OR

weekly market commentary

Stocks close flat amid quiet trading week

Published On: August 4, 2018 07:26 AM NPT By: Republica | @RepublicaNepal

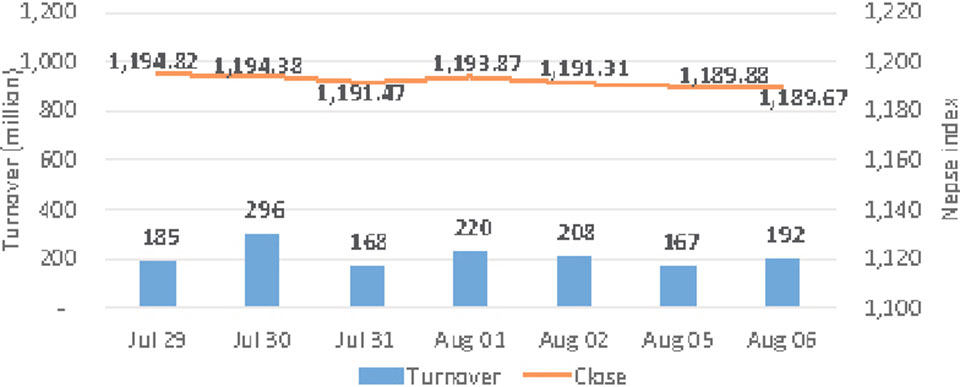

KATHMANDU, Aug 4: The sole equity market witnessed a lackluster trading week as the Nepal Stock Exchange (Nepse) index closed between the tight range of 1,190 to 1,195 points in all five trading sessions. The index that started the week at 1,191.20 points gained over 3 points on the first trading day of the week. However, it pared its gains in the latter sessions as the index hovered around the unchanged line. Eventually, Nepse closed the week almost unchanged adding 0.11 points to settle at 1,191.31 points.

Bland trading sessions continue to make way in the exchange on the back of muted enthusiasm put forth by investors. Quarterly results being published by banks and financial institutions have also failed to provide an impetus to the securities market. Consequently, Nepse witnessed a below average turnover of just over Rs. 1 billion in the week.

Nonetheless, interest rates on deposits have been decreasing of late which suggests improved liquidity in the market. Subsequently, a positive impact on the bourse can be expected.

Sectoral indices performance remained slightly biased toward the negative territory. Banking stocks showed strength amid upbeat financial reports published by commercial banks. Its sub-index gained 0.49 percent. Development Bank sub-index also rose 0.38 percent, while Life Insurance Sub-Index edged 0.12% higher.

Conversely, weakness was visible among hotels stocks as its sub-index slumped over 2 percent. 'Others' sub-index followed suit with a drop of over 1 percent Further, Non-Life Insurance and Microfinance sub-indices closed lower by 0.93 percent and 0.68 percent respectively.

In the review period, shares of Machhapuchhre Bank Ltd were traded the most with a total transaction of over Rs. 68 million. It was followed by other commercial banks including NMB Bank Ltd and Nepal Credit and Commerce bank Ltd with turnovers of Rs. 58 million and Rs. 48 million, correspondingly. NMB Bank Ltd closed its shareholders book on Thursday for the issue of 15 percent bonus shares while the latter had its book closure for 50 percent right share issuance on Tuesday.

Neco Insurance Company Ltd Promoter Share and Sanima Mai Hydropower Ltd were the other active stocks for the week registering turnovers of over Rs. 40 million each.

On the corporate front, Citizens Bank International commenced its Further Public Offering (FPO) of 463,826 unit shares on Tuesday. The issue, which lasted till Friday, was floated primarily to maintain the promoter and public shareholding ratio at 51:49.

As per the ARKS technical analysis, market has further prolonged its consolidation this week. The index's trading span has further tightened suggesting that the market, in the current juncture, lacks conviction. Additionally, technical indicators have suggested absence of notable momentum for more than a month.

Hence, investors are better off remaining cautious for now and taking major positions only if the market breaks out of this consolidation with considerable turnover.

This column is produced by ARKS Capital Advisors Ltd www.arkscapitaladvisors.com

(Views expressed are those of the producer and do not necessarily reflect those of this publication)

You May Like This

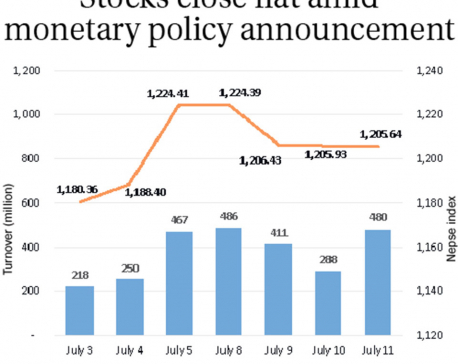

Stocks close flat amid monetary policy announcement

KATHMANDU, July 12: Stocks got off to a strong start in the morning session on Wednesday, managing to move 15... Read More...

Stocks close flat despite improved market activity

KATHMANDU, July 31: Stocks turned flat in another choppy session on Monday as the Nepal Stock Exchange (Nepse) index continued... Read More...

Stocks end flat in volatile trading session

KATHMANDU, July 9: Stock market opened on a positive note on Sunday, but failed to hold gains as the Nepal... Read More...

Just In

- Kushal Dixit selected for London Marathon

- Nepal faces Hong Kong today for ACC Emerging Teams Asia Cup

- 286 new industries registered in Nepal in first nine months of current FY, attracting Rs 165 billion investment

- UML's National Convention Representatives Council meeting today

- Gandaki Province CM assigns ministerial portfolios to Hari Bahadur Chuman and Deepak Manange

- 352 climbers obtain permits to ascend Mount Everest this season

- 16 candidates shortlisted for CEO position at Nepal Tourism Board

- WB to take financial management lead for proposed Upper Arun Project

_20220508065243.jpg)

Leave A Comment