OR

Stocks witness correction after two days of loss

Published On: June 12, 2018 02:30 AM NPT By: Republica | @RepublicaNepal

KATHMANDU, June 12: The Nepal Stock Exchange (Nepse) index remained volatile throughout Monday's trading session. The benchmark fell slightly in the first trading hour, but managed to pare its losses in the afternoon. At the end of the trading session, Nepse closed at 1241.19 points, or 9.55 points higher compared to Sunday.

The stock market recovered marginally after posting significant loss in the past two trading days. However, price fluctuation seen in the day shows that investors are still in a state of indecision. No major catalyst to uplift the market has been observed recently. Consequently, the stock market recorded a moderate turnover of Rs 440 million – down by 0.92 percent compared to Sunday. Major sub-indices ended the day in green. Hotels sector turned in the best performance as its sub-Index rose 3.35 percent. Similarly, sub-indices of Insurance and Microfinance groups surged above 1 percent each. Conversely, sub-indices of Trading, Finance, Development bank sectors closed lower.

Nabil Bank Limited (Promoter Share) was the most active stock on the day, recording turnover of over Rs 38 million. Likewise, shares worth Rs 17 million of Civil Bank Ltd changed hands on the day. The bank has recently proposed 10.25 percent bonus shares after which its capital will reach the mandatory Rs 8 billion. Shares of Nepal Bank Ltd and Nepal Investment Bank Ltd also recorded high turnovers on Monday.

Unnati Microfinance Bittiya Sanstha Ltd led the gains for the second consecutive day with its share price gaining almost 10 percent. Similarly, share of National Hydro Developers Ltd rallied more than 9 percent. Other top gaining stocks include Mithila Laghubitta Bikas Bank Ltd, Samata Microfinance Bittiya Sanstha Ltd and NLG Insurance Company Ltd.

On the contrary, share price of Everest Bank Ltd (Convertible Preference Share) declined the most. Its share price dropped over 9 percent. Further, NIBL Pragati Fund unit price was down 5.9 percent. Kanchan Development Bank Ltd and NMB Sulav Investment Fund-1 also plunged 3.78 percent and 3.64 percent, respectively.

On announcements, Shree Investment Finance Company Ltd has called for its Annual General Meeting (AGM) on July 6. The finance company has proposed 26.57 percent bonus shares to its shareholders. Furthermore, Manjushree Finance Company Ltd is holding its AGM on July 4. Issuance of 5.71 percent bonus shares is one of the agendas of the AGM.

As per the ARKS technical analysis model, the stock market witnessed a slight correction with the formation of a bullish candlestick after two days of losses. The index is hovering between the support and resistance of 1,200 points and 1,300 points, making movement towards either direction likely.

Following today's gain, Relative Strength Index (RSI) bounced slightly from the oversold zone while Moving Average Convergence/ Divergence (MACD) continued to slope downwards. This indicates that the market is still lacking a significant thrust to enter into a prolonged uptrend.

You May Like This

Nepse recovers slightly after two days of loss

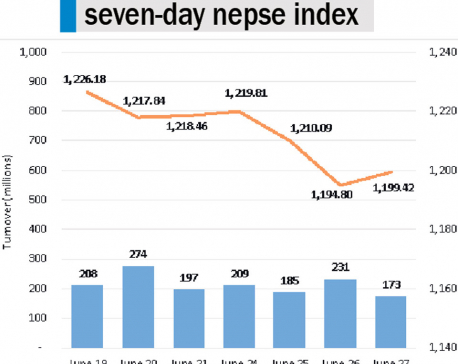

KATHMANDU, June 28: Nepal Stock Exchange (Nepse) index started momentum during mid-session on Wednesday after trading essentially fell flat for... Read More...

Loss of heritage is loss of living culture

KATHMANDU, Nov 28: The idols of goddess Bal Kumari and Rudryani from the Rudrayani Temple in Khokana was stolen on the... Read More...

Stocks in freefall as Nepse tanks 42 points

KATHMANDU, Mar 5: Nepal Stock Exchange (Nepse) index took a dive of 41.56 points, or 3.09 percent, to close at 1,304.43... Read More...

Just In

- Rautahat traders call for extended night market hours amid summer heat

- Resignation of JSP minister rejected in Lumbini province

- Russia warns NATO nuclear facilities in Poland could become military target

- 16th Five Year Plan: Govt unveils 40 goals for prosperity (with full list)

- SC hearing on fake Bhutanese refugees case involving ex-deputy PM Rayamajhi today

- Clash erupts between police and agitating locals in Dhanusha, nine tear gas shells fired

- Abducted Mishra rescued after eight hours, six arrested

- Forest fire destroys 13 houses in Khotang

Leave A Comment