OR

Nepse ends slightly lower as govt unveils policy and programs

Published On: May 22, 2018 02:30 AM NPT By: Akash Shrestha

KATHMANDU, May 22: Nepal Stock Exchange (Nepse) index made a partial recovery on Monday after hitting an intraday low of 2.06 points during midday trading. The benchmark index closed the day at 1337.13 points.

The stock market witnessed another ordinary trading session as the daily turnover volume remained near Rs 350-million mark. Investors remained cautious during Monday's trading session as they awaited policies and programs of the government for the upcoming fiscal year. The government's approach toward the development of capital market remains to be the main concern for the investors.

Sub-indices turned in mixed performance on Monday. The Microfinance Sub-index posted the highest growth of 2.06 percent. Hotels Sub-index also gained 0.57 percent. However, Insurance Sub-index lost the most and closed 1.1 percent lower. The sub-indices of Hydropower, Development Bank, Banking and Finance groups also ended in the red.

Citizen Investment Trust was the most active stock on the day, recording a turnover of Rs 24.19 million as the company proposed 22.06 percent bonus shares and 1.16 percent cash dividend on Monday. Stocks of Rastriya Beema Company Ltd and National Life Insurance Company Ltd were also in high demand.

Primarily, microfinance companies dominated the top gainers list led by Naya Nepal Laghubitta Bikas Bank Ltd whose shares surged 9.71 percent to close at Rs. 2,249 per unit. Further, Swarojgar LaghuBitta Bikas Bank Ltd and Nagbeli Laghubitta Bikas Bank Ltd closed higher by 8.09 percent and 6.76 percent, respectively. On the contrary, shares of Rastriya Beema Company lost the most and declined by 5.80 percent to close at Rs 774. Taragaon Regency Hotel Ltd and Progressive Finance Ltd were among other top losers.

Khanikhola Hydropower Company Ltd reported a growth in its net loss by 45.71 percent year-on-year. Its loss stands at Rs 112.8 million as per its financial report for the third quarter. Furthermore, United Insurance Company Ltd published a notice for its AGM to be held on June 10. However, no agenda for its earlier proposed 240 percent right issue has been included.

ARKS technical analysis model indicates another bearish candle formation as the index inched marginally down. The market continued to stay in the consolidation phase with the index trading within a narrow range for the past five days. Evidently, no particular short-term trend is visible.

With Relative Strength Index (RSI) exactly in the mid zone and Moving Average Convergence/Divergence (MACD) slightly sloping downward, the sentiment remains neutral among investors. In the present context, a possible breakout of the resistance of 1,350 point with significant increase in volumes can present opportunity for buying stocks in the market.

Shrestha is an equity analyst at ARKS Capital Advisors Pvt Ltd.

(Views expressed in the article are those of the author and do not necessarily reflect those of this publication)

You May Like This

Nepse ends week lower despite increased market activity

KATHMANDU, July 14: Nepal’s stock market failed to extend gains from the previous week as index ended all five trading... Read More...

Bhattarai challenges govt to present plan for implementing policy and programs

KATHMANDU, May 25: Former prime minister and coordinator of Naya Shakti Party, Nepal, Baburam Bhattarai, has challenged the government to present... Read More...

Karnali govt unveils programs and policies

SURKHET, April 25: The government of Karnali Province on Monday unveiled its plans and policies prioritizing tourism, infrastructure, herbs and... Read More...

Just In

- Nepalgunj ICP handed over to Nepal, to come into operation from May 8

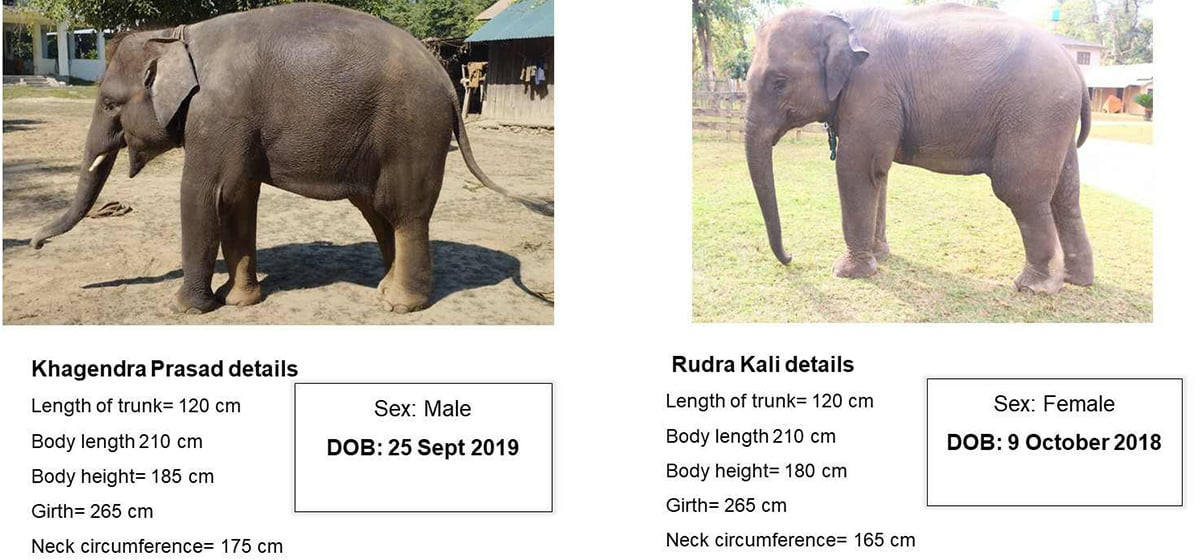

- Nepal to gift two elephants to Qatar during Emir's state visit

- NUP Chair Shrestha: Resham Chaudhary, convicted in Tikapur murder case, ineligible for party membership

- Dr Ram Kantha Makaju Shrestha: A visionary leader transforming healthcare in Nepal

- Let us present practical projects, not 'wish list': PM Dahal

- President Paudel requests Emir of Qatar to initiate release of Bipin Joshi

- Emir of Qatar and President Paudel hold discussions at Sheetal Niwas

- Devi Khadka: The champion of sexual violence victims

_20240423174443.jpg)

Leave A Comment