OR

NRB unveils domestic borrowing calendar

Published On: August 5, 2017 03:28 AM NPT

KATHMANDU, August 4: Nepal Rastra Bank (NRB) has made public its internal borrowing calendar to raise Rs 145 billion in the current fiscal year 2017/18.

The central bank is raising money inside the country in line with the government's plan of collecting Rs 145 billion in the current fiscal year for deficit financing as mentioned in the budget for the new fiscal year.

Unveiling the budget in July, the government has said that it will spend a total of Rs 1,278 billion in the current fiscal year 2017/18. The government announced to make internal borrowing of Rs 145 billion for financing budget deficit after realizing that the targeted revenue and foreign grants would be insufficient to finance its spending plans.

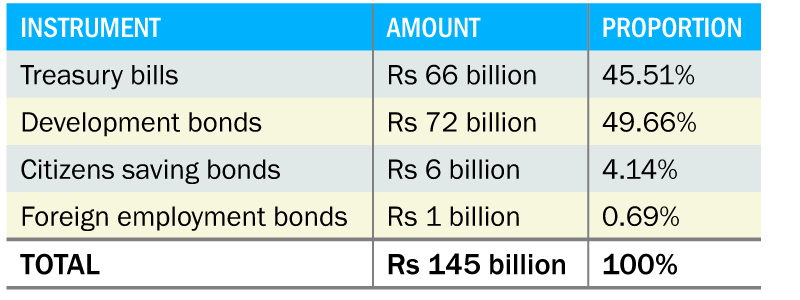

The central bank will use instruments like treasury bills, development bonds, citizens saving bonds and diaspora bonds, named as foreign employment bonds, to raise domestic debt.

According to the NRB calendar, the central bank will raise Rs 32.54 billion (22.44 percent) in the first quarter, Rs 46.61 billion (32.15 percent) in second quarter, Rs 45.89 billion (31.65 percent) in third quarter and Rs 19.96 billion (13.76 percent) in the last quarter.

The borrowing schedule is, however, subject to change on need basis.

The highest amount of money will be collected from development bonds where bank and financial institutions lend the government. The NRB has set a target of collecting Rs 72 billion, or 49.66 percent of the total internal borrowing, through development bonds in the fiscal year. This instrument has the longest maturity among the instruments that the central bank floats to raise the debt. There are nine types of development bond with maturity period ranging from five to 15 years. BFIs, non-banking institutions, organized institutions as well as public can subscribe this instrument. Interest rate of this instrument is fixed through bidding.

Similarly, the central bank plans to borrow a total of Rs 66 billion, or 45.52 percent, of the total domestic debt by issuing treasury bills. There are four types of treasury bills based on their maturity periods, i.e 28-day, 91-day, 182-day and 364-day treasury bills. Interest rate of this instrument is also fixed based on bidding by the participating bank and financial institutions.

The highest interest rate of treasury bills in the last fiscal year had reached 3.97 percent while the lowest was at 0.3259 percent. The government had raised a total of Rs 88.34 billion in the last fiscal year 2016/17, compared to the original plan to raise Rs 111 billion.

Similarly, the central bank plans to issue citizen saving bonds worth Rs 6 billion in the current fiscal year. Only public (Nepali citizens) can purchase this bond which yields fixed interest rates, known as coupon rate, set by the open market operation committee.

Despite under-subscription in the last fiscal year, the NRB has unveiled to draw a total of Rs 1 billion from Nepalis working abroad. The central bank in the last fiscal years was struggling to get migrant workers buy the foreign employment bonds. Under this bond, where fixed interest rates are offered, migrant workers can provide loans to the government through the central bank from the countries where they are currently working. Interest can be made to directly to their kin's account in Nepal if they wish so. Both citizens saving bond and foreign employment bond have a maturity of 5 years.

You May Like This

NRB unveils Payment System Oversight Framework

KATHMANDU, March 3: Nepal Rastra Bank (NRB) has introduced ‘Payment System Oversight Framework’ as part of its objectives to ensure... Read More...

NVA unveils annual calendar

KATHMANDU, June 10: Nepal Volleyball Association (NVA) has unveiled the annual calendar of the events for the fiscal year 2017/18 on... Read More...

Nepal Boxing Association unveils its calendar

KATHMANDU, May 30: Nepal Boxing Association (NBA), on Tuesday, has unveiled its calendar for the year 2017 which includes organizing... Read More...

