‘While the move will entail state lose billions of rupees in tax, it gives undue benefits to the companies concerned’

KATHMANDU, Dec 5: Amid rising concerns over Malaysia’s telecommunication conglomerate Axiata Group selling its shares of Ncell, a leading private sector telecom company of Nepal, speculation is rife that the group might have made the alleged move to prevent transfer of Ncell’s ownership to the government along with securing its profits fully in the long run.

Axiata Group, which partnered with Ncell in 2016, announced its exit from the company last week. Ncell’s operating license will expire in August-end 2029. According to the legal provision, the ownership of the company will be automatically transferred to the government after the expiration of the operating license.

Ncell preparing to extend service period by acquiring Smart Tel...

“Axiata’s has made such a move that it will repatriate its entire stakes in the next six years, while the transfer of its shares to the Nepali partner will enable domestic shareholders to increase their stakes to over 50 percent. This could prevent transfer of the company’s ownership to the government,” said an expert of the telecommunication sector.

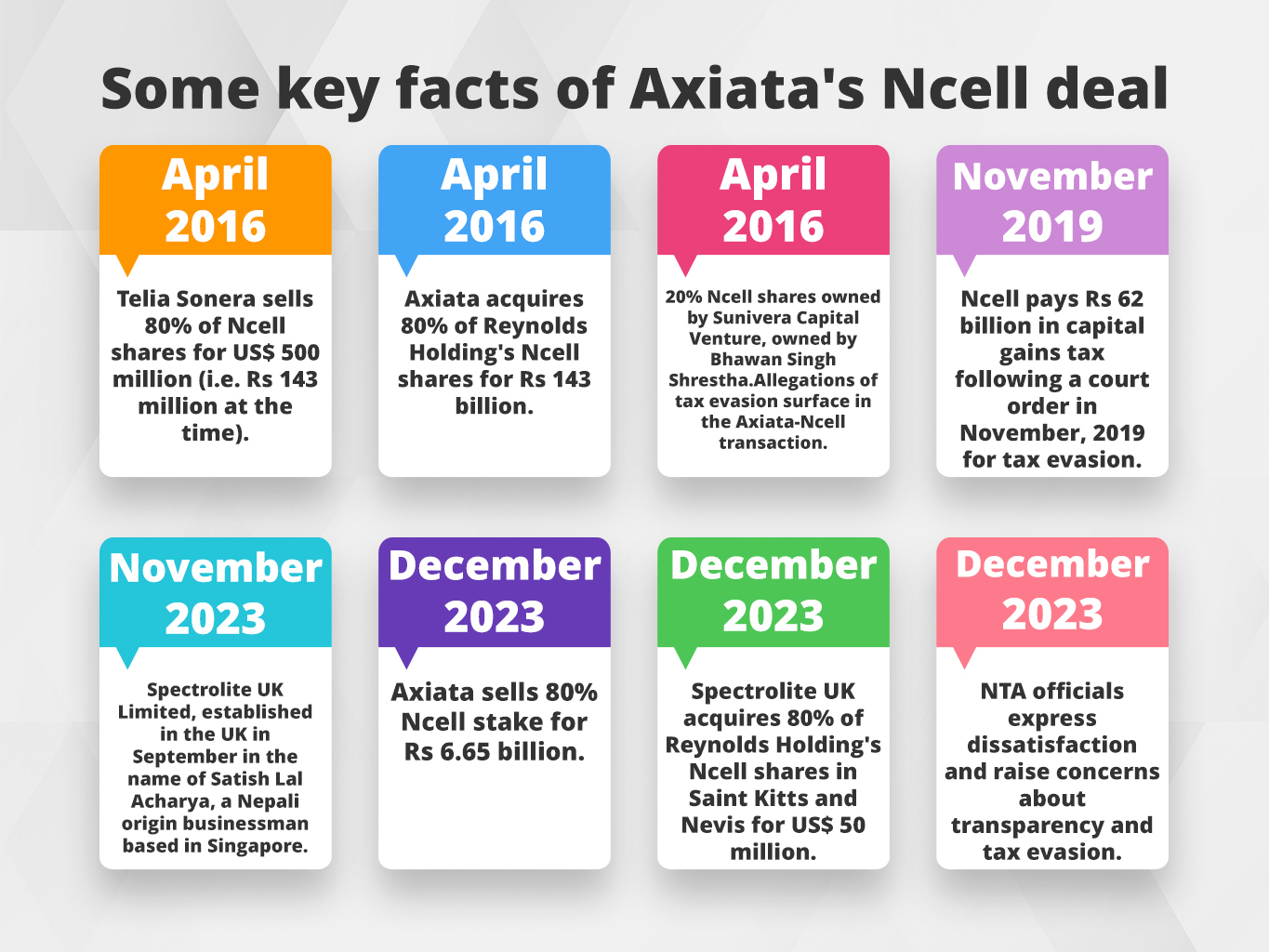

Foreign investor Axiata has sold its shares for Rs 6.65 billion. Axiata sold 80 percent of its holdings to Spectrlite UK. Reynolds Holding Limited, owned by the Axiata Group, has been bought by Spectrlite UK Limited.

In 2016, Axiata bought 80 percent of Reynolds Holding's shares in Ncell for Rs 143 billion. After seven years, the selling of the same shares for just 4.65 percent of the purchase price, i.e. 95.35 percent less than the sale price, has raised suspicion of ulterior motives to secure undue benefits.

While making the deal with Spectrlite UK Limited, Axiata Group is said to have agreed on two clauses. The Malaysian company has agreed on the payment settlement by Spectrlite UK in two phases. Under the first clause, the buyer company will be permitting Axiata to repatriate the given dividend in the next six years.

As per the precondition, Axiata will be taking away cent percent dividends out of Ncell’s profits in 2023. In the next two years, the Malaysian company will be receiving 40 percent dividends and then 30 percent dividends in 2026 and 2027. Likewise, it will secure 20 percent dividends in 2028 and 2029.

Rule 15 (K) of the Telecommunications Regulations 2054 stipulates that any telecom company must obtain the approval of the authority before buying or selling shares of more than 5 percent of the paid-up capital. But Axiata violated the provision and sold shares in foreign lands without taking formal approval from the government body.

“This clearly shows that the alliance is fooling the state mechanism thereby imposing a heavy financial loss to the country,” the expert said.

_20230331074225.jpg)