs. 4.15 billion on Wednesday, Thursday saw a new record in terms of market activity as Rs 4.46 billion worth of securities were traded on the day.

While most of the sectors saw correction, gains from Banking segment pushed the index to a multi-year high. Sub-index of banking stocks shot up by over 6%, while that of Development Banks segment jumped by 1.91%. Manufacturing & Processing sub-index also edged higher. On the other hand, Trading sub-index suffered the most and slumped 4.88%. Non-Life Insurance, ‘Others’ and Microfinance segments also retraced by over 2%. Similarly, all other sectors saw declines of over 1% each.

Shares of Nepal Life Insurance Company Ltd were traded heavily on the day with a total turnover of Rs 289 million. Similarly, NIC Asia Bank Ltd saw Rs 205 million worth of shares traded. NMB Bank Ltd and Nabil Bank Ltd registered total transactions of roughly Rs 150 million each. Shivam Cements Ltd, Prabhu Bank Ltd and Himalayan Distillery Ltd were among other active stocks of the day.

Share price of four commercial banks neared the upper circuit of 10%. While Everest Bank Ltd saw its share prices shot up by 10%, share prices of Nepal SBI Bank Ltd, Himalayan Bank Ltd and Nabil Bank Ltd were up by over 9%. Womi Microfinance Bittiya Sanstha Ltd added 9.31% on its share price, whereas Standard Chartered Bank Ltd, NIC Asia Bank Ltd and Unilever Nepal Ltd saw advances of over 8% each.

On the other hand, Ngadi Group Power Ltd, Synergy Power Development Ltd and Samriddhi Finance Company Ltd saw some of the worst performances of the day as each scrip gave up more than 6% on its price. Shares of Salt Trading Corporation Ltd, United Insurance Co (Nepal) Ltd and Nepal Seva Laghubitta Bittiya Sanstha Ltd’s shares also came under considerable pressure and closed over 4% lower.

In the news, Api Power Company Ltd is holding its annual general meeting (AGM) on March 20. It has proposed to distribute 5% bonus shares and 47% right shares. The company’s shareholders book will remain closed from March 14.

Nepse index, as per the ARKS technical analysis, formed a bullish candlestick for a third straight day on Thursday, suggesting that the index is gathering pace with heavy momentum. The index has also breached 1,600-point resistance level which can act as a support if any retracement occurs in the near term. Technical indicators also suggest strong uptrend in action backed by record-breaking market activity. Hence, the index is unlikely to lose its steam soon and investors can go long in case of minor retracements.

This column is produced by ARKS Capital Advisors Ltd

www.arkscapitaladvisors.com

(Views expressed are those of the producer and do not necessarily reflect those of this publication)

You May Like This

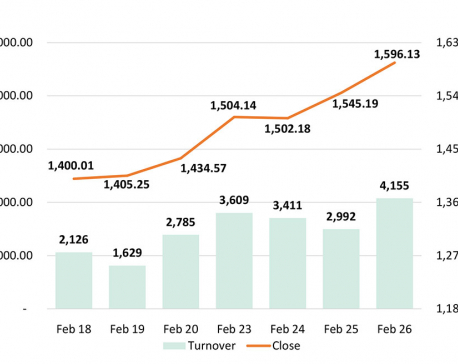

Nepse near 1,600 points, logs turnover of Rs 4.15b

KATHMANDU: The Nepal Stock Exchange (Nepse) index rallied sharply in the morning on Wednesday adding more than 25 points. The... Read More...

Nepse turns green after Wednesday’s retracement

KATHMANDU: The Nepal Stock Exchange (Nepse) index rose on Thursday morning but quickly gave up its gains to trade in... Read More...

Nepse index hits double-digit fall

KATHMANDU, Nov 29: The price of shares in the domestic stock market has dropped by two digits. ... Read More...

Just In

- President Paudel approves mobilization of army personnel for by-elections security

- Bhajang and Ilam by-elections: 69 polling stations classified as ‘highly sensitive’

- Karnali CM Kandel secures vote of confidence

- National Youth Scientists Conference to be organized in Surkhet

- Rautahat traders call for extended night market hours amid summer heat

- Resignation of JSP minister rejected in Lumbini province

- Russia warns NATO nuclear facilities in Poland could become military target

- 16th Five Year Plan: Govt unveils 40 goals for prosperity (with full list)

Leave A Comment