Just In

- MoEST seeks EC’s help in identifying teachers linked to political parties

- 70 community and national forests affected by fire in Parbat till Wednesday

- NEPSE loses 3.24 points, while daily turnover inclines to Rs 2.36 billion

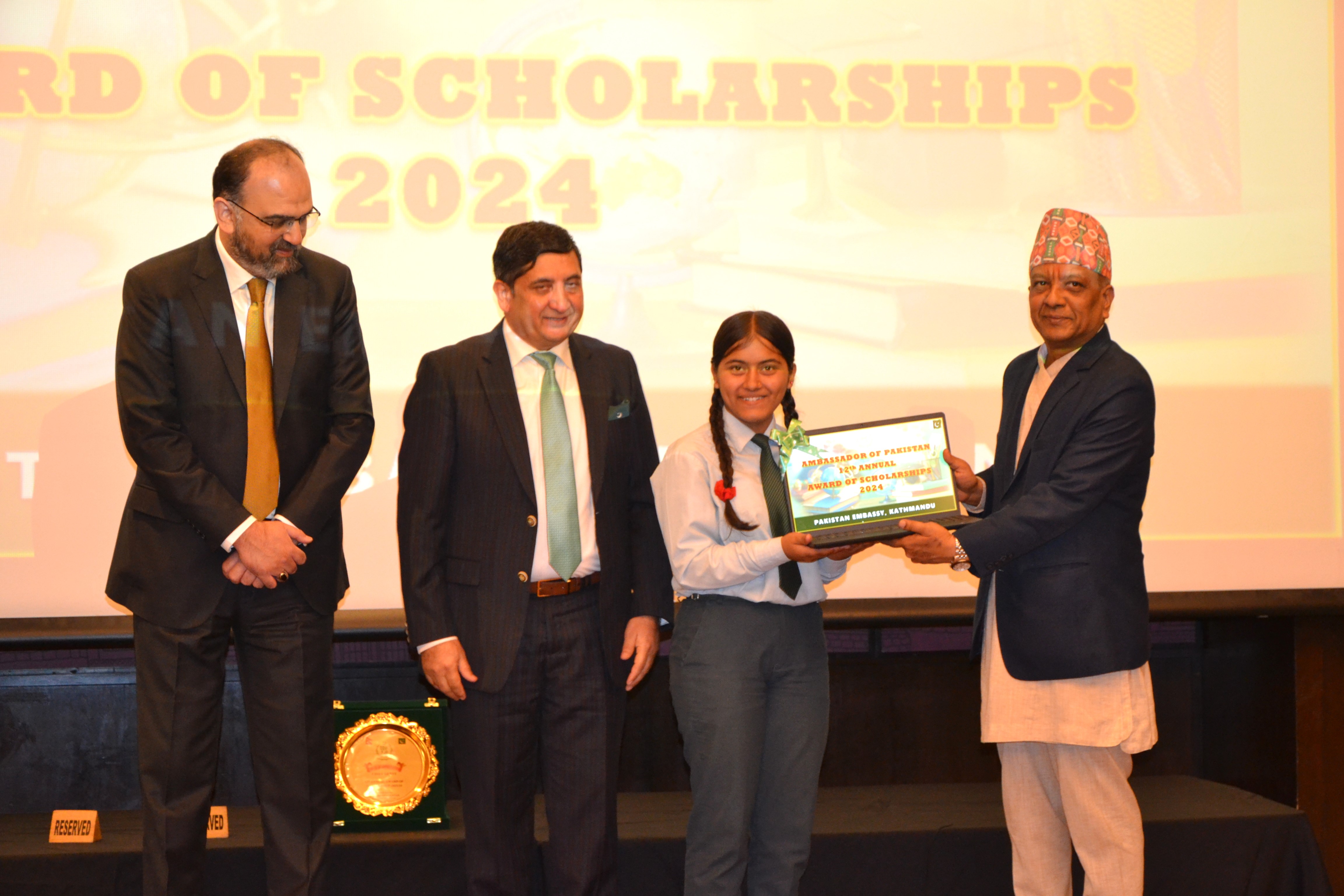

- Pak Embassy awards scholarships to 180 Nepali students

- President Paudel approves mobilization of army personnel for by-elections security

- Bhajang and Ilam by-elections: 69 polling stations classified as ‘highly sensitive’

- Karnali CM Kandel secures vote of confidence

- National Youth Scientists Conference to be organized in Surkhet

Leave A Comment