OR

Race to attract fixed deposits won't ease liquidity crunch

Published On: February 1, 2017 01:11 AM NPT By: Republica | @RepublicaNepal

Bankers say it is unlikely to pump money into the banking system

KATHMANDU, Jan 31: While bank and financial institutions (BFIs) are raising their fixed deposit rates rapidly to lure deposits to overcome the shortage of loan-able funds, many bankers say such move is less likely to pump money into the banking system.

Instead, such high offer would only attract fund from one bank to another or from one type of bank account to another rather than injecting fresh money in the banking system, they added.

“The only thing that the fixed deposit with higher rates would do is move money within the system. It's like the shift of money from one pocket to another,” Upendra Poudyal, former president of Nepal Bankers Association (NBA), said. “It can address the problem of some particular bank, but not of the banking industry as a whole which has been facing acute shortage of money to expand credit,” Poudyal, who is also the CEO of NMB Bank Ltd, added.

According to bankers, depositors would be tempted to withdraw from a bank offering lower rate to park money on the fixed deposit scheme of the other bank that offers higher rates. Since fixed deposit account is for relatively higher amount, say for example more than Rs 100,000, it is less likely that the money would come from under the mattress to the bank account, say bankers.

As the credit to core-capital-cum-deposit (CCD) ratio of many bank and financial institutions (BFIs) is breaching the upper limit of 80 percent, they are offering as high as 13 percent interest rates on fixed deposit.

The breach of the upper limit of the CCD ratio attracts regulatory action and banks cannot lend money until they add deposits to bring the ratio down to the ceiling.

The CCD requirement that the central bank enforces to maintain adequate liquidity in the system allows a bank to lend only up to 80 percent of its total deposits and core capital. It says that 20 percent should be held as cash reserves and government securities investment, among other liquid assets. For example, if a bank's total deposits and core capital amounts to Rs 100, it can only lend up to Rs 80 and maintain Rs 6 as cash reserves and Rs 8 in government securities investment, among others.

A banker, requesting anonymity, termed the rush of some banks to offer a 'misguided' move. “The way they are increasing the rate is perpetuating an unhealthy competition in the banking sector that do not help to resolve the current problem. It will create further chaos as lending rates will have to be raised in line with the rise in the cost of the fund,” the banker said. “This will have a damning effect on the economy when rise of lending rate rises and borrowers default rate goes up due to failure to repay loans that they had borrowed at far lower rates,” he warned.

You May Like This

Rs 20b repo meant to ease liquidity crunch gets lukewarm response

KATHMANDU, Jan 7: Bank and financial institutions (BFIs), which have been seeking financing facility from the Nepal Rastra Bank (NRB) to... Read More...

Three into two won't go in Champions League race

With the title and relegation issues decided, three teams will scrap for the two remaining Champions League places on the... Read More...

Worried of fund crunch, MFIs seek permission to mobilize deposits

KATHMANDU, Oct 24: Microfinance institutions (MFIs) have sought permission to mobilize deposit from public after their traditional source of fund is... Read More...

Just In

- Gold items weighing over 1 kg found in Air India aircraft at TIA

- ACC Premier Cup semi-final: Nepal vs UAE

- Sindhupalchowk bus accident update: The dead identified, injured undergoing treatment

- Construction of bailey bridge over Bheri river along Bheri corridor reaches final stage

- Taylor Swift releases ‘The Tortured Poets Department’

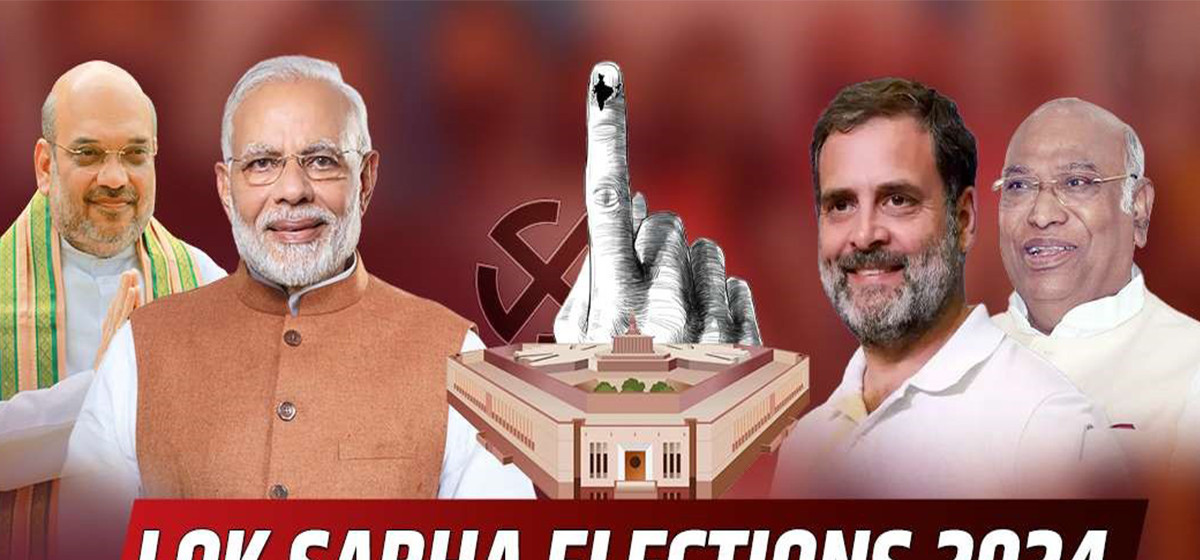

- India starts voting in the world’s largest election as Modi seeks a third term as prime minister

- EC seeks cooperation for free and fair by-election

- Bus carrying wedding procession attendees meets with accident in Sindhupalchowk; three killed

Leave A Comment