OR

NRB allows BFIs to deduct subsidized loans in CCD ratio

Published On: November 29, 2018 08:59 AM NPT By: Republica | @RepublicaNepal

Policy flexibility aims at encouraging banks to lend in subsidized loan schemes

KATHMANDU, Nov 29: Nepal Rastra Bank (NRB) has taken a flexible policy for commercial banks in terms of calculation of their prudential lending limit known as credit to capital plus deposit ratio (CCD), amid a shortage of lendable fund in the banking system.

In its first quarterly review of the monetary policy for the current Fiscal Year 2018/19 released on Tuesday, the NRB has announced a relaxation in its rule of calculating the CCD ratio for bank and financial institutions (BFIs) which may help to free up more funds for them to lend.

According to the new policy, BFIs will be able to deduct concessional loans that they float under the recently launched subsidized interest schemes in the CCD.

The relaxation will enable BFIs to lend the amount equal to the credits floated under the scheme as the funds will be allowed to be deducted in the CCD ratio. As many commercial banks are near 80 percent of CCD, they are facing shortage of funds to extend as loans. The central bank has set a ceiling of 80 percent on CCD ratio.

NRB officials say that the central bank’s new relaxation is aimed at encouraging BFIs to float their loans to the targeted borrowers under those schemes.

Earlier on November 6, the NRB had unveiled a working procedure on providing interest subsidies for various types of concessional loans in line with the government announcement in the budget. Under those schemes, various targeted groups can get concessional loans from BFIs at cheaper interest rates as some of the interest costs will be subsidized by the government.

Concessional loans ranging from Rs 700,000 to Rs 50 million are targeted for commercial farming, educated youth self employment, projects of youths returned from foreign employment, women entrepreneurship, Dalit community entrepreneurship, higher and technical education and construction of houses for earthquake survivors.

NRB had introduced similar relaxation earlier in the previous Fiscal Year 2016/17 through a mid-term review of the monetary policy allowing BFIs to deduct loans to deprived sector and subsidized agro loans along with credits floated to productive sector until mid-July 2017.

Though the policy relaxation came as a respite for BFIs, it was criticized by the International Monetary Fund.

This relaxation, however, is likely to release comparatively lesser funds for BFIs as the size of loans under the scheme is small while the productive sector loans have also been excluded from the deduction on CCD.

You May Like This

NRB announces additional benefits for banks that carry out joint operation by mid-July

KATHMANDU, June 6: Nepal Rastra Bank (NRB), in a bid to facilitate big mergers of commercial banks, has announced to provide... Read More...

NRB sets age bar for CEO, board directors of BFIs

KATHMANDU, Aug 6: Nepal Rastra Bank (NRB) has set age bar for chief executive officers (CEOs) and board directors of... Read More...

NRB unveils monetary policy for upcoming fiscal year, reduces interest spread (with full text)

KATHMANDU, July 11: Nepal Rastra Bank has reduced the spread in interest rate to 4.5 percent from 5 percent. Unveiling... Read More...

Just In

- Karnali Chief Minister Kandel to seek vote of confidence today

- Chain for Change organizes ‘Project Wings to Dreams’ orientation event for inclusive education

- Gold price decreases by Rs 200 per tola today

- National Development Council meeting underway

- Meeting of Industry, Commerce, Labor and Consumer Welfare Committee being held today

- Nepali announces cricket squad under captaincy of Rohit Paudel for series against West Indies 'A'

- Partly cloudy weather likely in hilly region, other parts of country to remain clear

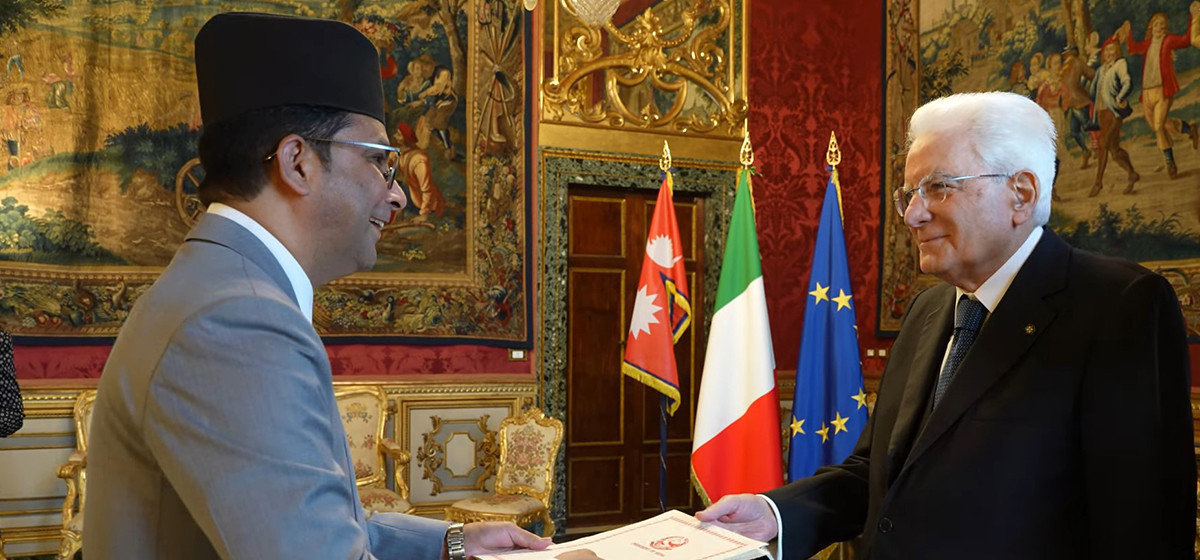

- Nepal’s Non-resident Ambassador to Italy presents Letter of credence to President of Italy

Leave A Comment